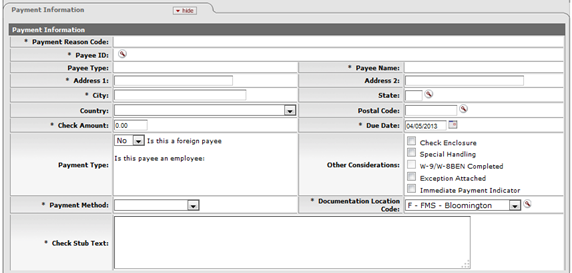

Payment Information Tab

The Payment Information tab contains important information such as the payment reason, amount, payment method, attachments, and documentation location. This section must be completed for every DV document.

Payment Information tab definition

|

Title |

Description |

|

Payment Reason Code |

Required. Display-only. This code identifies the

reason for the disbursement and determines any restrictions the payment is

subject to. After you select the payee ID from the Payee lookup

|

|

Payee ID |

Required. Retrieve the payee ID from the Payee Lookup

|

|

Payee Type |

Display-only. After you select the payee ID from the

Payee lookup

|

|

Name |

Display-only. After you select the payee ID from the

Payee lookup

|

|

Address 1 |

Required. The first line of address to which the check should be mailed. The system fills in this information automatically but you may change it. |

|

Address 2 |

Optional. Enter the second line of the address to which the check should be mailed. |

|

City |

Required. Enter the city to which the check should be mailed. |

|

State |

Required for US. Enter the state to which the check should be mailed. |

|

Country |

Optional. Select the payee's country from the Country list. |

|

Postal Code |

Required for US. Enter the postal code to which the check should be mailed. |

|

Check Amount |

Required. Enter the total amount of the disbursement for this document. |

|

Due Date |

Required. Enter the date or select it from the

calendar |

|

Payment Type |

Optional. Display-only. The payment types are determined by the payee selected for the DV. These values apply only to DV payees, which are established through the use of the Payee Type document. Each Payment Type attribute from the Payee Type record that is evaluated when the DV is submitted may have an impact on the ability to process a particular payment on a DV, and how it routes for approval. Is this a foreign payee? If the payee is a nonresident alien, select 'Yes'. Employee Paid Outside of Payroll? If the Payee record is an Employee record or a Vendor record with the same tax identification number as an Employee record, then this is set to 'Yes'. Your institution may wish to perform specialized review on these transactions to make sure they should not be processed through your regular payroll process. Revolving Fund Payee? If the Vendor payee record is flagged as a revolving fund, this is set to 'Yes'. Revolving funds are similar to petty cash accounts. Cash can be borrowed from a revolving fund and paid back using the disbursement voucher. |

|

Other Considerations |

Optional. Select these check boxes as necessary to reflect special circumstances or special requests that are needed for the payment: Check Enclosure: Refers to any documents related to the DV document that must accompany the check when it is mailed to the payee. Examples might include a registration form that must accompany a payment of a conference fee or a subscription form that must be returned with payment for a subscription to an academic journal. Selecting the check box properly indicates that there is a form or other attachment that must accompany the check. Special Handling: Indicates that the payment should be mailed to a person other than the payee. For example, a check needs to be returned to the document initiator so it can be express mailed or picked up by the payee. When selected, a message asking you to add a note explaining the need for special handling is displayed. W9/W-8BEN Completed: Indicates if the payee has a W-9 (or W-8BEN for nonresident aliens) on file. For nonemployees this is generally completed as part of processing of the Payee document. Exception Attached: Indicates that you are requesting an exception to policy on this DV document. For instance, your institution may require that all disbursement vouchers have supporting documentation, but in this case you do not have such documentation. When this option is selected, a message prompting you to add a note of explanation is displayed. Immediate Payment Indicator: Indicates that a check is needed on the same day. This indicator allows for an approved Disbursement Voucher to be extracted for payment when the Immediates Extract job is run. Only the Disbursement Manager may select this option. |

|

Payment Method |

Required. Select the method in which the payment should be made from the Payment Method list. Check/ACH: This selection generates a check or, if ACH information exists in the disbursement processing system for this payee, an Automated Clearing House direct deposit is initiated. Foreign Draft: This selection indicates that the payment is to be made in a foreign currency. When you select Foreign Draft as the payment method you are prompted to complete the Foreign Draft tab. In this section, you indicate whether the DV is stated in foreign currency or US dollars, and what currency the payment is to be made in. For example, the DV could be stated in Euros and paid in Euros, or the DV could be stated in US Dollars converted to Euros for payment. Wire Transfer: This selection indicates you wish to have the disbursement wired to the recipient. To do so you are required to provide additional banking information on the Wire Transfer tab. Some institutions may charge a fee to the initiating department for processing a wire transfer. Wire transfers may be made in US Dollars or foreign currency, similar to Foreign Drafts as described above. |

|

Documentation Location Code |

Required. Select the unique code for the location

where the documentation is to be kept from the Documentation Location

Code list or lookup This indicates where supporting documentation should be sent, as well as who is responsible for maintaining the documentation. Supporting documentation refers to documents or backup submitted with the disbursement voucher (receipts, invoices, letters, memos) that detail what was purchased, the cost, the name of the vendor and the date of the transaction. If a disbursement voucher is for services, the documentation might include a memorandum or contract outlining what services are performed and the agreed-upon contract amount. Initiating Organization: Indicates that your department plans to retain the documentation. When you select this location you may receive a message with additional instructions based on your institution's procedures and documentation retention policies. No Documentation: Indicates that you have no supporting documentation for this transaction. If selected, you are required to attach a note in the Notes and Attachments tab of the document explaining why. |

|

Check Stub Text |

Required. Enter the information regarding the payment itself, intended for the payee. This commonly includes what the payment is for (invoice number, for example) or other information to assist the payee in identifying the source and reason for the payment. |

For more information about the

Payment Reason Code, see Disbursement

Voucher.

For more information about the

Payment Reason Code, see Disbursement

Voucher.

Notes regarding

Documentation Location:

Restrictions may be in place, which

require you to send your documentation to a particular location. As a default in

the KFS, Travel Payments require the documentation be sent to Travel Management

and payments to nonresident aliens must be sent to the Tax Department. Your

institution may have other specific requirements based on Payment Reason or

other attributes of the transaction. Specific locations can be customized and

may vary from institution to institution.

Notes regarding

Documentation Location:

Restrictions may be in place, which

require you to send your documentation to a particular location. As a default in

the KFS, Travel Payments require the documentation be sent to Travel Management

and payments to nonresident aliens must be sent to the Tax Department. Your

institution may have other specific requirements based on Payment Reason or

other attributes of the transaction. Specific locations can be customized and

may vary from institution to institution.

The payee ID is required on the Payment Information tab. This identifies the person or business the disbursement is paid to. Payees must exist in the system in order to be selected on the disbursement voucher. The KFS uses the Vendor table and the KIM Person table for reference. If the payee already exists in the system, you can identify it by searching for it by using the Payee lookup.

Several KFS parameters exist to control which types of payees can be selected for a given payment reason. After clicking search, the restrictions for the selected payment reason are displayed at the top of the lookup.

,

the system automatically fills in the payment code reason.

,

the system automatically fills in the payment code reason. . The

default date is the earliest date that a payment can be made (assuming the

. The

default date is the earliest date that a payment can be made (assuming the

Payee

Lookup

Payee

Lookup