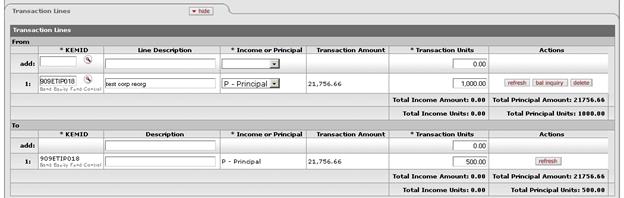

Transaction Lines Tab

This tab contains a From section that specifies the KEMID that holds the security along with all relevant financial details for the transaction. Only one KEMID is allowed in the From section. The system copies the KEMID from the From section to the To section. You cannot change the KEMID in the To section.

Transaction Lines tab definition

|

Description | |

|

KEMID |

Required in the From section;

display only in the To section. The

KEMID affected by the transaction. The KEMID must be a permanent endowment. Enter the ID or use the lookup

|

|

Line Description (From line) Description (To line) |

Optional. A description of the transaction, such as 'Merger with Walt Disney.' |

|

Income or Principal |

Required in the From section; display only in the To section. Indicates whether the affected securities are held in income or principal. Select the appropriate value from the list in the From section. The options are 'P' (Principal) and 'I' (Income). The system automatically copies this value from the From section to the To section. |

|

Transaction Amount |

Display only. The total holding cost for all tax lots in the transaction. Automatically displayed in both the From and To sections after the system calculates amounts for the tax lot lines. |

|

Transaction Units |

Required. The number of units or shares involved in the transaction. In the To section, enter the number of units being transferred. The number of units in the To section does not need to match the number in the From section. |

|

Actions |

Click the appropriate button to perform an action on this line. When you are adding a new line, only the add button is displayed. After you have added a line to the From section, the refresh (which forces the system to update the tax lot information after you have changed data on a line), bal inquiry (which allows you to select and view balance inquiry reports for the KEMID), and delete (which allows you to delete the line) buttons are displayed. After you have added a line to the To section, only the refresh button (which forces the system to update the tax lot information after you have changed data on a line) is displayed. |

|

Total Income Amount |

Display only. In the From section, if the Income/Principal indicator is set to 'Income,' this value is the total income amount. In the To section, this value is automatically populated by the system. |

|

Total Principal Amount |

Display only. In the From section, if the Income/Principal indicator is set to 'Principal,' this value is the total principal amount. In the To section, this value is automatically populated by the system. |

|

Total Income Units |

Display only. The total number of shares affecting income on the transaction lines. Calculated and displayed separately for the From and To sections of the tab. |

|

Total Principal Units |

Display only. The total number of shares affecting principal on the transaction lines. Calculated and displayed separately for the From and To sections of the tab. |

to find it. The system copies the

KEMID from the

to find it. The system copies the

KEMID from the  Tax Lot Lines Tab

Tax Lot Lines Tab