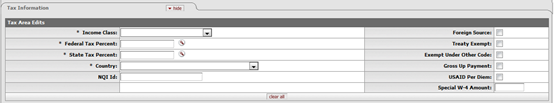

Tax Information Tab

The Tax Information tab is displayed only when the PREQ is routed to the Tax Manager. This tab allows the tax manager to review and change tax information.

Tax Information tab definition

|

Title |

Description |

|

Income Class |

Required. The type of activity this disbursement is

for. Select the type of activity from the list. Values may vary, but

examples include: |

|

Federal Tax Percent |

Required if the Income Class

entry is Fellowship or Independent Contractor. No entry is allowed if the

Income

Class entry is Non-Reportable. The percentage of federal

tax to be withheld from the payment. Either enter the appropriate

percentage for the income class or use the lookup |

|

State Tax Percent |

Required if the Income Class

entry is Fellowship or Independent Contractor. No entry is

allowed if the Income Class

entry is Non-Reportable. The percentage of state tax to be

withheld from the payment. Either enter the appropriate percentage for the

income class or use the lookup |

|

Country |

Required if the Income Class entry is Fellowship or Independent Contractor. No entry is allowed if the Income Class entry is Non-Reportable. The nonresident alien payee’s country of citizenship. Select the country from the list.

|

|

NQI Id |

Optional, except no entry is allowed if the Income Class entry is Non-Reportable. Select this box if the payment is defined as a nonqualified intermediate. Selecting this check box indicates that there is no tax withholding on the payment. |

|

Foreign Source |

Optional, except no entry is allowed if the Income Class entry is Non-Reportable. Select this check box if the payment is defined as foreign source based on U.S. income sourcing rules. Selecting this check box indicates that there is no tax withholding on the payment. |

|

Treaty Exempt |

Optional, except no entry is allowed if the Income Class entry is Non-Reportable. Select this check box if there is a tax treaty with the nonresident alien payee's country. Selecting this check box indicates that there is no tax withholding on the payment. |

|

Exempt Under Other Code |

Optional, except no entry is allowed if the Income Class entry is Non-Reportable. Check this box if the payment is tax exempt under another code, as specified by the IRS. |

|

Gross Up Payment |

Optional, except no entry is allowed if the Income Class entry is Non-Reportable. Select this check box if the payee is to receive the stated check amount regardless of any required tax withholding.

|

|

USAID Per Diem |

Optional, except no entry is allowed if the Income Class entry is Non-Reportable. Check this box if the USAID per diem exemption applies, as specified by the IRS. Selecting this check box indicates that there is no tax withholding on the payment. |

|

Special W-4 Amount |

Optional, except no entry is allowed if the Income Class entry is Non-Reportable. Enter the special W-4 amount to be withheld. |

to search for it.

The default entry is 0.

to search for it.

The default entry is 0. The payee's country

of citizenship is not necessarily the payee's country of

residence.

The payee's country

of citizenship is not necessarily the payee's country of

residence. Any taxes required to

be withheld are calculated and added to the original amount of the

Any taxes required to

be withheld are calculated and added to the original amount of the  Process Items Tab

Process Items Tab