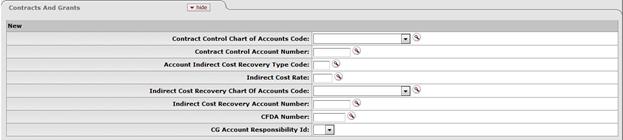

Contracts and Grants Tab

The fields on this tab define attributes that are pertinent to Contracts and Grants accounts. If establishing a contract or grant account, these fields allow you to define how the account automatically generates and distributes indirect cost. The tab also collects information about any control account that might be related to this account and the CFDA number field categorizes grants for audit purposes. These fields are required if the account is identified as a Contracts and Grants account by its Fund Group or Sub-Fund Group.

Contracts and Grants tab definition

|

Description | |

|

Contract Control Chart of Accounts Code |

Required if the fund

group code or sub-fund group code identifies

the account as a Contracts and Grants account, otherwise not allowed.

Select the Chart of Accounts that the Contract Control

Account Number belongs to from the Chart list, or search for it from the

lookup

|

|

Contract Control Account Number |

Required if the fund group code or sub-fund group code

identifies the account as a Contracts and Grants account, otherwise not

allowed. Enter the primary spending authority account for a contract that

has been assigned multiple accounts in the system or search for it from

the Account lookup

|

|

Account Indirect Cost Recovery Type Code |

Required if the fund group code or sub-fund group code identifies the account as a Contracts and Grants account; otherwise not allowed. Enter the code to identify a particular indirect cost recovery type. This code identifies a certain set of object codes that are excluded from indirect cost charges. |

|

Financial Series ID |

Required if the fund group code or sub-fund group code identifies the account as a Contracts and Grants account, otherwise not allowed. Enter the unique identifier that indicates which series ID from the Automated Indirect Cost Recovery table is used to determine indirect cost percentage and the income and expense account(s). |

|

Indirect Cost Rate |

Required if the fund group code or sub-fund group code identifies the account as a Contracts and Grants account, otherwise not allowed. Enter the cost recovery rate relative to direct costs spent in a particular fiscal year on Contracts and Grants that covers the cost of indirect expenses such as light, heat, central administration, etc. that cannot be directly allocated to any particular sponsored project but nonetheless are real costs incurred by the institution as a result of participating in the sponsored project. |

|

Indirect Cost Recovery Chart of Accounts Code |

Required if the fund group code or sub-fund group

code identifies the account as a Contracts and Grants account, otherwise

not allowed. Enter the chart code for the indirect cost recovery

account that is receiving the indirect cost charged, or search for it from

the Chart

lookup

|

|

Indirect Cost Recovery Account Number |

Required if the fund group code or sub-fund group code

identifies the account as a Contracts and Grants account, otherwise not

allowed. Enter the account number that is receiving the indirect cost

recovery income generated by the account, or search for it from the

Account lookup

|

|

CFDA Number |

Required if the fund group code or sub-fund group code identifies the account as a Contracts and Grants account, otherwise not allowed. Enter the Code of Federal Domestic Assistance number used to identify Contracts and Grants accounts for a Federal A-123 audit. |

. An account can be referenced as its

own control account.

. An account can be referenced as its

own control account.  If accounts cannot

cross Charts (

If accounts cannot

cross Charts ( Guidelines and Purpose

Tab

Guidelines and Purpose

Tab