Core ModulesChart of Accounts (COA)Standard COA E-Docs

Sub-Account

![]() >

>![]() >

>![]() >

>![]() >

>![]() >

>![]()

The Sub-Account document is used to define an optional part of the accounting string that allows tracking of financial activity within a particular account at a finer level of detail. Instead of associating budget, actuals and encumbrances with an account, you can specify a sub-account within that account to apply these entries. Sub-accounts are often used to help track expenses when several different activities may be funded by the same account.

For example, a large organization may have money in a general account that is used by several different areas of that organization. The organization might segregate the budgets for each of the areas into Sub-accounts such as 'Marketing,' 'Research,' and 'Recruitment. When expenses are applied to the account they can be applied to the sub-account level, allowing direct comparisons between the budget and the actual income and expenditures of these smaller categories. Because all of the activity is still within a single account, it is still easy to report on the finances of the overall account.

Sub-accounts take on most of the attributes of the account to which it reports, including Fiscal Officer, account supervisor, fund group, and function code.

The KFS also has a system that uses special sub-accounts to help track cost share associated with Contracts and Grants accounts. This works by establishing specially coded sub-accounts as part of a Contract or Grant account. These sub-accounts also have a designated Cost Share account. The Cost Share account is the account that is actually sharing costs with the grant. Expenses applied to the cost share sub-account are automatically reimbursed by the cost share account via an automatic transfer of funds generated by the KFS Cost Share batch process. This allows you to track what has been cost shared for a particular contract or grant account, while still appropriately applying the expense to a different account.

Sub-accounts also allow you to take advantage of the Financial Reporting Code. This is an optional sub-account attribute that can be defined by a particular organization and retrieved from the KFS via decision support queries.

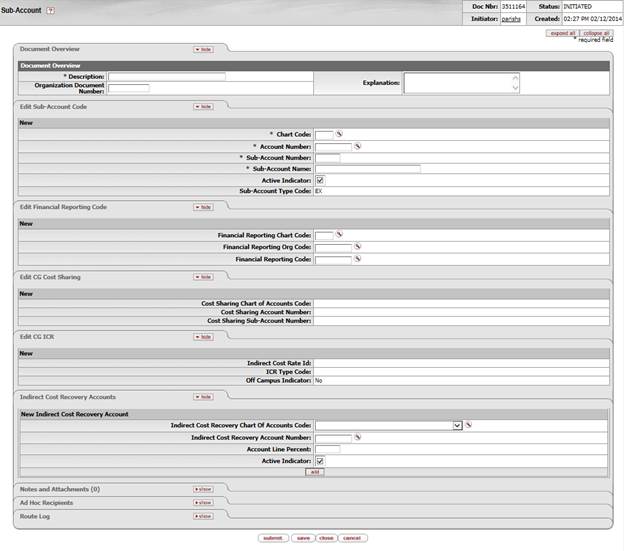

The Sub-Account document includes the Edit Sub-Account Code, Edit Financial Reporting Code, Edit CG Cost Sharing, and Edit CG ICR tabs.

More:

![]() Edit Financial

Reporting Code Tab

Edit Financial

Reporting Code Tab

Edit Sub-Account Code Tab

If you are not establishing a Cost Share sub-account or using the Financial Reporting Code, the Edit Sub-Account Code and the Document Overview tabs are the only required tabs on the document.

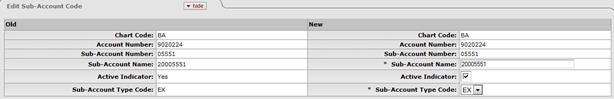

Edit Sub-Account Code tab definition

|

Description |

|

|

Required. Enter the

chart code associated

with the account associated with the sub-account, or search for it from the UserID

lookup

|

|

|

Account Number |

Required. Enter the

account number on which you want to create the sub-account or search for it

from the Account lookup |

|

Sub-Account Number |

Required. Enter the code to define the sub-account. This is the code to be entered in the sub-account field of the Accounting Lines tab of financial documents. |

|

Sub-Account Name |

Required. Enter the long descriptive name. This name appears on the Accounting Lines tab in financial documents as well as in searches and reports. |

|

|

Optional. Select the check box if the sub-account is active. Clear the check box if it is inactive. |

|

Sub-Account Type Code |

Required for the members of the KFS-SYS Contracts & Grants Processor role; otherwise display-only (the field is editable only for the members of the KFS-SYS Contracts & Grants Processor role and the field defaults to 'EX' for others). Select the code to indicate the purpose of the sub-account from the Sub-Account Type list. Your institution's values may vary, but standard examples would include 'EX' to indicate that this is a sub-account to be used to segregate budget and actuals on an account, or 'CS' to indicate that this is a sub-account that is used to track cost share expenses on a contract or grant account. |

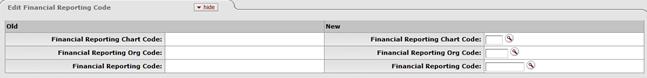

Edit Financial Reporting Code Tab

This Financial Reporting Code tab is optional but can be used to associate this sub-account with a Financial Reporting Code. The associated reporting code could then be retrieved via decision support tools.

Edit Financial Reporting Code tab definition

|

Description |

|

|

Financial Reporting Chart Code |

Optional. Enter the

chart code associated

with the organization that owns the

assigned financial reporting code, or search for it from the Chart lookup

|

|

Financial Reporting Org Code |

Optional. Enter the

code for the organization that owns the assigned financial reporting code, or

search for it from the Org Code lookup |

|

Financial Reporting Code |

Optional. Enter the

reporting code assigned to the Sub-Account, or search for it

from the Financial Reporting Code lookup |

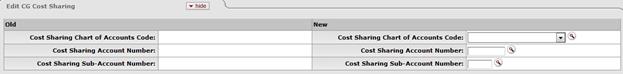

Edit CG Cost Sharing Tab

The CG Cost Sharing tab is only required if the sub-account type code value has been set to 'CS.' Fields in this tab are available only to members of the KFS-SYS Contracts & Grants Processor role.

Edit CG Cost Sharing tab definition

|

Description |

|

|

Cost Sharing Chart of Accounts Code |

Optional. Select the chart associated with the cost share account assigned to the sub-account from the Chart list. |

|

Cost Sharing Account Number |

Optional. Enter the account number that bears the cost share expenses applied to the cost share sub-account. |

|

Cost Sharing Sub-Account Number |

Optional. Enter the sub-account number on the cost share account to which the cost share expenses should be applied. If this check box is not selected, cost share expenses are applied directly to the cost share account with no sub-account assigned. |

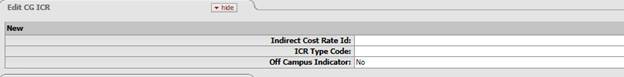

Edit CG ICR Tab

The CG ICR tab must be completed if this is an expense sub-account associated with a Contracts and Grants account. This information determines how indirect cost should be calculated for expenses applied to this sub-account. This information may be the same as the ICR information for the parent account or it may be different. For example, a sub-account might be used to track expenses that record indirect costs at a greater or lesser percentage of direct costs than the rest of the account.

The CG ICR tab is only required if the sub-account type code value has been set to 'EX.

Edit CG ICR tab definition

|

Description |

|

|

ICR Id |

Optional. Enter the ID rate to which indirect cost revenue should be applied. |

|

ICR Type Code |

Optional. Select the type code which defines what kind of direct costs generate indirect costs on the sub-account from the ICR Type Code list. |

|

Off Campus Indicator |

Optional. Select the check box if the indirect cost recovery associated with the account reflects an off-campus rate (off-campus rates often differ from regular on-campus rates). Clear the check box if it does not. |

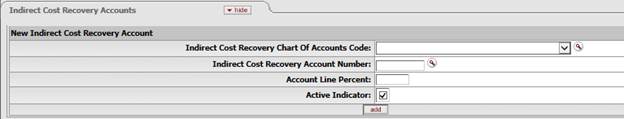

Indirect Cost Recovery Accounts Tab

The Indirect Cost Recovery Accounts tab must be completed if this is an expense sub-account associated with a Contracts and Grants account.

Indirect Cost Recovery Accounts tab definition

|

Description |

|

|

ICR Chart of Accounts Code |

Optional. Select the chart associated with the account to which the indirect cost recovery revenue is applied from the Chart list. |

|

ICR Account Number |

Optional. Enter the account to which indirect cost revenue should be applied. |

|

Account Line Percent |

Optional. Enter the percentage of indirect costs to apply on the sub-account. |

|

Active Indicator |

Optional. Select the check box if the indirect cost recovery account is needed. Clear the check box if it does not. |

Business Rules

· Only members of the KFS-SYS Contracts & Grants Processor role can modify the sub-account type code.

· If sub-account type code is 'CS,' then the fields Cost Sharing Chart of Accounts Code and Cost Sharing Account Number in the Edit CG Cost Sharing tab are required.

· If sub-account type code is 'EX' and the Account associated with the Sub-Account is a Contracts and Grants account, then all fields in the Edit CG ICR tab are required.

· If any field in the Financial Reporting Code tab is completed, all fields become required.

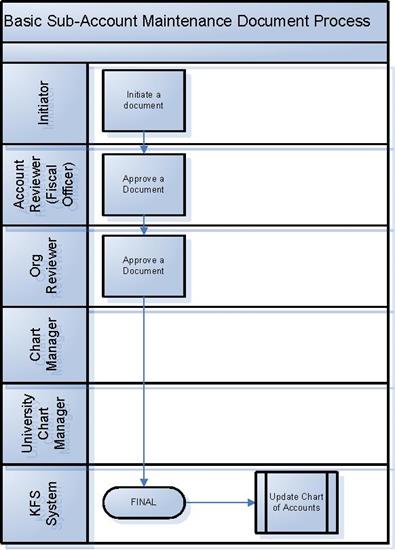

Routing

· The Sub-Account document routes to the Fiscal Officer associated with the account on the document.

· The Sub-Account document routes to Org Review based on the organization that owns the account associated with the document.