Per Diem Section

This section is

optional if the Personal Vehicle or Traveler

Expenses section is completed.

This section is

optional if the Personal Vehicle or Traveler

Expenses section is completed.

The Per Diem section is used to calculate the amount due the nonemployee traveler for meals and incidental expenses. The calculation is based on dates and times provided in the Destination section above and the per diem rate as set forth by the Travel Per Diem table (available on the Maintenance menu tab).

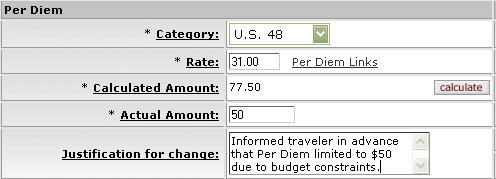

Per Diem section definition

|

Title |

Description |

|

Category |

Required. Select the category of destination of the traveler from the Category list defined by your institution but examples might include Foreign, U.S. 48, and U.S. AK & HI. |

|

Rate |

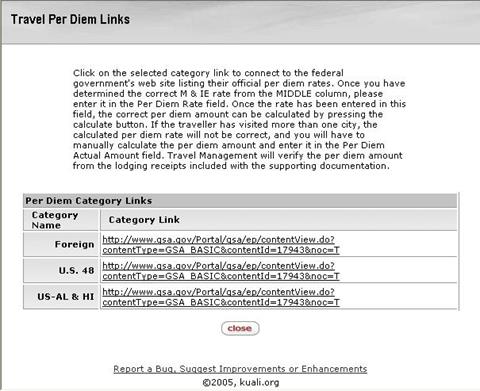

Required. Enter the per diem rate in dollars. Per diem rates are based on rates set by the IRS but may vary from institution to institution. These rates are typically calculated based on the city where the traveler spent the night (per IRS regulations). Additional information about per diem rates is available by clicking Per Diem Links next to the rate field in this section. |

|

Calculated Amount |

Required. Display-only. The amount is updated when calculate is clicked. |

|

Actual Amount |

Required. This field is pre-filled with the calculated amount but may be edited to reduce the actual per diem payment (but never increased). |

|

Justification for Change |

Optional. Enter an explanation for the reason for the changes in the Actual Amount in the Per Diem, if it is changed. |

Personal Vehicle

Section

Personal Vehicle

Section