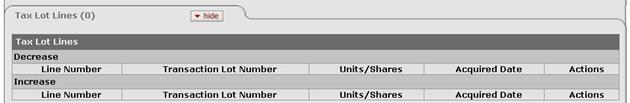

Tax Lot Lines Tab

When you initiate an increase or decrease transaction and make the necessary entries in the Security Details and Transaction Lines tabs, the system calculates impact of the transaction on the tax lots. It then displays information in this tab to show how the change is distributed among the individual tax lots for the security. The tab header indicates the number of tax lines in the e-doc.

After data is displayed in the tax lot lines, you may delete any line that should not be a part of this adjustment. (For example, you might delete a tax lot line for a lot that was received after a stock split cutoff date). If one or more lines are deleted, the system recalculates the unit distribution among the remaining lots.

All calculations for tax lot lines

are rounded according to the standard KFS endowment rules for rounding. For more

information on these rules, see Standard

Rounding Rules.

All calculations for tax lot lines

are rounded according to the standard KFS endowment rules for rounding. For more

information on these rules, see Standard

Rounding Rules.

Tax Lot Lines tab definition

|

Description | |

|

Line Number |

Display only. The line number from the corresponding Increase or Decrease transaction line. |

|

Transaction Lot Number |

Display only. A system-generated ID number for the tax lot based on the tax lot holding number. |

|

Units/Shares |

Display only. The number of units or shares calculated by the system based on the number of units in the original tax lots as a percentage of the total units of the security tax lots in the record held by the KEMID. |

|

Acquired Date |

Display only. The acquisition date for the holdings in this tax lot. |

|

Actions |

Click |

to delete a

tax lot. At least one tax lot must remain. Deleting a line causes the

system to recalculate the distribution among the remaining

lines.

to delete a

tax lot. At least one tax lot must remain. Deleting a line causes the

system to recalculate the distribution among the remaining

lines. Process Overview

Process Overview