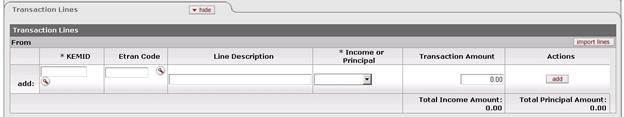

Transaction Lines Tab

This tab contains one or more lines that specify the KEMID(s) affected, including all relevant financial details for the transaction as it applies to each KEMID specified.

Transaction Lines tab definition

|

Description | |

|

KEMID |

Required. The KEMID to which this transaction applies.

Enter the KEMID to which this cash

decrease applies or use the lookup

|

|

Etran Code |

Identifies the type of processing required for this

transaction. Enter the ID or use the lookup |

|

Line Description |

Describes this transaction. Enter text as desired. |

|

Income or Principal |

Required. Indicates whether this transaction pertains to income or principal. Enter the appropriate value from the list. |

|

Transaction Amount |

Required. Indicates the dollar amount of this transaction. |

|

Actions |

Click the button to perform an action on this line. When you are adding a new line, only the add button is displayed. After you have added a line, the refresh, bal inquiry, and delete buttons are displayed. |

|

Total Income Amount |

Display only. Indicates the amount of income in all transaction lines. |

|

Total Principal Amount |

Display only. Indicates the total amount of principal in all transaction lines. |

Buttons on this tab allow you to

add, import data, refresh tax lot information, delete lines and perform balance

inquiries on the KEMID(s) specified. For information and instructions, see Working in the Transaction Lines Tab.

Buttons on this tab allow you to

add, import data, refresh tax lot information, delete lines and perform balance

inquiries on the KEMID(s) specified. For information and instructions, see Working in the Transaction Lines Tab.

For information about the layout

of the data import template for this e-doc, see

KEM_ECI_ECDD_ECT_Import.xls.

For information about the layout

of the data import template for this e-doc, see

KEM_ECI_ECDD_ECT_Import.xls.

to find it.

The KEMID you specify must be valid and must not be closed. The system

then displays the description of the KEMID you specified.

to find it.

The KEMID you specify must be valid and must not be closed. The system

then displays the description of the KEMID you specified. If the KEMID specified

has a permanent restriction code and if the transaction line is

for

If the KEMID specified

has a permanent restriction code and if the transaction line is

for  Process Overview

Process Overview