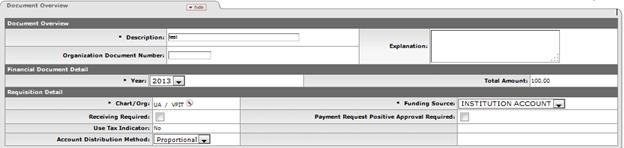

Document Overview Tab

Unlike the Document Overview tab in other financial documents, a special Fiscal Year field is included in this tab on the Requisition document because, in some circumstances, users may be able to select from more than one fiscal year to which a Requisition should be applied. The tab also includes the Requisition Detail section, which identifies the contract manager and funding source for this requisition.

Document Overview tab definition

|

Description | |

|

Year |

Required. The default is the current fiscal year. this field is not editable until the 'ALLOW ENCUMBER NEXT FY DAYS' parameter has been met. Setting the year to the next fiscal year can affect the requisition in several ways. The requisition may not become an APO if the 'ALLOW APO NEXT FY DAYS' parameter has not been met, and the funds will not be encumbered until the next fiscal year once a PO is fully approved. |

|

Total Amount |

Display-only. Displays the total amount of the requisition after tax and fees. |

|

|

Required. Automatically completed based on the initiator's

chart/org. This value may be changed manually via the lookup |

|

Funding Source |

Required. Defaults to 'Institution Account'. May be changed by selecting another option from the list. |

|

Receiving Required |

Optional. Select the check box to ignore the receiving thresholds on the approved purchase order. If the field is checked, then a Line Item Receiving document must be processed with sufficient quantities received before a payment will route to the fiscal officer. |

|

Payment Request Positive Approval Required |

Optional. The 'DEFAULT POS APPRVL LMT' parameter determines the dollar limit where payment requests must receive positive approval from a fiscal officer. If this field is selected, positive approval on the payment request is required regardless of the total of the payment. |

|

Use Tax Indicator |

Required if the 'ENABLE SALES TAX IND' parameter is set to 'Y,' Otherwise, this field does not display at all. Indicates whether or not sales or use tax applies to the requisition. |

|

Account Distribution Method |

Required. Payments made against purchase orders funded via proportional account distribution will disencumber accounts proportionally, based on the percentages entered for each line. Payments made against purchase orders funded via the sequential account distribution method will disencumber accounts in the sequence that they are listed, up to the dollar amount specified. Any excess will be funded proportionally, based on the percentages. Valid value(s) are derived from the ‘DISTRIBUTION_METHOD_FOR_ACCOUNTING_LINES' parameter. The possible values for this parameter include: ‘P' – All requisitions will be set to use the proportional account distribution method. ‘S' – All requisitions will be set to use the sequential account distribution method. ‘P;S' – The user will have the option to choose between proportional and sequential. Proportional will be the default value. ‘S;P' – The user will have the option to choose between proportional and sequential. Sequential will be the default value. |

. This

value is also the chart/org that is used for the Content route

level.

. This

value is also the chart/org that is used for the Content route

level. Delivery

Tab

Delivery

Tab