Financial ProcessingStandard Transaction E-Docs

Advance Deposit

![]() >

>![]() >

>![]() >

>

![]() >

> ![]()

![]() In order for users to submit the Advance Deposit document,

the ENABLE BANK SPECIFICATION IND parameter must

be set to Y and the DEFAULT_BANK_BY_DOCUMENT_TYPE parameter must be completed.

Even if your institution is not planning to use the Bank Offset feature

in KFS,

the DEFAULT_BANK_BY_DOCUMENT_TYPE parameter must be completed if your users

plan to use the Advance Deposit document. Bank offsets will not be created if

the Bank Offset feature has not been configured

In order for users to submit the Advance Deposit document,

the ENABLE BANK SPECIFICATION IND parameter must

be set to Y and the DEFAULT_BANK_BY_DOCUMENT_TYPE parameter must be completed.

Even if your institution is not planning to use the Bank Offset feature

in KFS,

the DEFAULT_BANK_BY_DOCUMENT_TYPE parameter must be completed if your users

plan to use the Advance Deposit document. Bank offsets will not be created if

the Bank Offset feature has not been configured

The Advance Deposit (AD) document is used to record deposits that go directly to the bank, without being verified through the normal cash receipts process. This document enables distribution of the amount received to the appropriate accounts in the financial system.

The AD document is used to record deposits that are not processed through a central processing area (such as a Cashier's Office). The AD document is used by university departments that make their own deposits, departments that use a lockbox at the bank for cash receipts, and anyone who needs to record bank deposits that are not processed through the Cashiers Office. The AD is used when checks or cash are received and need to be credited to a KFS account. The user creating the AD is responsible for ensuring that the actual bank deposit occurs. The AD document creates the specified accounting entries in the KFS.

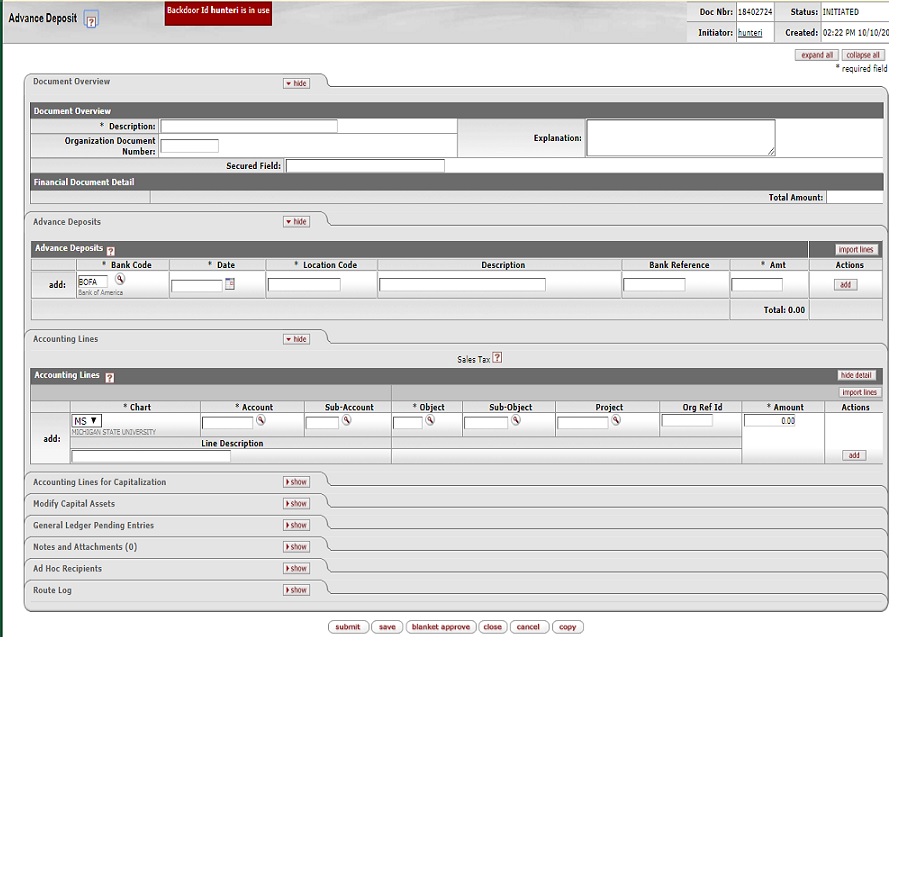

Document Layout

The AD document has its own unique tab called Advance Deposits in addition to the standard financial transaction tabs.

![]() For more information about

the standard tabs, see Standard Tabs.

For more information about

the standard tabs, see Standard Tabs.

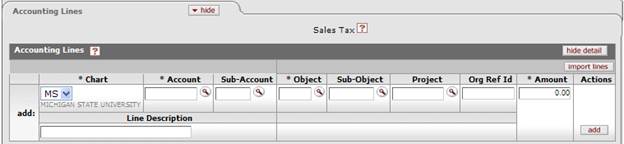

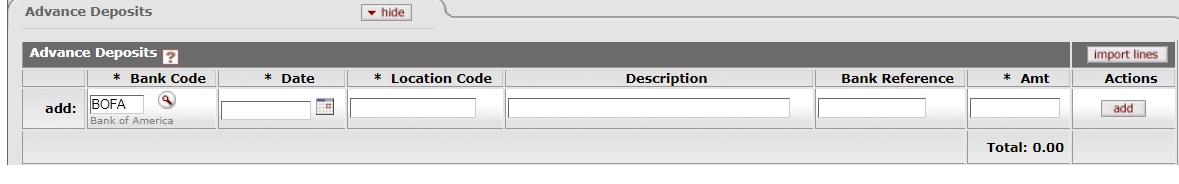

Advance Deposits tab

Advance Deposits tab definition

|

Title |

Description |

|

Bank Code |

Required.

Enter the bank code number to which the funds are deposited or search for a

bank account from the Bank Account lookup |

|

Date |

Required.

Enter the actual date of the deposit or select it from the calendar |

|

Location Code |

Required. Identifies the department making the bank deposit. Enter the location code for the department processing the deposit. |

|

Description |

Optional. 40 Character field provides a brief description of the deposit transaction. This is for departmental use only, and does not appear on financial reports. |

|

Bank Reference |

Optional. Intended for bank reconciliation purposes by central office. Field may be blank or, if used, must be exactly 11 digits. |

|

Amt |

Required. Enter the total amount of the deposit. |

Sales Tax Lookup

Business Rules

· The advance deposits total amount must be greater than zero.

· The advance deposits total must be equal to the total of the Accounting Lines tab.

· Negative accounting line amounts are allowed.

· There must be at least one accounting line in the document

· The AD document is one-sided. The KFS automatically generates the other side of the entry affecting the cash account, as defined by data entered into the document.

· Object sub type and object code restrictions are as follows.

Object sub type code type restrictions for Advance Deposit documents

|

Object Sub Type Code |

Description |

Restrictions |

|

AR |

Accounts Receivable |

Unallowable |

|

BI |

Bond Issuance |

Unallowable |

|

BU |

Budget-Only Object Codes |

Unallowable |

|

CA |

Cash |

Unallowable |

|

CE |

Cost Recovery Expenses |

Unallowable |

|

CL |

Capital Lease Purchases |

Unallowable |

|

CS |

Cash |

Unallowable |

|

DR |

Depreciation |

Unallowable |

|

FB |

Fund Balance |

Unallowable |

|

FR |

Fringe Benefits |

Unallowable |

|

HW |

Hourly Wages |

Unallowable |

|

MT |

Mandatory Transfers |

Unallowable |

|

NC |

Non-Current Assets Non-Current Liabilities |

Unallowable |

|

NL |

Non-Current Liabilities |

Unallowable |

|

PL |

Capital Assets |

Unallowable |

|

RE |

Reserves |

Unallowable |

|

SA |

Salary And Wages |

Unallowable |

|

TF |

Transfer Of Funds |

Unallowable |

|

TN |

Transfers - Generic |

Unallowable |

|

VA |

Valuations And Adjustments |

Unallowable |

Object type code restrictions for Advance Deposit documents

|

Object Type Code |

Description |

Restrictions |

|

ES |

Expense Not Expenditure |

Unallowable |

|

IC |

Income Not Cash |

Unallowable |

Consolidated object code restrictions for Advance Deposit documents

|

Consolidated Object Code |

Description |

Restrictions |

|

FDBL |

Fund Balance |

Unallowable |

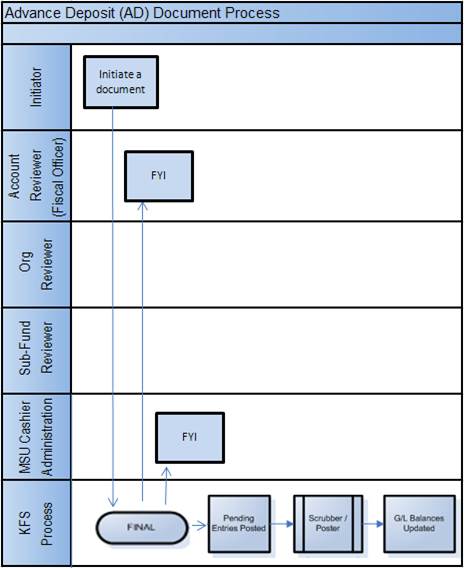

Routing

After an AD document is submitted, it is automatically approved the document status is 'FINAL' .However, the document routes for ‘FYI’ to the Fiscal Officer(s) and to the Cashier Administration for oversight. The transaction is posted to the G/L during the next G/L batch process.

Initiating an Advance Deposit Document

1. Select Advance Deposit from the Financial Transactions menu.

2. Log into the KFS as necessary.

A blank AD document with a new document ID appears.

3. Complete

the Advance Deposits tab and click ![]() .

.

Enter an advance deposit line, click add, and continue adding as many advance deposits as necessary.

4. Complete the standard tabs.

![]() For information

about the standard tabs such as Document Overview, Notes

and Attachments, Ad

Hoc Recipients, Route

Log, and Accounting Lines tabs, see Standard

Tabs.

For information

about the standard tabs such as Document Overview, Notes

and Attachments, Ad

Hoc Recipients, Route

Log, and Accounting Lines tabs, see Standard

Tabs.

5. Click ![]() .

.

6. Review the General Ledger Pending Entries tab.

The pending entries include offset generation lines to cash or fund balance object codes.

7. Review the Route Log tab.

No approval is required, but an FYI generated to the Fiscal Officer and the Cashier Administration.

![]() For more information about the Route Log, see Route

Log.

For more information about the Route Log, see Route

Log.

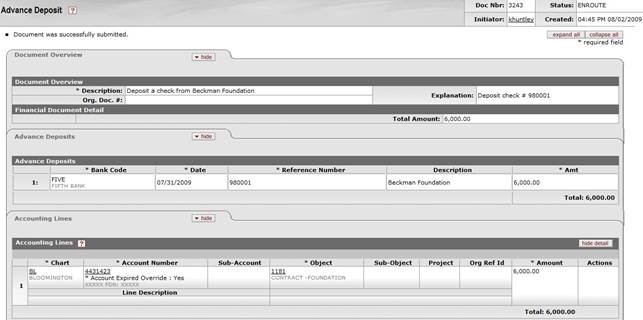

Example

The University receives a check from the Beckman Foundation for a grant agreement. At this University, separate bank accounts are maintained for grant related funds and deposits to these accounts are not routed to a central processing office.

The Advance Deposit document allows the area receiving the check to directly deposit the check into a designated bank account and properly reflect the credit in the correct account in the KFS. The advance deposit generates an FYI to the Fiscal Officer(s) and to the Cashier Administration after it is submitted and is at a “Final” status.