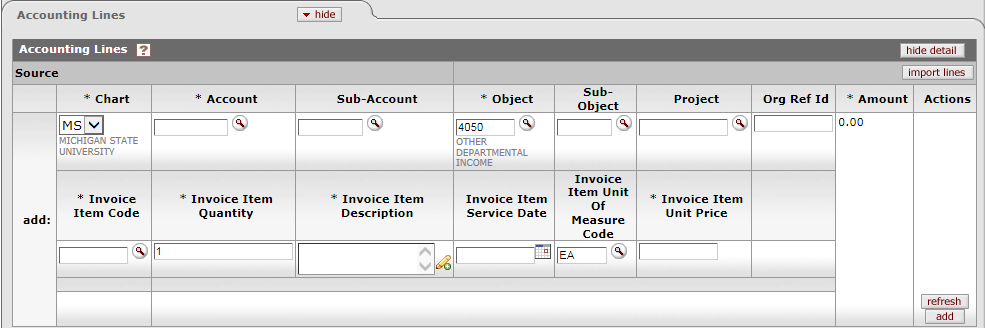

Accounting Lines Tab

The Accounting Lines tab contains several fields specific to the customer invoice in addition to the fields found on the standard Accounting Lines tab.

For more information about the standard Accounting Lines tab, see Accounting Lines Tab.

For more information about the standard Accounting Lines tab, see Accounting Lines Tab.

Accounting Lines tab definition

|

Title |

Description |

|

Chart |

Required. Enter the alphanumeric value that uniquely identifies the chart associated with the account specified in the next field.

|

|

Account Number |

Required. Enter the account number or search from the

Account lookup

|

|

Sub Account |

Optional. Enter the sub-account number or search from the

Sub-Account

lookup |

|

Object |

Required. This value identifies the object being

credited with the revenue recognized from the sales/service activity.

Enter the object or search from the Object lookup

|

|

Sub-Object |

Optional. Enter the sub-object or search from the

Sub-Object lookup |

|

Project |

Optional. Enter the project number or search from the

Project lookup

|

|

Org Ref Id |

Optional. Enter the organizational reference ID used by the associated organization. |

|

Invoice Item Code |

Required. Enter the Invoice Item Code or search from the Invoice

Item Code lookup |

|

Invoice Item Quantity |

Required. Enter the quantity to be invoiced for this line item. |

|

Invoice Item Description |

Required. Enter the description of this line item. |

|

Invoice Item Service Date |

Optional. Enter the date of service for this line item. |

|

Invoice Item Unit of Measure Code |

Required. Enter the unit

of measure for this line item or search from the UOM lookup |

|

Invoice Item Unit Price |

Required. Enter the unit price of the item. This amount will be multiplied by the Invoice Item Quantity to arrive at the total amount for this line item. |

|

Tax? |

Display-only. If the 'ENABLE SALES TAX IND' is 'N,' this column is not displayed. If sales tax is turned on, check this box if this item is subject to sales tax. |

|

Amount |

Display-only. Upon add invoice line items to customer invoice this amount will automatically calculate. Enter the unit price of the item. This amount will be multiplied by the Invoice Item Quantity to arrive at the total amount for this line item. |

|

|

Click the add button to add a new detail line to the customer invoice. |

|

|

Click the refresh button if any modification is needed prior to adding a new item line to refresh the data entered. |

|

|

This button is available only when modifying an existing detail line to the customer invoice. Click the recalculate button if any modification to an existing item line needs to be recalculated. |

|

|

This button is available only when modifying an existing detail line to the customer invoice. Click the bal inquiry button to view balance inquiry results for accounts. |

|

|

This button is available only when modifying an existing detail line to the customer invoice. Click the discount button to apply available discounts if they are utilized to an existing item line. |

|

|

This button is available only when modifying an existing detail line to the customer invoice. Click the delete button to delete the individual customer payment application document detail line available only in Saved status. |

The accounting line

information will be automatically populated based on the organization accounting

defaults or from the Invoice Item Code, if entered. Alternatively, you can enter

them manually.

The accounting line

information will be automatically populated based on the organization accounting

defaults or from the Invoice Item Code, if entered. Alternatively, you can enter

them manually.

When the

When the  . This number identifies

the account receiving credit from the provision of a service or

product

. This number identifies

the account receiving credit from the provision of a service or

product Clicking the

Clicking the

Related Documents Tab

Related Documents Tab