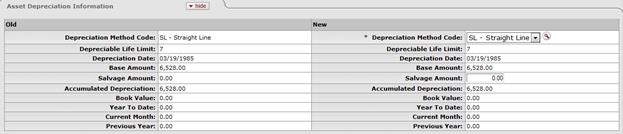

Asset Depreciation Information Tab

This tab contains the current asset depreciation information in the Old section. Most of this information is view only. The New section may be used to update the depreciation method and the salvage amount only.

Asset Depreciation Information tab definitions

|

Description | |

|

Depreciation Method Code |

Required. Select the code for the depreciation method

from the list or search for it from the Asset Depreciation

Method lookup SL - straight-line |

|

Depreciation Life Limit |

Display-only. The useful life (depreciable life) of the asset. |

|

Depreciation Date |

Display-only. The date the depreciation of the asset started. |

|

Base Amount |

Display-only. The amount eligible for deprecation. It

excludes any federal or other owned amounts. The base amount is calculated

by summing the account amounts on payment records that do

not have federally funded financial object sub-type codes

of: |

|

Salvage Amount |

Optional. Enter the amount the university could recover if the asset is salvaged. This amount cannot be greater than the base amount. |

|

Accumulated Depreciation |

Display-only. The depreciation that has taken place on an asset up to the present time. |

|

Book Value |

Display-only. The value of an asset according to its balance sheet account balance. |

|

Year To Date |

Display-only. The depreciation that has taken place on the asset for the current fiscal year. |

|

Current Month |

Display-only. The depreciation that has taken place on the asset for the current month. |

|

Previous Year |

Display-only. The depreciation that has taken place on the asset during the preceding fiscal year. |

. There are two depreciation methods

defined:

. There are two depreciation methods

defined: View Asset Separate History

Tab

View Asset Separate History

Tab