Imported Expenses Section

This section allows you to search for, select and add imported payments to the document if your institution uses the manual reconciliation (By TRV) import method.

If parameter

INCLUDE_ARRANGER_EXPENSE_IN_IMPORTED_EXPENSE_IND = Yes, then the Arranger can

import their own expenses in addition to the Payee/Traveler.

If parameter

INCLUDE_ARRANGER_EXPENSE_IN_IMPORTED_EXPENSE_IND = Yes, then the Arranger can

import their own expenses in addition to the Payee/Traveler.

Before you begin working in this section, it looks like this:

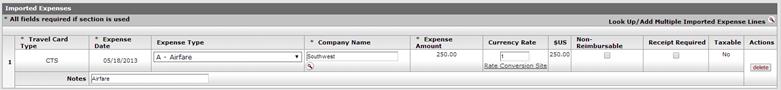

After you add imported expenses, the section contains the fields shown here:

Actual Expenses tab, Imported Expenses section definition

|

Description | |

|

Travel Card Type |

Display only. The type of card used. |

|

Expense Date |

Display only. The date the expense was incurred or the receipt was issued. |

|

Expense Type |

Required if this section is used. The type of expense incurred. You may change the expense type shown by selecting from the list. |

|

Company Name |

Required if this section is used. The name of the vendor. |

|

Expense Amount |

Display only. The amount on the receipt. This field cannot be changed. |

|

Currency Rate |

Optional. The currency conversion rate applied. |

|

$US |

Display only. The U.S. dollar equivalent of the amount on the receipt. |

|

Non-Reimbursable |

Indicates whether this expense is reimbursable. Check the box to indicate that it is non-reimbursable.

|

|

Indicates whether a receipt is required for reimbursement. | |

|

Taxable |

Display only. Indicates whether this amount is taxable.

|

|

Notes |

Explanatory note. |

Non-reimbursable amounts are not included in the accounting line

distribution, but they are included in the

Non-reimbursable amounts are not included in the accounting line

distribution, but they are included in the  Working in the Imported Expenses

Section

Working in the Imported Expenses

Section