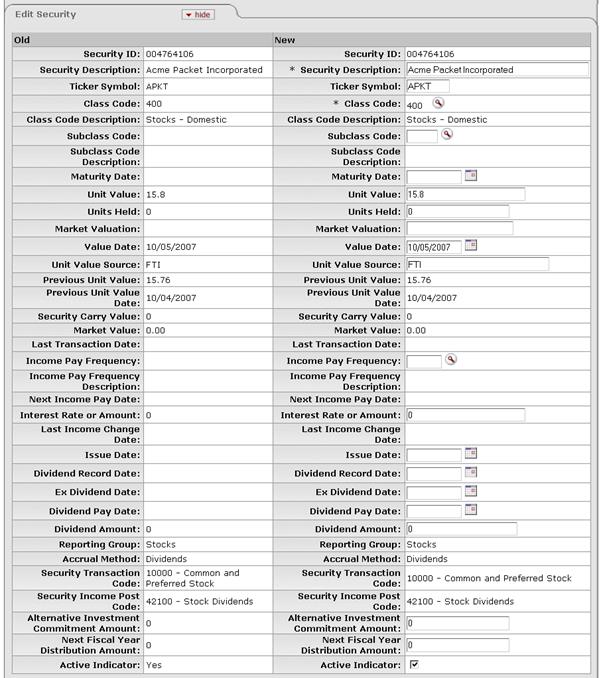

Edit Security Tab

This tab (shown above in edit mode) contains essential information about the security.

In document create mode, the screen contains a subset

of the fields displayed above. It does not contain fields (shown above) used to

calculate the value of the security.

In document create mode, the screen contains a subset

of the fields displayed above. It does not contain fields (shown above) used to

calculate the value of the security.

Edit Security tab definition

|

Description | |

|

Security ID |

Required when initiating a document; otherwise, display only. Uniquely identifies this security. The Security ID is nine alpha or numeric characters and is often the CUSIP number. When you create a new security record, enter only the first eight digits. The system calculates the ninth character and displays a message confirming the value. |

|

Security Description |

Required. Provides a description of this security. |

|

Ticker Symbol |

Indicates the ticker symbol (if any) for the security. |

|

Class Code |

Required. Identifies the group of securities to which this security

belongs. Enter an existing code or use the lookup |

|

Class Code Description |

Display only. Provides a description of the group of securities to which this security belongs. Derived from the class code of the security. |

|

Subclass Code |

Identifies the subgroup of securities to which this

security belongs. Enter an existing code or use the lookup |

|

Subclass Code Description |

Display only. Provides a description of the group of securities to which this security belongs. |

|

Maturity Date |

Required if the security class code for the new

security record has a Security Accrual Method entry of '3',

'6', B', 'M' or 'T. Indicates the date (if any) on which this security

will mature. Enter a date or select it from the calendar |

|

Unit Value |

Required if the security class code has a valuation method of 'U' (Unit Value). No entry permitted if the class code for the security has a valuation method of 'M' (Market Value). If the security has a class code type of 'P' (Pooled Funds), you cannot change this entry on the e-doc. Indicates the calculated per share value for units of the security. The system displays this field only when in edit or inquiry mode. When a new security is created the system automatically sets the unit value at '1' except for liabilities, for which the value defaults to '-1'. The unit value must always be greater than or equal to zero except for liabilities, which are always '-1'. If the class code for the security has a valuation method of 'M' (Market Value), the system calculates the new unit value with the formula: Market Valuation divided by Units Held = the new Unit Value. |

|

Units Held |

Indicates the total number of units of the security held by the organization. The system changes the entry as a result of transaction processing during the Post E-Doc batch process. The number of decimal places is defined by your institution, up to five decimal positions, to allow for fractional shares. The system displays this field only when the screen is in edit mode. |

|

Market Valuation |

Required if the class code for the security has a valuation method of 'M' (Market Value). No entry is permitted if the class code for the security has a valuation method of 'U' (Unit Value). Market valuation is a stated value as of the stated value date. The system displays this field only when in edit or inquiry mode. |

|

Value Date |

Indicates the date on which the market valuation was

last determined. Enter the date or select it from the calendar The system displays this field only when the screen is in edit mode. |

|

Unit Value Source |

Identifies the person or other source that last entered the unit value or market valuation. If the change is a result of input from a pricing file from an outside source, the file update program populates this field automatically. The system displays this field only when the screen is in edit mode. |

|

Previous Unit Value |

Display only. Indicates the unit value of the security before it was last changed. Based on the previous entry in the Unit Value field. The system displays this field only when the screen is in edit mode. |

|

Previous Unit Value Date |

Display only. Indicates the date on which the unit value was last changed. Based on the previous value in the Value Date field. The system displays this field only when the screen is in edit mode. |

|

Security Carry Value |

Display only. Indicates the total original cost for the security held by the organization. This value is automatically changed during transaction processing in the Post E-Doc batch process. The number is restricted to two decimal places. When a transaction generates a change to the carry value, the change reflects the exact amount of the carry value of the transaction as calculated and rounded according to standard rounding rules. The system displays this field only when the screen is in edit mode. |

|

Market Value |

Display only. The value that your institution or the holder of the security might expect to receive if the security were sold. This is a calculated number based upon the best information available regarding the market value per share or unit held. |

|

Last Transaction Date |

Display only. Indicates the date on which the most recent transaction for this security took place. The system changes the entry each time the number of units and/or carry value is changed as a result of transaction processing. The date reflects the process date in the System Values table at the time the transaction was posted during the Post E-Doc batch process. The system displays this field only when the screen is in edit mode. |

|

Income Pay Frequency |

Required if the security class code for the new

security record has a Security Accrual

Method entry of '3', '6', B', 'M' or 'T. Indicates the

system code associated with the frequency of income payments for this

security. Enter the frequency code or use the lookup |

|

Income Pay Frequency Description |

Display only. Provides a description of the income pay frequency. |

|

Next Income Pay Date |

Display only. Indicates the date on which income will next be paid. Calculation is based upon the process date in the System Values table and the security income pay frequency code selected for the payment. Updated as a result of the Roll Frequency Dates nightly batch process. |

|

Interest Rate or Amount |

Required if the security class code for the new security record has a Security Accrual Method entry of '3', '6', B', 'M' or 'T'. If the security has a class code type of 'P' (Pooled Funds), no change is allowed on this e-doc. Indicates the current rate or amount of interest. If the security has a class code type of 'P' (Pooled Funds), the system automatically updates this value when the distribution amount in the pooled fund value is updated. The value is calculated by multiplying the amount of the distribution by the number of times per year that the institution will distribute income to the account holders. |

|

Last Income Change Date |

Display only. Indicates the date on which income was last paid. The system displays this field only when the screen is in edit mode. |

|

Issue Date |

Required if the security class code for the new

security record has a Security Accrual

Method entry of '3', '6', B', 'M' or 'T. Indicates the

original date of issue of the security. Enter the date or select it from

the calendar |

|

Dividend Record Date |

Indicates the date on which one must hold shares of a stock to be entitled to the dividend. Enter the

date or select it from the calendar The system displays this field only when the screen is in edit mode. |

|

Ex Dividend Date |

Indicates the last date one may purchase shares of a

stock and be entitled to the dividend (to allow time for trade

settlement). Enter the date or select it from the calendar The system displays this field only when the screen is in edit mode. |

|

Dividend Pay Date |

Indicates the date the dividend will actually be paid.

The system displays this field only when the screen is in edit mode. Enter

the date or select it from the calendar |

|

Dividend Amount |

Indicates the dividend amount paid per share When you change this value, the system multiplies the changed value by 4, enters the result rounded to five decimals in the Interest Rate or Amount field, and changes the Last Income Change Date entry to reflect the current process date. The system displays this field only when the screen is in edit mode. |

|

Reporting Group |

Display only. Indicates the reporting group to which the security belongs. Derived from the class code of the security. |

|

Accrual Method |

Display only. Indicates the accrual method used for this security. Derived from the class code of the security. |

|

Security Transaction Code |

Display only. Indicates the security transaction code assigned to this security. Derived from the class code of the security. |

|

Security Income Post Code |

Display only. Indicates the General Ledger code used to record income (dividend or interest). Derived from the class code of the security. |

|

Alternative Investment Commitment Amount |

Required if the class code entered has a class code type of 'Alternative Investment.' Indicates the dollar amount committed to this specific alternative investment over time. |

|

Next Fiscal Year Distribution Amount |

Indicates the estimated distribution over the next fiscal year. Entry is allowed only for securities with a class code type of 'P' (Pooled Funds). Automatically updated to zero at fiscal year end. The system displays this field only when the screen is in edit mode. |

|

Active Indicator |

Indicates whether this security is active or not. Select the check box if the security is active in the system. Clear the check box if it is inactive. |

to find it.

to find it. .

. Process Overview

Process Overview