Purchasing/Accounts PayableStandard Transaction E-Docs

Vendor Credit Memo

![]() >

>![]() >

>![]() >

>![]() >

>![]()

The Vendor Credit Memo (CM) document allows you to process vendor refunds for goods or services related to invoices processed on POs. You may process a vendor credit memo against a specific payment request, a purchase order, or a vendor ID.

![]() You must be a member of the role

KUALI_PURAP_ACCOUNTS_PAYABLE_PROCESSOR

to initiate the Vendor Credit Memo document.

You must be a member of the role

KUALI_PURAP_ACCOUNTS_PAYABLE_PROCESSOR

to initiate the Vendor Credit Memo document.

Document Layout

Two screens are associated with this e-doc—an initiation screen with a single folder, followed by a main screen with multiple folder tabs.

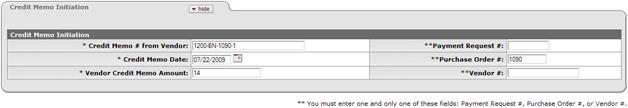

Credit Memo Initiation Tab

When you select Vendor Credit Memo from the main menu, the system displays the Credit Memo Initiation tab.

This tab is used to specify the vendor credit memo number, date, and amount for the credit memo along with the number for either a payment request, a purchase order, or a vendor in order to initiate the Vendor Credit Memo document.

Credit Memo Initiation tab definition

|

Title |

Description |

|

Credit Memo # from Vendor |

Required. Enter the number found on the vendor's credit memo. |

|

Credit Memo Date |

Required. Enter the date found on the credit memo itself

or select the date from the calendar |

|

Vendor Credit Memo Amount |

Required. Enter the net amount of the credit. |

|

Payment Request # |

Specify a payment request number in this field only if the vendor credit memo is processed against a specific payment request. See note below. |

|

Purchase Order # |

Specify a PO number in this field only if the vendor credit memo is processed against a specific PO. See note below. |

|

Vendor # |

Specify a vendor number in this field only if the vendor credit memo is general in nature (not applicable to a specific payment request or a specific PO). See note below. |

![]() An entry in one and only one of these three fields is required: Payment

Request #, Purchase Order #, or Vendor #.

An entry in one and only one of these three fields is required: Payment

Request #, Purchase Order #, or Vendor #.

Click ![]() to begin initiation of this vendor credit

memo.

to begin initiation of this vendor credit

memo.

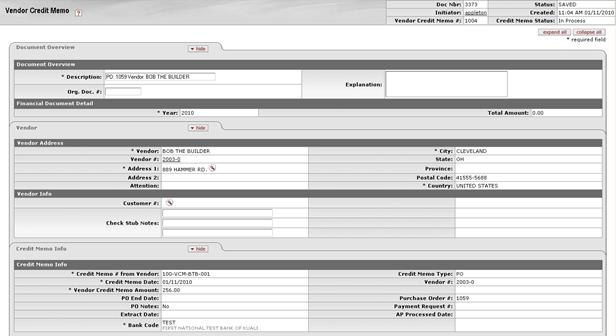

The Vendor Credit Memo document continues from the initiation screen to the main document screen that displays the unique Vendor, Credit Memo Info, and Process Items tabs in addition to the standard e-doc tabs.

![]() For more information about the standard tabs, see Standard

Tabs.

For more information about the standard tabs, see Standard

Tabs.

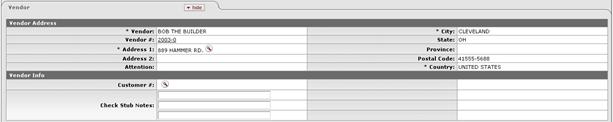

Vendor Tab

The Vendor tab allows you to modify the vendor address information via address lookup if the credit memo has been processed against a PO or a vendor. You may also add check stub notes on this tab.

This tab contains two sections, Vendor Address and Vendor Info.

Vendor Address section definition

|

Title |

Description |

|

Vendor |

Display-only. The name of the vendor. |

|

Vendor # |

Display-only. The number that uniquely identifies the particular vendor. |

|

Address 1 |

Required. The first line of the vendor's address. A

change of address is possible via lookup

Leave as is or search for the address from the Address lookup |

|

Address 2 |

Display-only. The second line of the vendor address. |

|

Attention |

Display-only. If the credit memo is against a payment request and the payment request had an attention line completed, the name in the attention line on the payment request populates this field. |

|

City |

Display-only. The city of the vendor's address. |

|

State |

Display-only. The state of the vendor's address. |

|

Province |

Display-only. The province of the vendor's address (foreign addresses). |

|

Postal Code |

Display-only. The postal code of the vendor's address. |

|

Country |

Display-only. The country of the vendor's address. |

Vendor Info Section

Vendor Info section definition

|

Title |

Description |

|

Customer # |

Display-only. The ID number for the customer. The system

displays this value if a customer number exists on the referenced document.

A change of customer number is possible via lookup

|

|

Check Stub Notes |

Optional. Enter text to be printed on the check stub. |

Credit Memo Info Tab

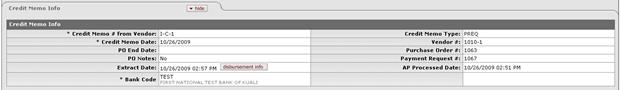

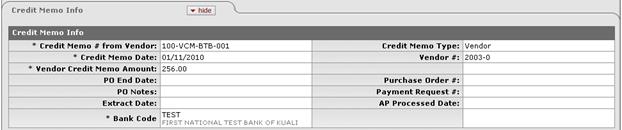

The Credit Memo Info tab displays information pertinent to the current credit memo. In the examples below, the first credit memo is against a payment request and the second is against a vendor.

Credit Memo Info tab definition

|

Title |

Description |

|

Credit Memo # from Vendor |

Display-only. The credit memo number as entered on the Credit Memo Initiation tab. |

|

Credit Memo Date |

Display-only. The credit memo date as entered on the Credit Memo Initiation tab. |

|

Vendor Credit Memo Amount |

Display-only. The amount of the credit as entered on the Credit Memo Initiation tab. This field is displayed only on an in-process Vendor Credit Memo document. After the document has been submitted, the field no longer carries forward. |

|

Display-only. The end date automatically populated from PO information. |

|

|

PO Notes |

Display-only. 'Yes' if the PO contains notes. |

|

Extract Date |

Display-only. The date the credit record was extracted to the Pre-Disbursement Processor. |

|

Bank Code |

Required. The bank code will be displayed only if the

Bank_Code_Document_Types includes 'CM' and Enable_Bank_Specification_Ind=‘Y.'

The default bank is determined by the Default_Bank_By_Document_Type parameter.

You may override this value by entering another bank code or selecting it

from the Bank lookup

|

|

|

Display-only. Indicates whether this credit memo references a payment request, PO, or vendor. |

|

Vendor # |

Display-only. Automatically populated based on the entry in the Credit Memo Initiation tab that references either the payment request, the purchase order or the vendor number. The vendor number is followed by a hyphen and the division number. |

|

Purchase Order # |

Display-only. The referenced purchase order number or the purchase order number associated with the referenced payment request. |

|

Payment Request # |

Display-only. If processing a credit against a payment request, this field is populated based on the entry in the Credit Memo Initiation tab. |

|

Display-only. The date the vendor credit memo was submitted by Accounts Payable. |

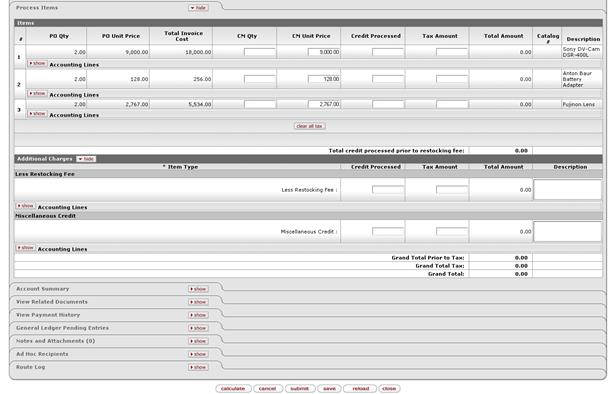

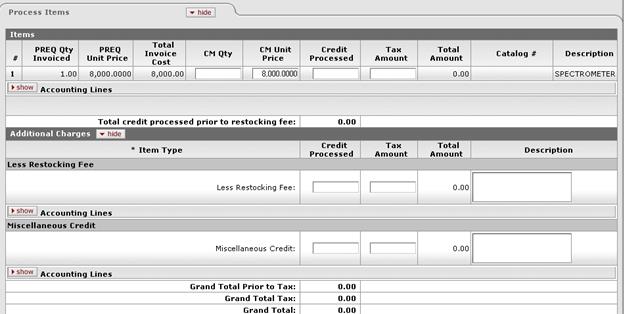

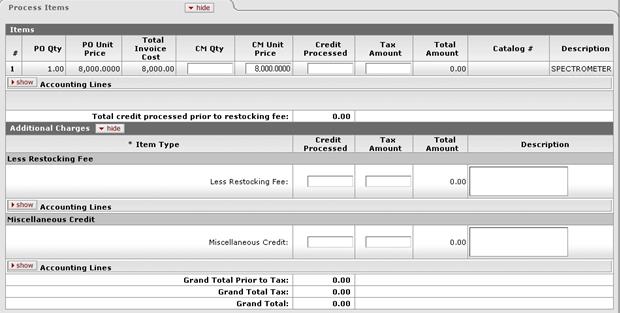

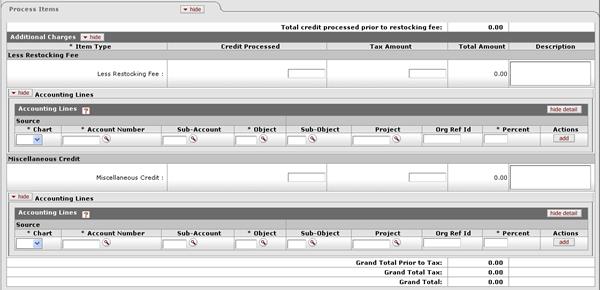

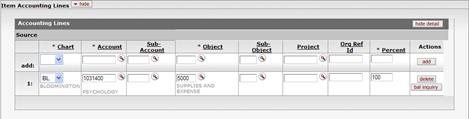

Process Items Tab

The Process Items tab identifies the lines of a specified purchase order or payment request that this credit relates to. It also indicates the dollar amounts to be credited to individual lines and allows you to edit the accounting information associated with these lines. It also allows you to enter additional credits pertaining to items such as restocking fees or miscellaneous credits.

The tab includes two sections: Items and Additional Charges. In the example below, the credit references a purchase order.

Items Section

The makeup of the Items section varies based on whether the credit is being applied to a purchase order, payment request or vendor. If crediting by vendor, the Items section contains no fields. See below for the section definition when the CM is based on a vendor number or a payment request.

Process Items tab definition (credit references a purchase order)

|

Description |

|

|

# |

Display-only. The item line number from the PO. |

|

PO Qty |

Display-only. The quantity of items available for credit. |

|

PO Unit Price |

Display-only. The unit price copied from the PO for this line item. |

|

Total Invoice Cost |

Display-only. The total amount already invoiced and available to credit for this line item. |

|

|

Optional. Enter the number of items for this line that are to be credited. This entry increases the Open Qty value for this line item on the PO. |

|

|

Optional. The unit price for this line item to be processed as a credit. This field is automatically populated using the price from the PO, but it may be edited to match the credit memo unit price. |

|

|

If blank and if the credit memo quantity invoiced is populated, the system calculates the credit processed for this line item when you click the calculate button.

|

|

Tax Amount |

Calculated when tax service is called. This field may be edited.

|

|

Total Amount |

Display-only. The sum of credit processed plus tax amount, if applicable. |

|

Catalog # |

Display-only. The catalog number for this item on the PO. |

|

Description |

Display-only. The description for this item on the PO. |

In this next example, the credit references a payment request.

Process Items tab definition (credit references a payment request)

|

Title |

Description |

|

# |

Display-only. The item line number from the payment request. |

|

PREQ Qty Invoiced |

Display-only. The quantity of items available to be credited on the specified Payment Request document. |

|

PREQ Unit Price |

Display-only. The unit price copied from the payment request for this line item. |

|

Total Invoice Cost |

Display-only. The total amount available to be credited for this line item on the specified Payment Request document. |

|

CM Qty |

Optional. Enter the number of items for this line that are to be credited. This increases the Open Qty value for this line item on the PO. |

|

CM Unit Price |

Optional. The unit price for this line item to be processed as a credit. This field is automatically populated using the price from the payment request, but the unit price may be edited if the credit reflects a different price. |

|

Credit Processed |

If blank and if the credit memo quantity invoiced is populated, the system calculates the credit processed for this line item when you click the calculate button. |

|

Tax Amount |

Calculated when tax service is called. This field may be edited.

|

|

Total Amount |

Display-only. The sum of credit processed plus tax amount. |

|

Catalog # |

Display-only. The catalog number for this item on the PO. |

|

Description |

Display-only. The description for this item on the PO. |

Additional Charges Section

Additional Charges section definition (credit references a payment request)

|

Title |

Description |

|

|

Display-only. The type of item to be charged.

|

|

Optional. Enter the amount that corresponds to this item type.

|

|

|

Tax Amount |

Calculated when tax service is called. This field may be edited.

|

|

Total Amount |

Display-only. The sum of credit processed plus tax amount, if applicable. |

|

Description |

Parameters control whether descriptions are required. |

For a vendor credit memo referencing a vendor ID, additional charges are the only types of information displayed in the Process Items tab. Dollar amounts are not prefilled, so you must enter accounting information.

In the example below, the credit references a vendor number.

This section presents information about restocking fees and miscellaneous credits that apply to the credit memo.

Additional Charges section definition (credit references a vendor number)

|

Title |

Description |

|

Credit Processed |

The dollar amount to be applied to this vendor credit memo. |

|

Tax Amount |

Calculated when tax service is called. This field may be edited.

|

|

Total Amount |

Display-only. The sum of credit processed plus tax amount, if applicable. |

|

Description |

Required by default for miscellaneous credit only.

|

Click show/hide to display or hide item accounting lines for each line item or additional item.

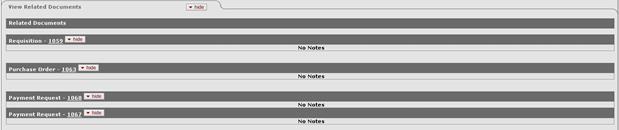

View Related Documents Tab

The View Related Documents tab collects information about Purchasing/AP documents related to this Vendor Credit Memo document. For example, it displays identifying information and any pertinent notes for the requisition, purchase order, receiving documents, payment requests, or other vendor credit memos associated with the purchase order.

This tab lists related documents.

View Related Documents tab definition

|

Title

|

Description |

|

Date |

Display-only. The date the related document was created. |

|

|

Display-only. The user who created the related document. Entry of 'Kuali System User' means the document was automatically created by the system. |

|

Note |

Display-only. A note describing the document. |

To access one of these related documents, click its document number. The system displays the document in a separate window.

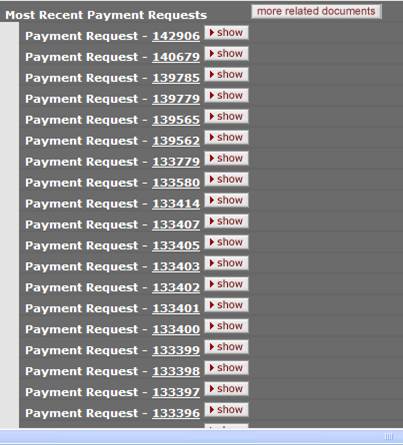

If there is a large volume of transactions associated with the document, only the most recent 100 documents will be displayed when you open the View Related Documents Tab. To see the additional documents click on the “More related documents” button.

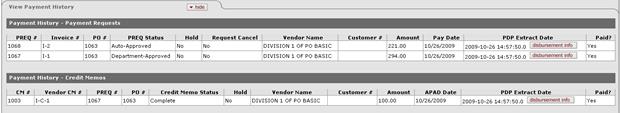

View Payment History Tab

The View Payment History tab tracks payment information related to the purchase order associated with this Vendor Credit Memo document. It shows pending payment information and updates indicating when a payment was processed through the Pre-Disbursement Processor (PDP). This tab also shows any other vendor credit memos that have been processed against the related purchase order and any associated payment requests.

Payment Requests section definition

|

Title |

Description |

|

PREQ# |

Display-only. The payment request number. |

|

Invoice # |

Display-only. The invoice number. |

|

PO# |

Display-only. The purchase order number. |

|

PREQ Status |

Display-only. The payment request status. |

|

Display-only. Displays 'yes' if the payment request in on hold. Displays 'no' if the payment request is not on hold. |

|

|

Req Canc |

Display-only. Displays 'yes' if the payment request has been requested to be canceled. Displays 'no' if the payment request has not been requested to be canceled or if the 'request cancel' has been removed. |

|

Vendor Name |

Display-only. The vendor name associated with this payment request. |

|

Customer # |

Display-only. The customer number associated with this payment request. |

|

Amount |

Display-only. The payment request amount. |

|

|

Display-only. The date the payment is scheduled to extract to PDP. |

|

|

Display-only. The date the payment request was extracted to the Pre-Disbursement Processor for disbursement processing. |

|

|

Display-only. Displays 'yes' if the payment has been disbursed. Displays 'no' if the payment has not been disbursed. |

Credit Memos section definition

|

Title |

Description |

|

CM# |

Display-only. The credit memo number assigned by KFS. |

|

Vendor CM# |

Display-only. The credit memo number assigned by the vendor. |

|

PREQ# |

Display-only. The payment request number, if a payment request was referenced in processing the credit memo. |

|

PO# |

Display-only. The purchase order number associated with this credit memo. |

|

|

Display-only. The credit memo status. |

|

Hold |

Display-only. Displays 'yes' if the credit memo is on hold. Displays 'no' if it is not on hold. |

|

Vendor Name |

Display-only. The vendor name associated with this credit memo. |

|

Customer # |

Display-only. The customer number associated with this credit memo. |

|

Amount |

Display-only. The dollar amount associated with this credit memo. |

|

APAD Date |

Display-only. The Accounts Payable approved date (that is, the date the Accounts Payable User submitted the credit memo). |

|

PDP Extract Date |

Display-only. The date the credit memo was extracted to the Pre-Disbursement Processor for disbursement processing. |

|

Paid? |

Display-only. Displays 'yes' if the credit has been disbursed. Displays 'no' if it has not been disbursed. |

Process Overview

![]() Initiating

a Vendor Credit Memo Document

Initiating

a Vendor Credit Memo Document

![]() Removing

a Vendor Credit Memo Hold

Removing

a Vendor Credit Memo Hold

Business Rules

• If the vendor number and credit memo number match those of a CM previously processed, a warning notifies you of the potential duplicate. You may override the warning and continue.

• If the credit memo amount and credit memo date match those of a CM previously processed, a warning notifies you of the potential duplicate. You may override the warning and continue.

• A credit memo may be processed against a payment request, a purchase order, or a vendor, but only one of the three.

• A credit memo processed at the vendor level requires processing on the Miscellaneous line. Accounting must be added to the Miscellaneous line during processing

• When a credit memo is processed at the level of payment request or purchase order and the purchase order has been closed, the system automatically reopens the purchase order..

• Modification of remit addresses is permitted for a credit memo referencing a PO or a vendor. The address lookup functionality is used to modify the remit address.

• You may process a credit memo only on items that have an invoiced open quantity or—for non-quantity items—invoiced dollar amounts remaining.

• After being approved by AP, accounts cannot be changed on a credit memo.

• The system re-encumbers amounts associated with each line item on a credit memo. The Amount encumbered follows the rules of PO encumbrance (CM Quantity x PO Unit Cost), which is similar to the payment request disencumbrance that utilizes the PO unit cost rather than the PREQ unit cost if the two unit costs are different.

• Accounts encumbered are the accounts on the original PO, with the account distribution in proportion to the distribution on the PO if more than one account is involved per line item. PO open quantities are incremented by the line item quantity on a credit memo.

o Credit entry: The accounts (full accounting string) on the vendor credit memo are credited in the G/L at the time of AP submit. The G/L entry is made in summary for each accounting string. (So, for example, if three line items on a CM use the same accounting string, only one expense credit entry—not three—is created in the G/L for that accounting string.)

o Debit entry: Create one offset to object code 9041 for each account and sub-account combination on a CM.

• After being canceled, the G/L entries of the credit memo are reversed, any encumbrance created from AP approval of the credit memo are reversed, and any PO open quantities that were incremented from the creation of the credit memo are decreased.

• The following rules apply for allowable accounts to be charged on a credit memo. The specific codes for these rules may be specified via parameters.

o Only object codes with an expense object type (EE, ES or EX) or with asset type AS (only the level of inventory—INV—is allowed for object code type AS). Parameter defined.

o Object codes in the consolidations of compensation (CMPN), financial aid (SCHL), reserves (RSRX), and assessments expenditures (ASEX) are not allowed. Parameter defined.

o Object codes in the levels of depreciation (DEPR), indirect cost expense (ICOE), valuations and adjustments (VADJ), and taxes (TAX) are not allowed. Parameter defined.

• Based on the setting of the SHOW_CONTINUATION_ACCOUNT_WARNING_AP_USERS_IND parameter, AP users are warned when one or more expired or closed accounts on a CM are replaced by a continuation account. When the parameter value is Y, a warning is presented. When an expired account is replaced by a continuation account, the accounting line shows the current accounts being used and includes a note indicating that the expired/closed account has been added to the CM. Users can refer to either the notes or the original PO to see the original accounts.

• FYI notification on a credit memo routes to the fiscal officer or CM delegate per the account number(s) on the credit memo.

• A credit memo may be canceled or placed on hold at any time prior to extraction.

• When a credit memo is in 'AP-Processed' status, it is eligible to be extracted to PDP for disbursement. Fiscal officer routing is not a prerequisite to disbursement.

• The system groups all PREQs and CMs eligible for extract for disbursement as a positive payment based on vendor and processing campus. These campus-specific bundling rules are established by your institution in system parameters.

• Only AP users may modify a CM's check stub notes after AP submit and before extract.

• Credit memo searches are available to all users.

Routing

The Vendor Credit Memo document is initiated by a member of the Accounts Payable Processor role. Routing is dependent on whether an image attachment is part of an institution's configuration.

• An AP Processor clicks the submit button to complete the processing of a Vendor Credit Memo document. The document goes into 'Awaiting AP Review' status if Require_attachment_ind='Y'. The AP Review status may be satisfied by an image attachment or in another fashion (configurable at your institution). After AP review, the document routes to the fiscal officer or fiscal officer delegate as an FYI. At the AP Review routing level, approvers are not permitted to change content on the document. They may only add notes and attachments and approve or cancel.

• The document routes an FYI copy to the fiscal officer associated with each account number that appears on the vendor credit memo.

![]() The Timing of G/L Update:

After a CM

document has been created and submitted, it updates the G/L the next time a batch

process runs. Note that this is different from most KFS

docs, which do not update the G/L until the document receives all approvals. If

accounting entries on the document change before it reaches 'FINAL' status, the

G/L entries are updated accordingly the next time a batch process runs.

The Timing of G/L Update:

After a CM

document has been created and submitted, it updates the G/L the next time a batch

process runs. Note that this is different from most KFS

docs, which do not update the G/L until the document receives all approvals. If

accounting entries on the document change before it reaches 'FINAL' status, the

G/L entries are updated accordingly the next time a batch process runs.

Initiating a Vendor Credit Memo Document

1. Select Vendor Credit Memo from the Purchasing/Accounts Payable submenu group on the Transactions menu group on the Main Menu tab.

2. Log into the KFS as necessary.

The system displays a blank Vendor Credit Memo Initiation tab with a new document ID.

3. Complete the Credit Memo Initiation tab as follows:

a) Enter values for Credit Memo # from Vendor, Credit Memo Date, and Vendor Credit Memo Amount.

b) Enter a value for one and only one of these: Payment Request #, Purchase Order #, or Vendor #.

4. Click ![]() .

.

5. Complete the Vendor tab as follows:

a) Verify the vendor address.

b) Add check stub notes if requested.

6. Review the Credit Memo Info tab and update the bank code, if necessary.

7. Complete the Process Items tab as follows:

a) For quantity-based line items, enter the credit memo quantity from the vendor credit.

b) For non-quantity-based line items, enter the credit processed amount using the vendor credit amount.

c) Enter a credit processed amount for additional charges, if needed. Miscellaneous charges require a description, depending on parameter setup.

7. Complete the standard tabs as necessary: Document Overview, Notes and Attachments, Ad Hoc Recipients, and Route Log.

![]() For information about the standard tabs, see Standard

Tabs.

For information about the standard tabs, see Standard

Tabs.

8. Click the ![]() button.

button.

9. Click ![]() .

.

10. AP reviewers approve the document if the parameter Require_attachment_ind='Y'.

![]() For more information about how to approve a document, see Workflow

Action Buttons.

For more information about how to approve a document, see Workflow

Action Buttons.

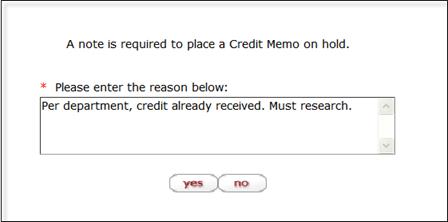

Placing a Credit Memo On Hold

An AP user may choose to place the credit memo on hold or remove the hold when it is no longer necessary. The hold flag prevents a vendor credit memo from being extracted and applied. When a document is taken off hold, it retains the status it had when the hold flag was set.

A credit memo in the 'AP-REVIEW' or 'COMPLETE' status may be placed on hold from the time of AP Submit until the time the credit extracts it to the Pre-Disbursement Processor.

To place a credit memo on hold, you must attach a note to the document explaining why it has been put on hold. To put a credit memo on hold:

1. After displaying the credit memo,

click ![]() .

.

2. Enter a reason for putting the CM

on hold and click ![]() .

.

The system marks the vendor credit memo as being in 'HOLD' status. It also displays a large header on the document indicating who placed the order on hold.

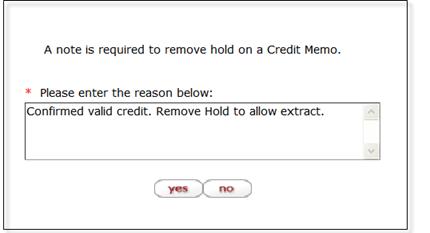

Removing a Vendor Credit Memo Hold

Either the person who placed the credit memo on hold or an AP supervisor may take a vendor credit memo off hold. To take a credit memo off hold:

1. Display the CM

and click ![]() .

.

2. Enter the reason for removing the

hold and click ![]() .

.

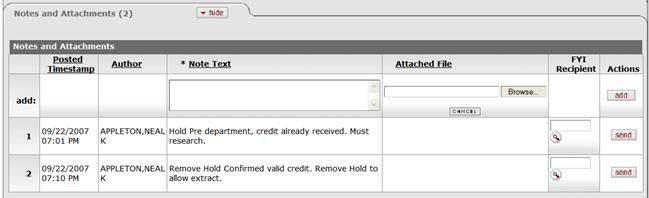

In the Notes and Attachments tab, the system displays the history of this action.

Example

A vendor issues a $30.00 credit for two items that were returned after payment was made. An AP user creates a credit memo referencing the payment request document that issued a payment for these two items.

The initiator, a user with the role of Accounts Payable Processor, creates a new credit memo document by entering the vendor credit memo number, amount and date; and one of the following: the payment request number, the PO number, or the Vendor number. When the initiator clicks continue, the system generates the Vendor Credit Memo document. In the Process Items tab, the initiator enters the quantity being credited and clicks calculate. At this point, the document is ready for submission and routing.