Standard Transaction Documents

>

> >

>

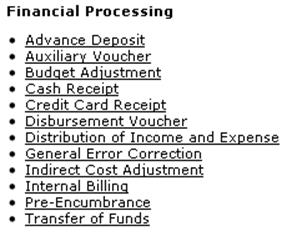

On the Main Menu tab, the Transactions submenu provides access to a variety of general-use documents that support basic financial operations.

FP documents available from the Main Menu, Transactions submenu

|

|

Description |

|

Records deposits that go directly to the bank without being verified through the normal cash receipts process. This document enables distribution of the amount received to the appropriate accounts in the financial system. | |

|

Records accrual, adjustment and recode entries. These may be posted to open periods, which are set by each institution. | |

|

Records income and expense transactions not processed through other documents, against an existing budget. It can be used to modify a base budget, a current budget or both. | |

|

Records cash and checks received by units, for subsequent deposit into bank accounts via the Cash Management Document (CMD). | |

|

Records credit card receipts and distributes the funds received to the appropriate accounts in the financial system. | |

|

Processes payments that are not transacted through the Accounts Payable/Purchasing module of the KFS. | |

|

Reallocates income and expense or assets and liabilities within the organization. | |

|

Corrects accounting string data for General Ledger entries generated from other financial transactions. | |

|

Allows adjustment to the amount of indirect cost expense charged to a Contracts and Grants account and automatically adjusts the associated amount of indirect cost revenue. | |

|

Bills for goods or services provided by one institution's department to another institution's department, reflecting income to the provider and expense to the customer. | |

|

Allows users to add encumbrances using a document instead of relying on information from a system outside the KFS. These transactions give fiscal officers the ability to earmark funds for which unofficial commitments have been made. | |

|

Transfers funds (cash) between accounts. |

Caveats

about information provided for financial documents:

Caveats

about information provided for financial documents:

Business rules provided for each document reflect the original configurations delivered with the KFS and may not reflect the rules and practices established at your institution. Your institution may have modified the delivered restrictions or made additional restrictions by attributes such as object code type, object code sub type, sub-fund group, consolidation object code, and others.

The explanations that follow exclude references to ad-hoc routing because this functionality is available for

use in any financial transaction document.

The explanations that follow

exclude specific references to the delegate where the fiscal officer is mentioned. Assume that any

action that can be performed by the fiscal officer can also be performed by the

delegate.

For information on

using a template to import items or accounts, see Data Import Templates.

For information on

using a template to import items or accounts, see Data Import Templates.

Advance Deposit

Advance Deposit