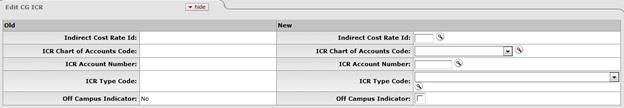

Edit CG ICR Tab

The CG ICR tab must be completed if this is an expense sub-account associated with a Contracts and Grants account. This information determines how indirect cost should be calculated for expenses applied to this sub-account. This information may be the same as the ICR information for the parent account or it may be different. For example, a sub-account might be used to track expenses that record indirect costs at a greater or lesser percentage of direct costs than the rest of the account.

The CG ICR tab is only required if the sub-account type code value has been set to 'EX.

Edit CG ICR tab definition

|

Description | |

|

Financial ICR Series Identifier |

Optional. Enter the series ID that indicates at what percentage indirect cost recovery should be applied to expenses on the sub-account. |

|

ICR Chart of Accounts Code |

Optional. Select the chart associated with the account to which the indirect cost recovery revenue is applied from the Chart list. |

|

ICR Account Number |

Optional. Enter the account to which indirect cost revenue should be applied. |

|

ICR Type Code |

Optional. Select the type code which defines what kind of direct costs generate indirect costs on the sub-account from the ICR Type Code list. |

|

Off Campus Indicator |

Optional. Select the check box if the indirect cost recovery associated with the account reflects an off-campus rate (off-campus rates often differ from regular on-campus rates). Clear the check box if it does not. |

Process Overview

Process Overview