Financial ProcessingStandard Transaction E-Docs

Cash Receipt

![]() >

>![]() >

>![]() >

>![]() >

>![]()

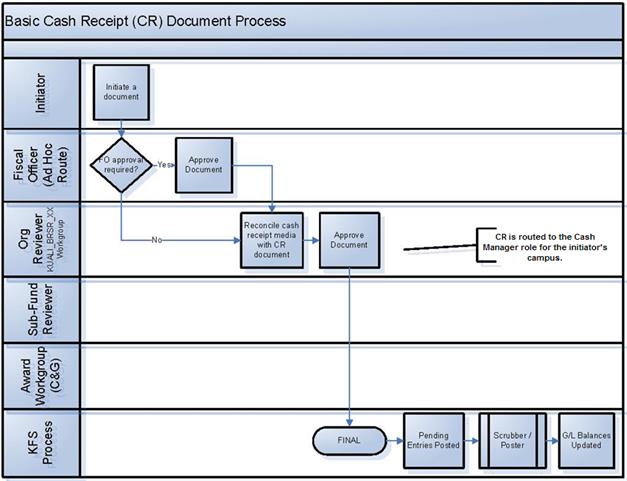

The Cash Receipt (CR) document is used to record cash and checks received by units, for subsequent deposit into bank accounts by a central processing unit. The CR document creates the specified accounting entries in the Financial System.

The CR document routes for verification and preparation of bank deposits. Recording refunds to the university via the CR document allows you to credit the funds to the account and object code from which they were originally paid. The CR document may be used by university central administration staff that collect cash and checks and reconcile a cash drawer, but do not physically make the bank deposit themselves.

The user creating the CR utilizes reconciliation within the CR. After approved, the CR document creates the specified accounting entries in the KFS.

More:

Document Layout

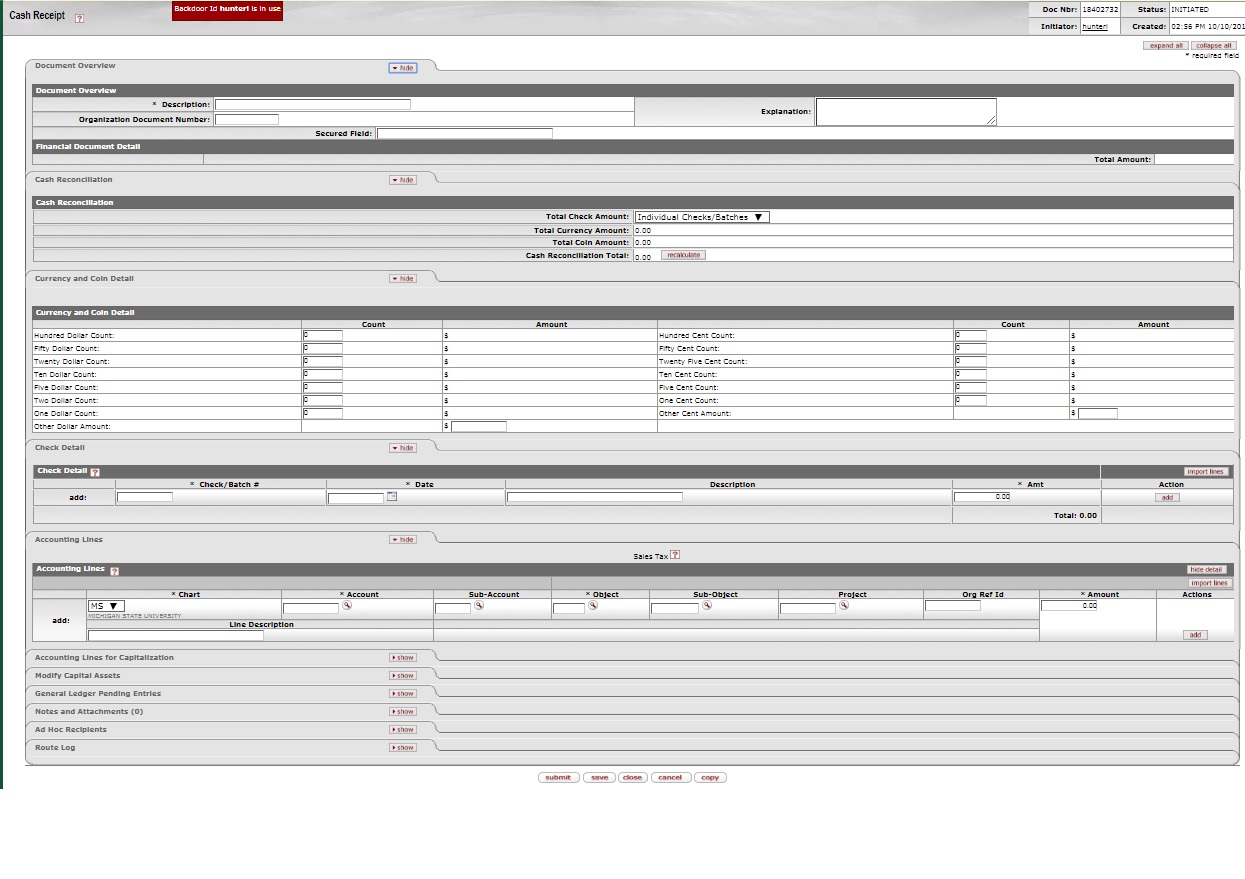

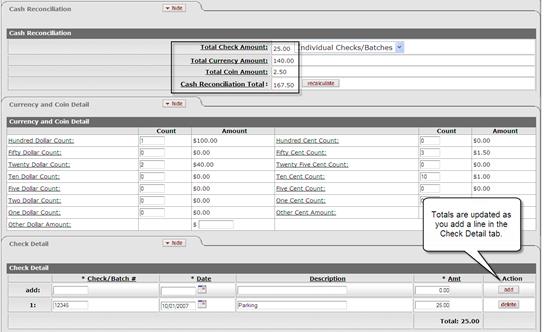

The CR document has its own unique tabs called Cash Reconciliation, Currency and Coin Detail, and Check Detail in addition to the standard financial transaction tabs.

![]() For information about the standard

tabs such as Document Overview, Notes and Attachments,

Ad

Hoc Recipients, Route

Log, Accounting Lines, Accounting Lines

for Capitalization and Modify Capital Asset tabs, see Standard

Tabs under Overview > KFS E-Doc Fundamentals.

For information about the standard

tabs such as Document Overview, Notes and Attachments,

Ad

Hoc Recipients, Route

Log, Accounting Lines, Accounting Lines

for Capitalization and Modify Capital Asset tabs, see Standard

Tabs under Overview > KFS E-Doc Fundamentals.

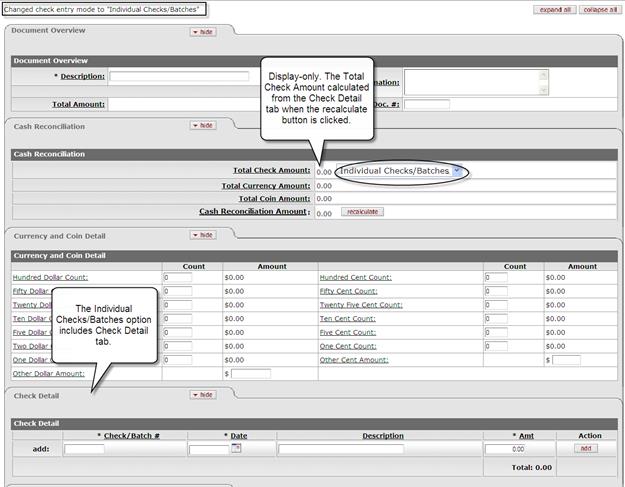

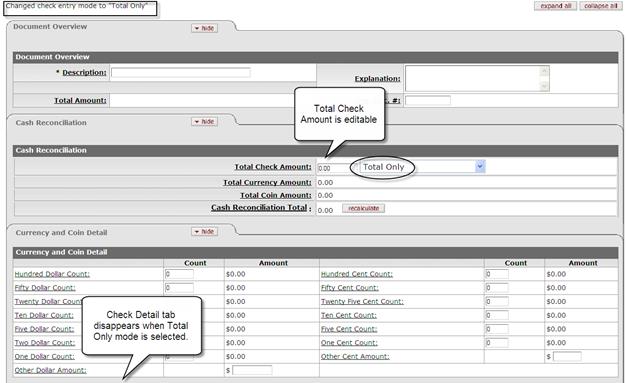

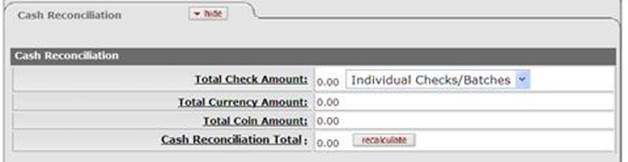

Check Entry Mode

You are able to change the check entry mode by selecting either Individual Checks/Batches or Total Only in the list located near the Total Check Amount field. Selecting Total Only allows you to manually enter the total check amount without the detailed check information. When Individual Checks/Batches is selected the system calculates the total amount from the detailed check data entered into the Check Detail tab.

When the Individual Checks/Batches check entry mode is selected, the Total Check Amount field becomes display-only. You must populate the Check Detail tab so that the system can automatically update the total check amount. The system displays the current entry mode in the upper left corner as you change the selection.

When the Total Only entry mode is selected, the Check Detail tab does not appear in the document and you are prompted to manually enter the Total Check Amount.

Cash Reconciliation Tab

Cash Reconciliation tab definition

|

Title |

Description |

|

Total Check Amount |

Optional. This field works in conjunction with the Individual Checks/Batches or Total Only list below. When Individual Checks/Batches is selected from the list, it becomes display-only. The system updates this total as checks are added to the Cash Reconciliation document in the Check Detail tab. When Total Only is selected from the list, it becomes an input box for a user to manually enter the Total Check Amount. |

|

Individual Checks/Batches or Total Only list |

Required. Select from the list: Individual Checks/Batches or Total Only. |

|

Total Currency Amount |

Display-only. Calculated from Currency and Coin Detail tab. |

|

Total Coin Amount |

Display-only. Calculated from Currency and Coin Detail tab. |

|

Cash Reconciliation Total |

Display-only. The total currency, coin, and check amount for the CR document. |

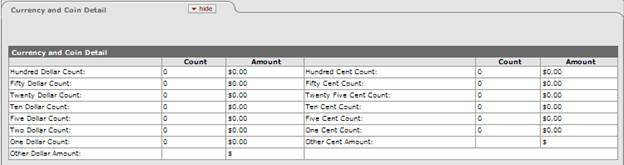

Currency and Coin Detail Tab

Currency and Coin Detail tab definition

|

Title |

Description |

|

Dollar Count |

Optional. Enter the total dollars per type of currency. If the type of currency is not hundred, fifty, twenty, ten, five, two, or one dollar bill, enter the total into the Other Dollar Amount box. |

|

Cent Count |

Optional. Enter the total cents per type of coin. If the type of coin is not hundred, fifty, twenty, ten, five, or one cent coin, enter the total into the Other Cent Amount box. |

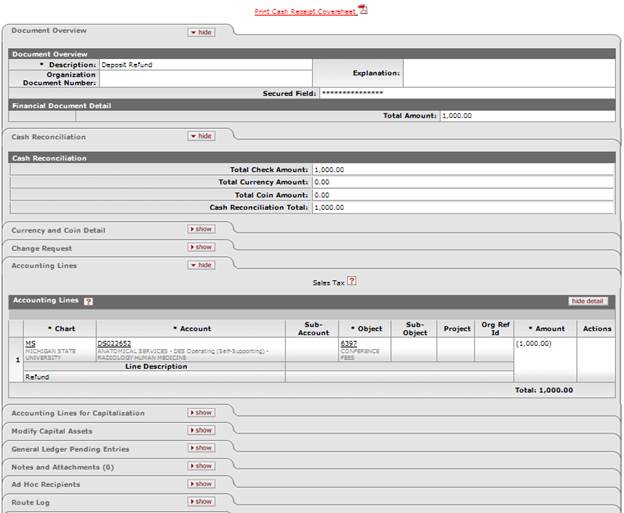

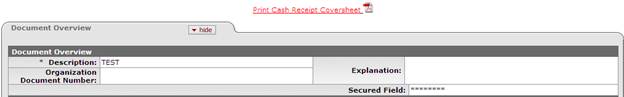

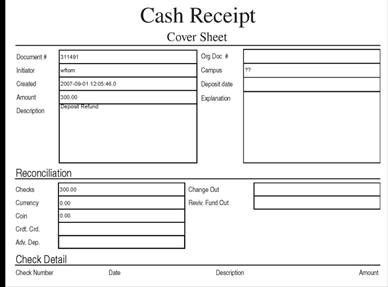

Print Cash Receipt Cover Sheet Option

If you need to send a paper copy

of the CR

document

to the verifying unit

along with the accompanying media (cash,

checks, coins, etc.) you can print a PDF version of a cash

receipt by clicking the Print Cash Receipt Coversheet link

![]() which appears in the top middle area of

the document after submitting the document.

which appears in the top middle area of

the document after submitting the document.

The cash receipt cover sheet looks like this:

Process Overview

Business Rules

· The Check Amount, Total Currency Amount, and Total Coin Amount must be zero or greater.

· The Cash Reconciliation Total must be equal to the total of the Accounting Lines.

· There must be at least one accounting line in the document.

· The CR document is one-sided. The KFS automatically generates the other side of the entry affecting the cash account, as defined by the data entered into the document.

· The object sub type and object code restrictions are as follows.

Object sub type code restrictions for Cash Receipt documents

|

Object Sub Type Code |

Description |

Restrictions |

|

AR |

Accounts Receivable |

Unallowable |

|

BI |

Bond Issuance |

Unallowable |

|

BU |

Budget Only Object Codes |

Unallowable |

|

CA |

Cash |

Unallowable |

|

CE |

Cost Recovery Expense |

Unallowable |

|

CL |

Capital Lease Purchases |

Unallowable |

|

CS |

Cash |

Unallowable |

|

DR |

Depreciation |

Unallowable |

|

FB |

Fund Balance |

Unallowable |

|

FR |

Fringe Benefits |

Unallowable |

|

HW |

Hourly Wages |

Unallowable |

|

MT |

Mandatory Transfers |

Unallowable |

|

NC |

Non-Current Assets |

Unallowable |

|

NL |

Non-Current Liabilities |

Unallowable |

|

PL |

Capital Assets |

Unallowable |

|

RE |

Reserves |

Unallowable |

|

SA |

Salary and Wages |

Unallowable |

|

TF |

Transfer of Funds |

Unallowable |

|

TN |

Transfers – Generic |

Unallowable |

|

VA |

Valuations and Adjustments |

Unallowable |

Object type code restrictions for Cash Receipt documents

|

Object Type Code |

Description |

Restrictions |

|

ES |

Equipment Start-Up Costs |

Unallowable |

|

IC |

Income Not Cash |

Unallowable |

Consolidated object code restrictions for Cash Receipt documents

|

Consolidated Object Code |

Description |

Restrictions |

|

FDBL |

Fund Balance |

Unallowable |

![]() Making Corrections: If a CR has been initiated

and approved, but the accounting line information was incorrect, use the General

Error Correction (GEC)

document to make corrections. If the total amount of a CR is incorrect, use the

Advance

Deposit (AD)

document to make the correction.

Making Corrections: If a CR has been initiated

and approved, but the accounting line information was incorrect, use the General

Error Correction (GEC)

document to make corrections. If the total amount of a CR is incorrect, use the

Advance

Deposit (AD)

document to make the correction.

![]() For more

information about the GEC and AD documents, see General

Error Correction and Advance

Deposit.

For more

information about the GEC and AD documents, see General

Error Correction and Advance

Deposit.

Routing

The procedures for processing CR documents are slightly different than for other financial documents. Upon submission, CR documents produce an FYI to the fiscal officer and the document routes directly to the members of the KFS-FP Cash Manager role associated with the CR initiator's campus code. This role will verify cash receipts and prepare bank deposits . After a CR document has been submitted by the initiator, ad hoc routing is not available to anyone else. If a fiscal officer wishes to approve the document before it is processed by the Cash Manager role, the initiator must ad-hoc route the document to the fiscal officer. Reminder emails are sent to the CR initiator, fiscal officer(s) and account supervisor(s) if the CR document is "ENROUTE" status at Cash Management

![]() How CR approvals work: The approval of CR documents is

controlled by the campus associated with each role member in the KFS-FP Cash

Manager role. The CR document is routed to the role members associated with the

campus that the initiator is associated with based on their KFS-SYS User

role (or the campus associated with the Department ID on their Person profile).

The initiator of the CR document cannot be a member of the KFS-FP Cash Manager

role.

How CR approvals work: The approval of CR documents is

controlled by the campus associated with each role member in the KFS-FP Cash

Manager role. The CR document is routed to the role members associated with the

campus that the initiator is associated with based on their KFS-SYS User

role (or the campus associated with the Department ID on their Person profile).

The initiator of the CR document cannot be a member of the KFS-FP Cash Manager

role.

Initiating a Cash Receipt Document

1. Select Cash Receipt from the Financial Processing submenu group in the Transactions submenu on the Main Menu tab.

2. Log into the KFS as necessary.

A blank CR document with a new document ID appears.

3. Complete the standard tabs.

If entering a refund (using an expense object code rather than an income object code) enter the dollar amount as a negative number in the Accounting Lines tab.

If entering a cash receipt for a capital asset, select the accounting lines on the Accounting Lines for Capitalization Tab enter the appropriate existing asset number in the Modify Capital Assets Tab. You cannot enter a new asset for a cash receipt.

![]() For information about the standard tabs such as Document Overview,

Notes and Attachments, Ad

Hoc Recipients, Route

Log, Accounting Lines, Accounting Lines

for Capitalization and Modify Capital Asset tabs, see Standard

Tabs.

For information about the standard tabs such as Document Overview,

Notes and Attachments, Ad

Hoc Recipients, Route

Log, Accounting Lines, Accounting Lines

for Capitalization and Modify Capital Asset tabs, see Standard

Tabs.

4. Complete the Coin and Currency Detail tab, if currency and coins are received.

5. Complete the Check Detail tab, if Individual Checks/Batches entry mode is selected.

6. If Total Only mode, enter the Check Amount in the Cash Reconciliation tab.

7. Click ![]() to update the Total Currency Amount,

Total Coin Amount, and Cash Reconciliation Total

fields (display-only)

to update the Total Currency Amount,

Total Coin Amount, and Cash Reconciliation Total

fields (display-only)

8. Click ![]() after entering information for each check or batch.

after entering information for each check or batch.

Each time you add a check or batch, the Total Check Amount, Total Currency Amount, Total Coin Amount, and Cash Reconciliation Total fields in the Check Reconciliation tab are updated.

9. Enter Accounting Line fields.

![]() Ad-hoc

route the document to another user

(optional).

Ad-hoc

route the document to another user

(optional).

If you wish another user (such as the fiscal

officer) to approve

or review the document before the approval by the central processing area,

select the requested action from the Action

Requested list, and enter the approver's username in the Person

box or select it from the person lookup ![]() .

.

![]() For more information about ad

hoc routing see Route

Log.

For more information about ad

hoc routing see Route

Log.

10. Click ![]() .

.

Unless the ad hoc recipients are specified, the document is directly routed to the members of the KFS-FP Cash Manager role associated with the initiator's campus code. A member of this role must approve this document for it to be completed.

11. Print the Cash Receipt Cover Sheet, if necessary.

12. Review the General Ledger Pending Entries tab.

The pending entries include offset generated lines to cash or fund balance object codes.

13. Review the Route Log tab.

![]() For information about the Route Log tab, see Route

Log.

For information about the Route Log tab, see Route

Log.

14. A fiscal officer receives an FYI or could approve the document if requested by the initiator through ad hoc routing.

15. A member of KFS-FP Cash Manager role approves the document.

![]() For more information about how to approve a document, see Workflow

Action Buttons.

For more information about how to approve a document, see Workflow

Action Buttons.

The central processing area should reconcile the amount received for deposit with the cash receipt media breakdown and the CR documents, verify the CR document by confirming the amount of the media, and then approve the CR document.

Example

The university received a check to refund a conference registration fee. In the Accounting Line tab, enter the account and expense object from which the funds were originally paid and enter the amount as a negative number. Because an expense object is being used with a negative amount, the system credits the expense object code, returning the funds to the account they originally came from. The pending entries include the credit to expense and offset generation to the cash.