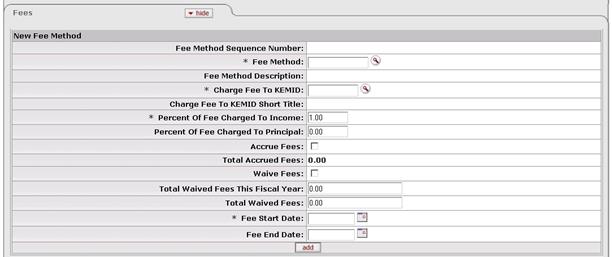

Fees Tab

This tab contains information that is used by the system to assess fees against KEMIDs. These fees are calculated and charged to KEMIDs through an overnight batch process. Use of this tab is not required for any KEMID record. If you choose to use the tab, you may associate one or more fee methods with the KEMID.

Fees tab definition

|

Description | |

|

Fee Method Sequence Number |

Display only. The system-assigned sequence number for this record. |

|

Fee Method |

Required when adding a record to associate this KEMID

with a fee method; otherwise, display only. The

code used by your institution to identify a particular set of parameters

for calculating fees to be assessed against KEMIDs. Enter an

existing fee method code or use the lookup |

|

Fee Method Description |

Display only. Your institution's description for this fee method. |

|

Charge Fee to KEMID |

The KEMID to which fees will be charged. Defaults to

the KEMID for the record, but you may enter another existing KEMID or use

the lookup |

|

Charge Fee to KEMID Short Title |

Display only. The KEMID's abbreviated title for internal reporting use. |

|

Percent Of Fee Charged To Income |

Required. The percent of the fee to be calculated on counts or values related to the income of the KEMID activity and/or holdings. Defaults to '1.00' (100%). You may change this value. The value entered must be a fixed point number, with three total digits including two digits to the right of the decimal point. |

|

Percent Of Fee Charged to Principal |

Defaults to 0.00 (0%). If only a portion of the fees are to be assessed against the income funds, the percent of the fee to be calculated on counts or values related to the principal of the KEMID activity and/or holdings. You may change this value, but it cannot exceed 0.00 if the Restriction Code value is 'NA' (Not Applicable) for the KEMID type code. The value entered must be a fixed point number, with three total digits including two digits to the right of the decimal point. |

|

Accrue Fees |

Indicates whether or not to accrue the fees charged to the account (Y/N). Defaults to 'No.' |

|

Total Accrued Fees |

The total of all fees calculated by this method that have accrued to date. Defaults to zero, is system generated, and may be changed in edit mode only.

|

|

Waive Fees |

Indicates whether or not to waive the fees charged to the KEMID (Y/N). Defaults to 'No.' |

|

Total Waived Fees This Fiscal Year |

Display only. The total of the waived fees that could have been charged to the account for the current fiscal year. Defaults to zero, is system generated, and cannot be changed.

|

|

Total Waived Fees |

Display only. The total of the waived fees calculated by this method that could have been charged to the account since the fee start date. Defaults to zero, is system generated, and cannot be changed. |

|

Fee Start Date |

Required. The first date on which this fee is to be

assessed. Defaults to the next processing date. May be changed only when

you are adding a new record. Enter the date or select it from the calendar

|

|

Fee End Date |

The last date on which this fee is to be assessed.

Enter the date or select it from the calendar |

to find

it.

to find

it. When the fee

When the fee  . If edited,

this value must be valid based on the fee

. If edited,

this value must be valid based on the fee  Report Groups Tab

Report Groups Tab