Financial ProcessingStandard Transaction E-Docs

Disbursement Voucher

![]() >

>![]() >

>![]() >

>![]() >

>

![]()

The Disbursement Voucher (DV) document is used to reimburse employees and nonemployees for expenses incurred while conducting university business and to pay other vendors for performing a service, or providing material goods for the university. Most often this payment is in the form of a check although direct deposit (ACH) and wire transfer options may be available.

The disbursement voucher may be used in situations in which a payment is not processed through another procurement method, such as purchase order or procurement card.

Institutions may have different rules for the processing of payments, but the following are some instances in which a disbursement voucher might be used:

· An employee needs to be reimbursed for the purchases of supplies for a project that were paid for out of personal funds.

· A department wishes to purchase a subscription to an academic journal.

· An honorarium is needed for a guest speaker.

· Research participants need to be compensated for taking part in a scientific study.

· An employee needs to register in advance for a work-related conference.

A disbursement voucher requires more information than most financial documents. Each disbursement voucher must include the following information:

· Who is to be paid (the 'Payee')

· Why the payee is being paid (the 'Payment Reason')

· How much the payee is to be paid and how the payment is to be made (the 'Amount' and 'Payment Method')

· All information on the Contact tab.

· Users must also keep the following points in mind about DVs:

· Some payment reasons, such as travel payments, may require that additional information be entered.

· Payments that are to be disbursed via check or ACH (direct deposit) will be passed to the KFS Pre-Disbursement Processor (PDP) for additional processing and disbursement.

· Because the KFS does not have check writing capabilities, fully approved disbursement vouchers must be passed to an external check-writing program for payment after they are processed in the PDP.

More:

Document Layout

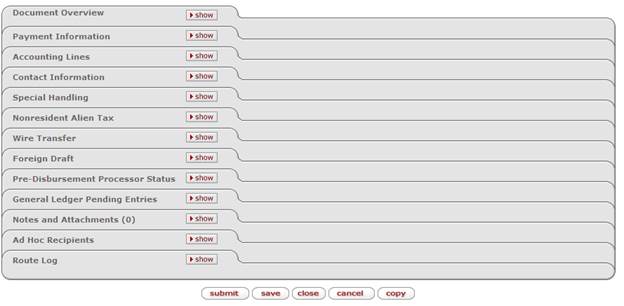

The DV document has several unique tabs - Payment Information, Contact Information, Special Handling, Nonresident Alien Tax, Wire Transfer, Foreign Draft, and Pre-Disbursement Processor Status - in addition to the standard financial transaction tabs.

· The Payment Information tab contains information regarding the payee, payment reason, payment method, documentation location, and attachments.

· The Contact Information tab contains information relating to the initiator and contains the text to be included on the check stub.

Other tabs may be required based on the selections made in the Payment Information tab.

More:

![]() Pre-Disbursement

Processor Status Tab

Pre-Disbursement

Processor Status Tab

Payment Information Tab

The Payment Information tab contains important information such as the payment reason, amount, payment method and attachments. This section must be completed for every DV document.

Payment Information tab definition

|

|

Description |

|

|

Required. Display-only. This code identifies the reason

for the disbursement and determines any restrictions the payment is subject to.

After you select the payee

ID from the Payee lookup |

|

Payee ID |

Required. Retrieve the payee ID from the Payee Lookup |

|

Payee Type |

Display-only. After you select the payee ID from the Payee

lookup |

|

Name |

Display-only. After you select the payee ID from the Payee

lookup |

|

Address 1 |

Required. After you select the payee ID from the Payee

lookup |

|

Address 2 |

After you select the payee ID from the Payee lookup |

|

City |

After you select the payee ID from the Payee lookup |

|

State |

After you select the payee ID from the Payee lookup |

|

After you select the payee ID from the Payee lookup |

|

|

Post Code

|

After you select the payee ID from the Payee lookup |

|

Check Amount |

Required. Enter the total amount of the disbursement for this document. |

|

Due Date |

Required. Enter the date or select it from the calendar

|

|

Payment Type |

Optional. Display-only. The payment types are determined by the payee selected for the DV. These values apply only to DV payees, which are established through the use of the Payee Type document. Each Payment Type attribute from the Payee Type record that is evaluated when the DV is submitted may have an impact on the ability to process a particular payment on a DV, and how it routes for approval. Is this a foreign payee? If the payee is a nonresident alien, select 'Yes'. |

|

Other Considerations |

Optional. Special Handling: Indicates that the payment should be mailed to a person other than the payee. For example, a check needs to be returned to the document initiator so it can be express mailed or picked up by the payee. When selected, a message asking you to add a note explaining the need for special handling is displayed and complete the special handling tab. |

|

Payment Method |

Required. Select the method in which the payment should be made from the Payment Method list. Check/ACH: This selection generates a check or, if ACH information exists in the disbursement processing system for this payee, an Automated Clearing House direct deposit is initiated. Foreign Draft: This selection indicates that the payment is to be made in a foreign currency. When you select Foreign Draft as the payment method you are prompted to complete the Foreign Draft tab. In this section, you indicate whether the DV is stated in foreign currency or US dollars, and what currency the payment is to be made in. For example, the DV could be stated in Euros and paid in Euros, or the DV could be stated in US Dollars converted to Euros for payment. Wire Transfer: This selection indicates you wish to have the disbursement wired to the recipient. To do so you are required to provide additional banking information on the Wire Transfer tab. Some institutions may charge a fee to the initiating department for processing a wire transfer. Wire transfers may be made in US Dollars or foreign currency, similar to Foreign Drafts as described above. |

|

Documentation Location Code |

Required. Will default as SA - Scan and Attach Documents. |

|

Check Stub Text |

Required. Enter the information regarding the payment itself, intended for the payee. This commonly includes what the payment is for (invoice number, for example) or other information to assist the payee in identifying the source and reason for the payment. |

The payee ID is required on the Payment Information tab. This identifies the person or business the disbursement is paid to. Payees must exist in the system in order to be selected on the disbursement voucher. The KFS uses the Vendor table and the KIM Person table for reference. If the payee already exists in the system, you can identify it by searching for it by using the Payee lookup.

Several KFS parameters exist to control which types of payees can be selected for a given payment reason. After clicking search, the restrictions for the selected payment reason are displayed at the top of the lookup.

Contact Information Tab

When the DV document is first initiated, the Contact Name, Phone Number, and the Campus Code default to those of the initiator's.

The Contact for a DV is typically the initiator, thus the contact information is typically the name and phone number of the initiator.

Contact Information tab definition

|

Title

|

Description |

|

Contact Name |

Required. This field is pre-filled with the name of the document initiator but may be edited. |

|

Phone |

Required. Enter the contact person's phone number (including area code) which is pre-filled based on the initiator |

|

Email Address |

Not Required |

|

Campus Code |

Pre-filled from the initiators information. |

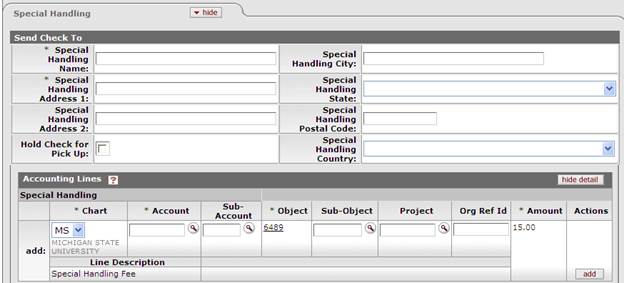

Special Handling Tab

The Special Handling tab is used when a check is to be sent to someone other than the payee, or if the check will be picked up at Accounting. For example, a department needs a check for a guest speaker sent to the Department Chair to present the check after the event. To request Special Handling for the payment, select the Special Handling check box in the Payment Information tab and complete the fields on this tab.

Special Handling tab definition

|

Description |

|

|

Special Handling Name |

Required. Enter the name of the person or entity where the check should be mailed. |

|

Special Handling Address 1 |

Required. Enter the first line of address where the check should be mailed. |

|

Special Handling Address 2 |

Optional. Enter the second line of address where the check should be mailed. |

|

Special Handling City |

Optional. Enter the city where the check should be mailed. |

|

Special Handling State |

Optional. Enter the state where the check should be mailed. |

|

Special Handling Zip Code |

Optional. Enter the zip code where the check should be mailed. |

|

Special Handling Country |

Optional. Select the payee's country from the Country list. |

|

Hold Check for Pick Up |

Optional. Select when requesting the check be picked up at the Accounting Office. |

|

Accounting Lines |

Required. Enter the appropriate accounting line information for the Special Handling fee to be applied. |

Nonresident Alien Tax Tab

This tab is completed only if the payee is a nonresident alien and it is only editable by a member of the KFS-SYS Tax Manager role when the document has routed to them. The information on this tab is used for reporting purposes and to add any special tax withholding that might be required as a result of the income classification of the payment when the fields are completed and generate lines is clicked. If the transaction is taxable, this function automatically adds the appropriate tax related accounting lines to the Accounting Lines tab of the document, and reduces the total check amount if tax needs to be withheld.

Click ![]() to

add the appropriate tax related accounting lines.

to

add the appropriate tax related accounting lines.

This following describes the definition for the Nonresident Alien Tax tab.

Nonresident Alien Tax tab definition

|

|

Description |

|

Income Class Code |

Required. The type of activity this disbursement is for.

Select the type of activity from the list. Values may vary, but some examples

include: |

|

Federal Tax Percent |

Required if the Income

Class entry is Fellowship or Independent Contractor. No

entry is allowed if the Income

Class entry is Non-Reportable. The percentage of federal tax

to be withheld from the payment. Either enter the appropriate percentage for

the income class or use the lookup |

|

State Tax Percent |

Required if the Income

Class entry is Fellowship or Independent Contractor. No entry

is allowed if the Income

Class entry is Non-Reportable. The percentage of state tax to

be withheld from the payment. Either enter the appropriate percentage for the

income class or use the lookup |

|

Country Code |

Required if the Income Class entry is Fellowship or Independent Contractor.. No entry is allowed if the Income Class entry is Non-Reportable. The nonresident alien payee’s country of citizenship. Select the country from the list.

|

|

Treaty Exempt |

Optional, except no entry is allowed if the Income Class entry is Non-Reportable. Select this check box if there is a tax treaty with the nonresident alien payee's country. Selecting this check box indicates that there is no tax withholding on the payment. |

|

Foreign Source |

Optional, except no entry is allowed if the Income Class entry is Non-Reportable. Select this check box if the payment is defined as foreign source based on U.S. income sourcing rules. Selecting this check box indicates that there is no tax withholding on the payment. |

|

Gross Up |

Optional, except no entry is allowed if the Income Class entry is Non-Reportable.

|

|

Reference Doc |

Optional, except no entry is allowed if the Income Class entry is Non-Reportable. Identifies a reference of a former payment. Used when processing a correction to a previous payment. Even when a tax rate is indicated, no tax withholding will occur. |

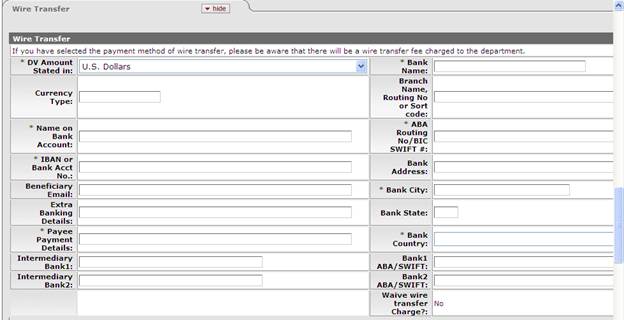

Wire Transfer Tab

When you select Wire Transfer as the

payment method you are prompted to complete the Wire Transfer

tab as seen below:

Wire Transfer tab definition

|

|

Description |

|

Bank Name |

Required. Enter the name of the financial institution to which the funds are to be wired |

|

Bank ABA Routing # |

Required for U.S. bank. Enter the nine-digit code that identifies the U.S. bank to which the funds are to be wired. Not required if wire is made to a foreign bank. |

|

Bank City |

Required. Enter the city location of the bank to which funds are to be wired |

|

Bank State |

Required for U.S. Enter the state location of the bank to which funds are to be wired. Not required, if wire is made to a foreign bank. |

|

Bank Country |

Required. Select the country location of the bank to which funds are to be wired from the Bank Country list. |

|

Bank Account# |

Required. Enter the specific account number to which the funds are to be wired. |

|

Name on Bank Account |

Required. Enter the name on the account indicated above in the Bank Account# field |

|

Waive wire transfer charge? |

Display-only. When institutions charge departments a wire transfer fee it is possible for the fee to be waived in particular situations. Only members of the KFS-FP Disbursement Method Reviewer role have permission to waive the fee for a wire transfer. |

|

Payee Payment Details |

Optional. Enter additional information that you would like to send to the financial institution regarding this wire transfer. |

|

Bank Count |

Select from whether the wire is to a US or foreign bank from the Wire To list. |

|

DV Amount Stated In |

Select the currency type from the DV Amount Stated in list. The choices are 'U.S. Dollars,' 'DV amount is stated in U.S. dollars; convert to foreign currency,' or 'DV amount is stated in foreign currency'. |

|

Currency Type |

Required. Enter the type or unit of currency for the payment |

|

Intermediary Bank 1 |

Optional. Name of Intermediary Bank |

|

Bank 1 ABA/Swift |

Optional. ABA/Swift number for Intermediary Bank 1 |

|

Intermediary Bank 2 |

Optional. Name of Intermediary Bank |

|

Bank 1 ABA/Swift |

Optional. ABA/Swift number for Intermediary Bank 1 |

|

Accounting Lines |

Required. Enter the appropriate accounting line information for the Special Handling fee to be applied. |

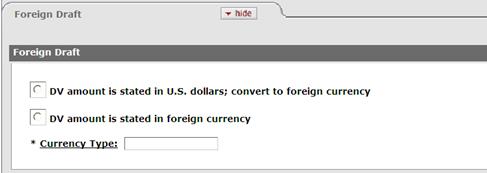

Foreign Draft Tab

When you select Foreign Draft as the payment method you are prompted to complete the Foreign Draft tab as seen below:

Foreign Draft tab definition

|

|

Description |

|

DV amount is stated in U.S. dollars; convert to foreign currency |

Optional. Select this option if the DV amount is stated in U.S. Dollars and needs to be converted to a foreign currency. |

|

DV amount is stated in foreign currency |

Optional. Select this option if the DV amount is stated in a foreign currency. |

|

Currency Type |

Required. Enter the type of currency for the payment. |

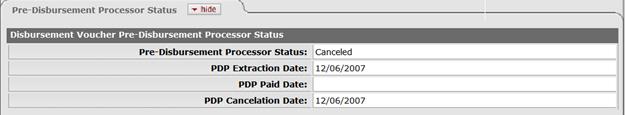

Pre-Disbursement Processor Status Tab

The Pre-Disbursement Processor Status tab displays information from the Pre-Disbursement Processor (PDP) so you can track the payment status and the status date.

Pre-Disbursement Processor Status tab definition

|

|

Description |

|

Pre-Disbursement Processor Status |

Display-only. Displays the payment processing status from the Pre-Disbursement Processor (PDP). |

|

PDP Extract Date

|

Display-only. The date when the disbursement voucher was extracted for payment processing by PDP. |

|

PDP Paid Date |

Display-only. The date when the payment was disbursed by PDP. |

|

PDP Cancellation Date |

Display-only. The date when the payment was canceled within PDP. |

|

Disbursement Information |

If the disbursement has been issued, this button will appear. Click on the button to open a window containing detailed payment information. |

Process Overview

More:

![]() Displaying

Detailed Payment Information

Displaying

Detailed Payment Information

Business Rules

· DV Payee must be active.

· Check amount cannot be negative.

· There must be at least one accounting line.

· Account lines total must not be negative.

· Total of accounting lines must match the Check Total field.

· If the Federal Tax Percent is 0, the State Tax Percent must be 0.

· If the Federal Tax Percent is >0, the State Tax Percent must be >0 if the income class has an associated state tax percent. (Royalty and Independent Contractor do not have a state tax percent, so 0 is allowed.)

· If Treaty Exempt is checked. no fields, dropdowns or checkboxes may be entered/selected/checked

· If Exempt Under Other Code is checked, Federal & State Tax Percent must be 0, no other boxes may be checked except for USAID Per Diem, and Special W-4 Amount may be blank or filled in.

· If Gross Up Payment is checked, Federal Tax Percent cannot be 0, State Tax Percent cannot be 0 if income class has an associated state tax percent other than 0 (Royalty and Independent Contractor do not have a state tax percent, so 0 is allowed), no other boxes may be checked, and Special W-4 Amount must be blank.

The object codes associated with the following object types or object levels are prohibited:

Object type restrictions for DV documents

|

Object Level |

Description |

Restrictions |

|

ES |

EXPENSE NOT EXPENDITURE |

Unallowable |

|

AS |

ASSET |

Unallowable |

|

CH |

CASH NOT INCOME |

Unallowable |

|

FB |

FUND BALANCE |

Unallowable |

|

IC |

INCOME NOT CASH |

Unallowable |

|

IN |

INCOME CASH |

Unallowable |

|

LI |

LIABILITY |

Unallowable |

|

TE |

TRANSFER OF FUNDS-EXPENSE |

Unallowable |

|

TI |

TANSFER OF FUNDS-INCOME |

Unallowable |

Object Level Restrictions for DV Documents

|

Object Level |

Description |

Restrictions |

|

BASE |

BASE |

Unallowable |

|

BASR |

ASSESMENTS REVENUE |

Unallowable |

|

CASH |

CASH |

Unallowable |

|

AR |

ACCOUNTS REVEIVABLE |

Unallowable |

|

INV |

INVENTORY |

Unallowable |

|

OASS |

OTHER |

Unallowable |

|

INVA |

INVESTMENTS |

Unallowable |

|

PLNT |

PLANT |

Unallowable |

|

BCOM |

BUDGET COMPENSATION |

Unallowable |

|

ACSA |

ACADEMIC SALARIES |

Unallowable |

|

PART |

PART TIME INSTRUCTION – NON STUDENT |

Unallowable |

|

SAAP |

STUDENT ACADMIC APPOINTEES |

Unallowable |

|

PRSA |

PROFESSIONAL SALARIES |

Unallowable |

|

BISA |

BI-WEEKLY SALARIES |

Unallowable |

|

SAAC |

SALARY ACCRUAL EXPENSES |

Unallowable |

|

HRCO |

HOURLY COMPENSATION |

Unallowable |

|

BENF |

BENEFITS |

Unallowable |

|

CAP |

CAPITALIZED EXPENDITURES |

Unallowable |

|

FUBL |

FUND BALANCE |

Unallowable |

|

DEPR |

DEPRECIATION |

Unallowable |

|

BGEX |

BUDGET GENERAL EXPENSE |

Unallowable |

|

VADJ |

ASSESMENTS REVENUE |

Unallowable |

|

CREX |

COST RECOVERIES-EXPENSE |

Unallowable |

|

ICOE |

INDIRECT COST RECOVERY EXPENSE |

Unallowable |

|

ICOR |

INDIRECT COST RECOVERY INCOME |

Unallowable |

|

DEFR |

UNEARNED REVENUE |

Unallowable |

|

ACPA |

ACCOUNTS PAYABLE |

Unallowable |

|

ACPY |

ACCRUED PAYROLL |

Unallowable |

|

BOND |

BONDS COSTS |

Unallowable |

|

ACSI |

ACCRUED SELF-INSURANCE |

Unallowable |

|

BCAS |

BEGINNING CASH |

Unallowable |

|

BORE |

BUDGET-OTHER REVENUE |

Unallowable |

|

C&G |

CONTRACT & GRANTS (SPONS. PROG) |

Unallowable |

|

INVR |

INVESTMENTS |

Unallowable |

|

GIFT |

GIFTS |

Unallowable |

|

SASV |

SALES AND SERVICES |

Unallowable |

|

OTHR |

OTHER REVENUE |

Unallowable |

|

CRIN |

COST RECOVERIES-INCOME |

Unallowable |

|

RESV |

RESERVES |

Unallowable |

|

STAP |

STATE APPROPRIATIONS |

Unallowable |

|

CSLR |

STUDENT LOAN RECEIVABLE |

Unallowable |

|

CPR |

PLEDGES RECEIVABLE |

Unallowable |

|

RCAS |

RESTRICTED CASH AND CASH EQUIVALENTS |

Unallowable |

|

RINV |

RESTRICTED INVESTMENTS |

Unallowable |

|

ENDO |

ENDOWMENT INVESTMENTS |

Unallowable |

|

OINV |

NCR - OTHER INVESTMENTS |

Unallowable |

|

NSLR |

NCR - STUDENT LOANS RECEIVABLE, NET |

Unallowable |

|

NPR |

NCR - PLEDGES RECEIVABLE, NET |

Unallowable |

|

OSCL |

OBLIGATIONS UNDER SECURITIES LENDING |

Unallowable |

|

PTAX |

PRE TAX DEDUCTIONS |

Unallowable |

|

DHFO |

DEPOSITS HELD FOR OTHERS |

Unallowable |

|

CTDO |

CUR PORTION OF LT DEBT AND OTH OBLIGAT |

Unallowable |

|

ANPY |

NCR - ACCRUED PERSONNEL COSTS |

Unallowable |

|

ANSI |

NCR - ACCRUED SELF-INSURANCE LIABILITIES |

Unallowable |

|

OPEB |

POST EMPLOYMENT BENEFITS |

Unallowable |

|

DERI |

DERIVATIVE INSTRUMENTS-LIABILITY |

Unallowable |

|

LTDO |

LONG-TERM DEBT AND OTHER OBLIGATIONS |

Unallowable |

Object Sub Type Restrictions for DV Documents

|

Object Sub Type |

Description |

Unallowable |

|

AR |

ACCOUNTS RECEIVABLE |

Unallowable |

|

AT |

ASSESSMENT |

Unallowable |

|

BU |

BUDGET ONLY OBJECT CODES |

Unallowable |

|

CS |

CASH |

Unallowable |

|

CE |

COST RECOVERY EXPENSE |

Unallowable |

|

CI |

COST RECOVERY INCOME |

Unallowable |

|

CP |

CONSTRUCTION IN PROCESS |

Unallowable |

|

CR |

COST RECOVERY RESTRICTED |

Unallowable |

|

DR |

DEPRECIATION |

Unallowable |

|

FB |

FUND BALANCE |

Unallowable |

|

HW |

HOURLY WAGES |

Unallowable |

|

LD |

LOSS ON DISPOSAL OF ASSETS |

Unallowable |

|

LO |

LOSS ON RETIREMENT OF ASSETS |

Unallowable |

|

MT |

MANDATORY TRANSFERS |

Unallowable |

|

OF |

OTHER FEE INCOME |

Unallowable |

|

PY |

PAYABLES |

Unallowable |

|

RE |

RESERVES |

Unallowable |

|

SA |

SALARIES |

Unallowable |

|

ST |

STATE APPROPRIATIONS |

Unallowable |

|

TF |

TRANSFER OF FUNDS |

Unallowable |

|

TN |

TRANSFERS - GENERIC |

Unallowable |

|

UC |

UNIVERSITY CONSTRUCTED |

Unallowable |

|

UF |

UNIVERSITY CONSTRUCTED - FEDERAL FUNDED |

Unallowable |

|

UO |

UNIVERSITY CONSTRUCTED - FEDERAL OWNED |

Unallowable |

|

VA |

VALUATIONS AND ADJUSTMENTS |

Unallowable |

|

WO |

WRITE-OFF EXPENSE |

Unallowable |

|

CA |

CURRENT ASSETS |

Unallowable |

|

NC |

NON-CURRENT ASSETS |

Unallowable |

|

CL |

CAPITAL LEASE PURCHASES |

Unallowable |

|

NL |

NON-CURRENT LIABILITIES |

Unallowable |

|

CF |

CAPITAL MOVEABLE EQUIPMENT - FED FUNDED |

Unallowable |

Institutions may create their own restrictions for object codes and payee type based on payment reasons.

Payment Reasons

When processing a DV document, users must indicate a payment reason by selecting a Payment Reason Code from the Payment Reason list in the Payment Information tab. The payment reason identifies the nature of the disbursement and determines what restrictions the disbursement is subject to.

Choosing a payment reason may restrict the other choices you can make on the document. For example, most payment reasons only allow certain object codes and some restrict whether the person being paid can be an employee or nonemployee.

The current payment reasons for using a disbursement voucher are explained below as typical examples:

Payment Reason Code

|

Payment Reason Code |

Payment Reason Name |

Payment Reason Description |

|

A |

Claims & Settlements, Legal, Insurance |

Payments for external insurance claims, worker's compensation, legal settlements, or taxes. |

|

B |

Scholarships and Fellowships |

Scholarships and Fellowships |

|

C |

Retreats/Workshops/Committee/Meetings |

Payment to a supplier for off campus supplies (i.e. food, off-campus Lodging) while not in travel status consistent with Section 45 of the Business Procedures Manual. |

|

D |

Medical, Health Care, and Insurance |

Includes payments for chiropractic care, counseling or psychiatric, medical, dental, or other health care. Also includes insurance payments. |

|

E |

Refunds |

Refunds |

|

F |

Research Participants |

Research participant for an individual participating in a research study. |

|

G |

Contr. Serv/Advertise/Print/Honoraria |

Payments for contractual agreements/services/advertising/printing/honoraria. |

|

H |

Gifts, Prizes, Stipend and Awards |

Gifts, prizes, awards, and stipends must be made to Non-employees/Non-students only. Awards may not include personal services, scholarship, or fellowship payments. |

|

I |

Reimbursements/Out of Pocket Expenses |

Reimbursement to an individual who incurs out-of-pocket expenses. No travel, or personal service payments may be made. |

|

J |

Rental Payment |

Rental payments for equipment and space. |

|

K |

Royalties |

Any payments associated with royalties, rights and permissions. |

|

L |

Subscriptions/Books/Fees/License |

Purchase of subscriptions or books, membership fees to a professional association, license and other required fees. |

|

M |

Supplies and Resale Items |

Payments for supplies or resale items. |

|

N |

Conference Hosting & Reg/Group Travel |

Conferences & seminars, hotel or event center charges for a departmental hosted conference, conference registrations, and group travel paid directly by MSU (non-employee reimbursable). |

|

O |

Travel Reimbursement |

Travel reimbursement for travel expenses. |

|

P |

Utilities/Postage/Phone/Internet |

Utilities, postage, and communications payments to non-employees only. Payments include cell phone, telephone, cable, internet charges. |

|

Q |

Subcontract Payments |

Payments for services rendered under a subcontract agreement |

|

R |

Replenish Open Ended Cash Advances |

For open ended and petty cash advances through the Cashier's Office. |

|

Z |

University Services Use Only |

Non Converted PO and/or Freight |

Routing

The DV document must route through a series of approvals before the disbursement is actually made based on the rules set up by the institution. Due to its unique nature, the DV document has some special routing issues which are explained below:

• The DV document first routes to the fiscal officer for each account in the Accounting Lines tab.

• After it has been approved by all required fiscal officers, the document routes, as specified by the institution's rule, to the organization review routing level.

• After the document has been approved by all organizational approvers, the DV document goes through any special routing as required by business rules surrounding the attributes of the transaction and the payee.

The document status becomes 'FINAL' when the required approvals are obtained and the transaction is processed by the institution defined process, which might include the Pre-Disbursement Processor.

![]() For information about the Pre-Disbursement Processor, see Pre-Disbursement

Processor.

For information about the Pre-Disbursement Processor, see Pre-Disbursement

Processor.

|

|

Special Routing |

|

Payee identified as being a nonresident alien (determined by the Nonresident Alien? option on the Payee tab) |

KFS-SYS Tax Manager role |

|

Account used on the document is a Contract and Grant Account |

Approval required by Contract and Grants. |

|

Payee identified is a purchase order vendor. |

Purchase Disbursement Voucher approval is required. |

|

Payment Method (Payment Information tab) is Wire Transfer |

KFS-FP Disbursement Method Reviewer role members associated with Payment Method 'W'. |

|

Payment Method is Foreign Draft |

KFS-FP Disbursement Method Reviewer role members associated with Payment Method 'F'. |

Initiating a DV Document

1. Select Disbursement Voucher from the Financial Transactions submenu.

2. Log into the KFS as necessary.

A blank Disbursement Voucher document with a new document ID appears.

3. Complete the Payment Information tab.

If you wish to permanently change a nonemployee's address information, process a Vendor document to change the default address stored in the KFS.

![]() For information about the Vendor document, see Vendor

(PVEN).

For information about the Vendor document, see Vendor

(PVEN).

4. Complete the Payment Information tab.

5. Complete the Accounting Lines tab.

Specify the accounts and object codes to be debited when making this disbursement.

6. Complete the Contact Information tab, and remaining DV-specific tabs as required.

7. Click ![]() .

.

8. Print a cover sheet, if necessary.

9. Appropriate fiscal officers and organization reviewers approve the document.

![]() For more information about how to approve a document, see Workflow

Action Buttons.

For more information about how to approve a document, see Workflow

Action Buttons.

Displaying Detailed Payment Information

After a DV has been approved, extracted, and formatted, you may access summary information about it in the Pre-Disbursement Processor Status tab. If the disbursement has been issued, this tab also displays the paid date.

To view more detailed payment information, click ![]() .

The system displays the Search for Payment screen and, below it, a row of data

containing additional information about the DV.

.

The system displays the Search for Payment screen and, below it, a row of data

containing additional information about the DV.