Financial ProcessingStandard Transaction E-Docs

Credit Card Receipt

![]() >

>![]() >

>![]() >

>![]() >

>![]()

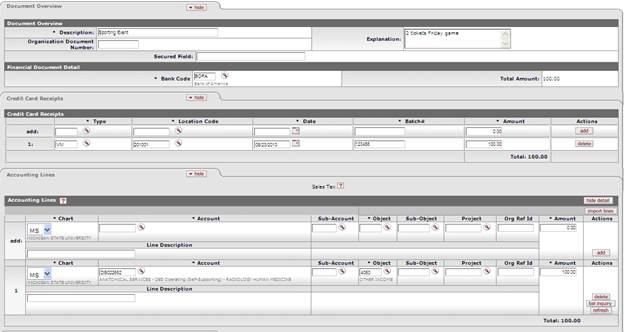

The Credit Card Receipt (CCR) document is used to record the receipt of income via credit card payments to the university and distribute the funds received to the appropriate accounts in the financial system. Fiscal officers and support staff, department, responsibility center, and campus administration staff are typical users of the CCR.

Document Layout

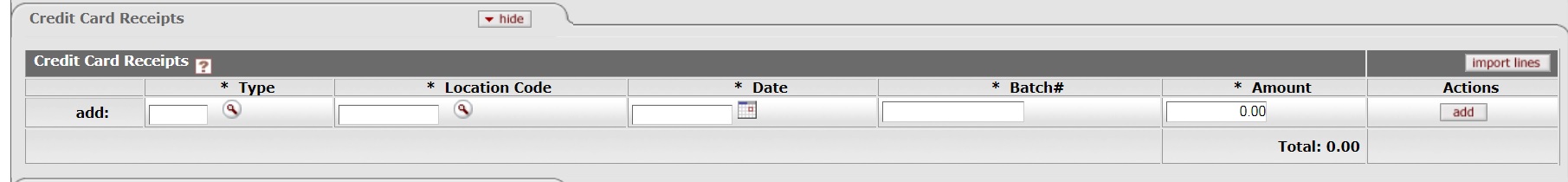

The CCR document has its own unique tab called Credit Card Receipts in addition to the standard financial transaction tabs.

![]() For information about the standard

tabs such as Document Overview, Notes and Attachments,

Ad

Hoc Recipients, Route

Log, Accounting Lines, Accounting Lines

for Capitalization, Create Capital Assets and Modify Capital Asset

tabs, see Standard

Tabs under Overview > KFS E-Doc Fundamentals.

For information about the standard

tabs such as Document Overview, Notes and Attachments,

Ad

Hoc Recipients, Route

Log, Accounting Lines, Accounting Lines

for Capitalization, Create Capital Assets and Modify Capital Asset

tabs, see Standard

Tabs under Overview > KFS E-Doc Fundamentals.

Credit Card Receipts tab definition

|

Type |

Required. Enter the unique code for the credit

card type, or search for a type from the Type lookup |

|

Location Code |

Required. . The unique number that identifies the Credit Card Vendor. |

|

Date |

Required. Enter the date of the receipt or select it from

the calendar |

|

Batch# |

Required. Enter the batch number assigned to this particular credit card transaction. |

|

Amount |

Required. Enter the amount of the credit card transaction. |

![]() Initiating

a Distribution of Income and Expenses Document

Initiating

a Distribution of Income and Expenses Document

Business Rules

• The credit cards receipts total must be greater than zero.

• The credit card receipt total must be equal to the total of the Accounting Lines tab.

• Negative accounting line amounts are allowed.

• There must be at least one accounting line in the document.

• The CCR document is one-sided. The KFS automatically generates the other side of the entry affecting the cash account, as defined by data entered into the document.

• The Object Code restrictions are as follows.

|

Object Sub Type Code |

Description |

Restrictions |

||

|

AR |

Accounts Receivable |

Unallowable |

||

|

BI |

Bond Issuance |

Unallowable |

||

|

BU |

Budget-Only Object Codes |

Unallowable |

||

|

CA |

Cash |

Unallowable |

||

|

CE |

Cost Recovery Expenses |

Unallowable |

||

|

CL |

Capital Lease Purchases |

Unallowable |

||

|

CS |

Cash |

Unallowable |

||

|

DR |

Depreciation |

Unallowable |

||

|

FB |

Fund Balance |

Unallowable |

||

|

FR |

Fringe Benefits |

Unallowable |

||

|

HW |

Hourly Wages |

Unallowable |

||

|

MT |

Mandatory Transfers |

Unallowable |

||

|

NC |

|

Unallowable |

||

|

NL |

Non-Current Liabilities |

Unallowable |

||

|

PL |

Capital Assets |

Unallowable |

||

|

RE |

Reserves |

Unallowable |

||

|

SA |

Salary And Wages |

Unallowable |

||

|

TF |

Transfer Of Funds |

Unallowable |

||

|

TN |

Transfers - Generic |

Unallowable |

||

|

VA |

Valuations And Adjustments |

Unallowable |

Object type code restrictions for Advance Deposit documents

|

Object Type Code |

Description |

Restrictions |

|

ES |

Expense Not Expenditure |

Unallowable |

|

IC |

Income Not Cash |

Unallowable |

Consolidated object code restrictions for Advance Deposit documents

|

Consolidated Object Code |

Description |

Restrictions |

|

FDBL |

Fund Balance |

Unallowable |

Object sub type code type restrictions for Credit Card

Receipt documents![]() Making Corrections:

If a Credit Card Receipt has been initiated

and approved, but the accounting line information was incorrect, use the GEC

document to make the correction. If the total amount of a Credit Card Receipt

is incorrect, use the AD

document to make the correction. If a credit card refund is made, use the AD

document to record the transaction.

Making Corrections:

If a Credit Card Receipt has been initiated

and approved, but the accounting line information was incorrect, use the GEC

document to make the correction. If the total amount of a Credit Card Receipt

is incorrect, use the AD

document to make the correction. If a credit card refund is made, use the AD

document to record the transaction.

![]() For more information about the GEC and AD documents, see General

Error Correction and Advance

Deposit.

For more information about the GEC and AD documents, see General

Error Correction and Advance

Deposit.

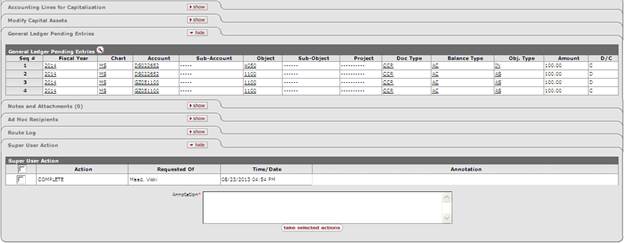

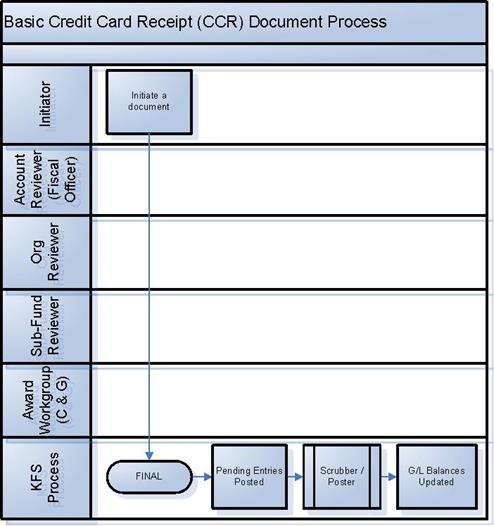

Routing

After a CCR document is submitted, it is automatically approved and does not route. The document status is 'FINAL' and the transaction is posted to the G/L during the next G/L batch process.

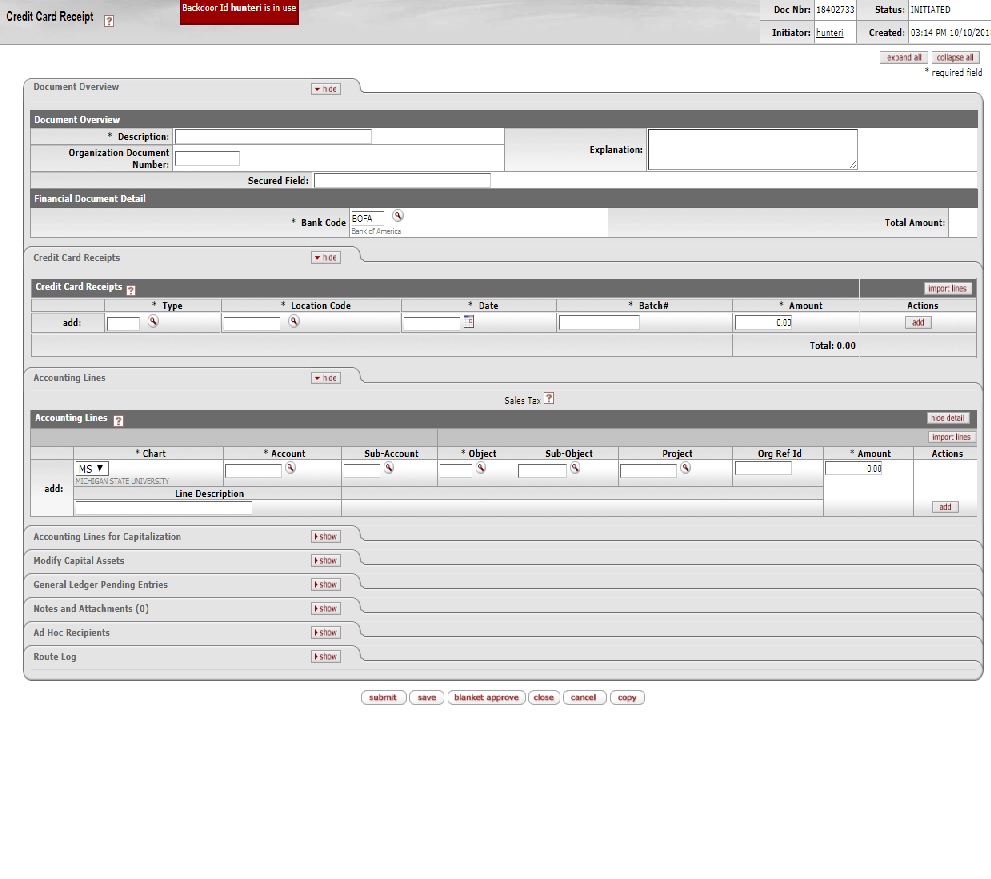

Initiating a CCR Document

1. Select Credit Card Receipt from the Financial Transactions menu.

2. Log into the KFS as necessary.

A blank CCR document with a new document ID appears.

3. Complete the standard tabs.

![]() For more information about the standard tabs, see Standard

Tabs.

For more information about the standard tabs, see Standard

Tabs.

4. Complete the Credit Card

Receipts tab and click ![]() .

.

Continue adding as many credit card receipt lines as necessary.

5. Click ![]() .

.

6. Review the General Ledger Pending Entries tab.

The pending entries include offset generation lines to cash or fund balance object codes.

7. Review the Route Log tab.

No approval is required.

![]() For information about the Route Log tab, see Route

Log.

For information about the Route Log tab, see Route

Log.

Example

Parking operations accepted a credit card payment in settlement of a parking fine. Each area capable of accepting credit card payments in this manner has a vendor number assigned (established using the Credit Card Vendor document on the Administration menu). This information, along with the reference number and amount of the transaction is entered in the Credit Card Receipts tab. The KFS account and object code that should receive the credit for this payment is entered in the Accounting Lines tab. The CCR document allows an operating unit to properly reflect receipts from credit card transactions that they have accepted, in the correct accounts in the KFS. Unlike Cash Receipt (CR) documents, the CCR document does not route to a central processing unit, such as a Bursar's office, for reconciliation and deposit.