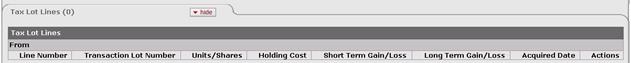

Tax Lot Lines Tab

This tab displays information about the tax lot(s) affected by each transaction line entered. All entries in this tab are system-generated after you add a transaction line. The total number of tax lot lines is displayed in parentheses to the right of the tab header. The tax lot entries are based on the tax lot indicator associated with the security you specified and on whether or not the transaction involves cash.

If you change the transaction line units or amount or delete the transaction line, the system corrects the entries in the Tax Lots Lines tab automatically.

The tab header indicates the number of tax lines in the e-doc.

All calculations for tax lot lines

are rounded according to the standard KFS endowment rules for rounding. For more

information on these rules, see Standard

Rounding Rules.

All calculations for tax lot lines

are rounded according to the standard KFS endowment rules for rounding. For more

information on these rules, see Standard

Rounding Rules.

Tax Lot Lines tab definition

|

Description | |

|

Line Number |

Display only. Indicates the transaction line with which this tax lot is associated. |

|

Transaction Lot Number |

Display only. Identifies the tax lot affected by the transaction. The tax lot referenced must have sufficient units and value to complete the transaction. |

|

Units/Shares |

Display only. Indicates the number of units or shares in the tax lot. The system always displays the value as a negative number. |

|

Holding Cost |

Display only. Indicates the original cost of the units being reduced. When the system processes the tax lot lines, it multiplies the total of the lot holding cost in the tax lot lines by -1. The system always displays the value as a negative number. |

|

Short Term Gain/Loss |

Display only. Indicates the short term gain or loss realized by this transaction. The system displays a gain as a positive number and a loss as a negative number. |

|

Long Term Gain/Loss |

Display only. Indicates the long term gain or loss realized by this transaction. The system displays a gain as a positive number and a loss as a negative number. |

|

Acquired Date |

Display only. Indicates the date the security was acquired. |

|

Actions |

Click a button to perform an action on this tax lot. The only action allowed is delete, which removes the tax lot from the calculations for the transaction. When you delete a lot from the transaction, the system recalculates and updates the remaining lots in the tab. |

Process Overview

Process Overview