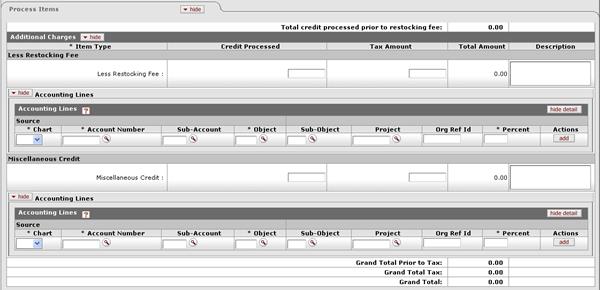

Additional Charges Section

Additional Charges section definition (credit references a payment request)

|

Title |

Description |

|

Item Type |

Display-only. The type of item to be charged.

|

|

Credit Processed |

Optional. Enter the amount that corresponds to this item type.

|

|

Tax Amount |

Calculated when tax service is called. This field may be edited.

|

|

Total Amount |

Display-only. The sum of credit processed plus tax amount, if applicable. |

|

Description |

Parameters control whether descriptions are required. |

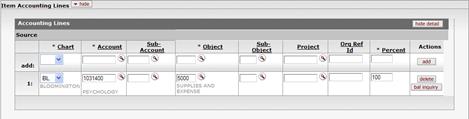

For a vendor credit memo referencing a vendor ID, additional charges are the only types of information displayed in the Process Items tab. Dollar amounts are not prefilled, so you must enter accounting information.

In the example below, the credit references a vendor number.

This section presents information about restocking fees and miscellaneous credits that apply to the credit memo.

Additional Charges section definition (credit references a vendor number)

|

Title |

Description |

|

Credit Processed |

The dollar amount to be applied to this vendor credit memo. |

|

Tax Amount |

Calculated when tax service is called. This field may be edited.

|

|

Total Amount |

Display-only. The sum of credit processed plus tax amount, if applicable. |

|

Description |

Required by default for miscellaneous credit only.

|

Click show/hide to display or hide item accounting lines for each line item or additional item.

An entry of 'Less

Restocking Fee' reduces the amount of any credit entered for other item

types.

An entry of 'Less

Restocking Fee' reduces the amount of any credit entered for other item

types. View Related Documents

Tab

View Related Documents

Tab