Auxiliary Voucher Adjustment

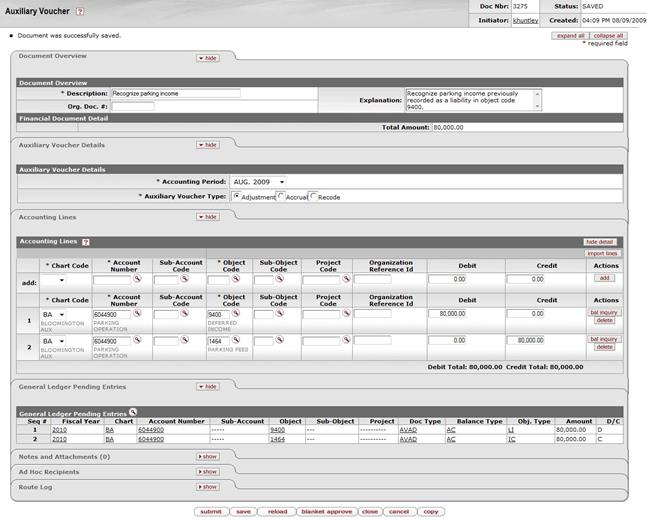

Parking Services needs to recognize income previously recorded and reduce the deferred income liability associated with that income. The income was recorded as a liability in object code 9400 (Deferred Income) and is recognized in object code 1464 (Parking Fees)

The period the income was recorded is used as the posting period, which is August, 2009 in this example. The Adjustment (AVAD) option is selected and no reversal date field is required so that field does not appear as a valid option. The Accounting Lines section is completed to debit the liability and credit the income object code.

The resulting pending ledger entries show this debit to the liability object code and a credit to the income object code.

Budget Adjustment

Budget Adjustment