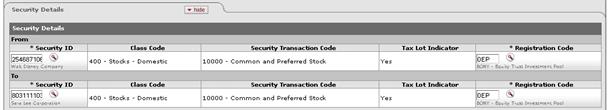

Security Details Tab

This tab contains the securities involved in the reorganization. The source security is identified in the From section, where only one transaction line is allowed. The target security is identified in the To section.

If more than one KEMID holds the security, a separate e-doc is required for each KEMID.

Security Details tab definition

|

Description | |

|

Security ID |

Required in both the To and From sections. The security involved in this transaction. Only one security may be specified in each section. The security records referenced in the To and From sections cannot be the same, must be valid and active in the system, and must not have a liability class code. The KEMID(s) you specify in the Transaction Lines tab must own sufficient shares of this security to complete the transaction. Enter the ID of a valid security or use the lookup

|

|

Class Code |

Display only. The class (group) to which this security belongs. Examples include: Alternative Investment, Bond, Cash Equivalents, Liability, Other, Pooled Investment and Stock. |

|

Security Transaction Code |

Display only. The security transaction code assigned to this security. The system obtains this value from the class code for the security. |

|

Tax Lot Indicator |

Display only. Indicates whether affected security units (holdings) are maintained in separate accounting (tax) lots. This indicator determines how gains and losses on the sale of the security are calculated. 'Yes' = Security units are maintained in separate tax lots. 'No' = Security units are consolidated into one holding. |

|

Registration Code |

Required. Indicates where (for example, at a bank, at a broker, or somewhere in the institution) a security is held in custody for the institution. The registration code specified must be valid and active in the system. Enter a valid, active registration code or use the

lookup |

to find it. After you enter the

security ID, the system displays the description of the security you

specified along with its class code and description, security transaction

code and description, and tax lot indicator.

to find it. After you enter the

security ID, the system displays the description of the security you

specified along with its class code and description, security transaction

code and description, and tax lot indicator. Transaction Lines

Tab

Transaction Lines

Tab