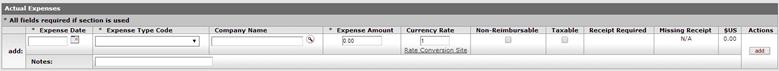

Actual Expenses Section

This section allows you to manually enter data for expenses that have not yet been recorded.

Actual Expenses section definition

|

Description | |

|

Expense Date |

Required if this section is used. The date the expense

was incurred. Enter the date or select it from the calendar

|

|

Expense Type Code |

Required if this section is used. The type of expense incurred. Select the appropriate type from the list.

|

|

Company Name |

Optional. The name of the company used. Enter the name

or use the lookup |

|

Expense Amount |

Required if this section is used. The monetary amount for this expense.

|

|

Currency Rate |

The currency conversion rate to be applied to the amount entered. To view conversion rates, click the Rate Conversion Site link.

|

|

Non-Reimbursable |

Indicates whether the amount is reimbursable. If this amount is not reimbursable, check the box.

|

|

Taxable |

Indicates whether the expense is taxable as defined by the Expense Type Object Code table.

|

|

Receipt Required |

Display only. Indicates whether a receipt is required for reimbursement as defined in the Expense Type Object Code Table.

|

|

Missing Receipt |

If a receipt is required for this expense, a check box will display so that you can indicate if the receipt is missing. You will also need to add a note. If the receipt is not available, check the box. If no receipt is required for the expense, the system displays the entry “N/A”.

|

|

$US |

Display only. Indicates the amount in US dollars. |

|

Notes |

Required if the Missing Receipt box is checked or as defined in the Expense Type Object Code table. Further explanation pertaining to this expense.

|

.

. The same

expense cannot be claimed on the same day. You can use the Detail Expense

tab to further breakout expenses.

The same

expense cannot be claimed on the same day. You can use the Detail Expense

tab to further breakout expenses. to find one. This field is not

validated.

to find one. This field is not

validated. If the expense

type is defined as a Pre-Paid Expense in the Expense Type table, the

expense is non-reimburseable and will be excluded from the amount due the

If the expense

type is defined as a Pre-Paid Expense in the Expense Type table, the

expense is non-reimburseable and will be excluded from the amount due the

Working in the Actual Expenses

Section

Working in the Actual Expenses

Section