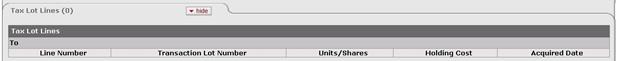

Tax Lot Lines Tab

This tab displays information about the tax lot(s) affected by each transaction line entered. All entries in this tab are system-generated after you add a transaction line. The total number of tax lot lines is displayed in parentheses to the right of the tab header. The total number of tax lot lines is displayed in parentheses to the right of the tab header. The tax lot entries are based on the tax lot indicator associated with the security you specified and whether or not the transaction involves cash.

If you change the transaction line units or amount or delete the transaction line, the system corrects the entries in the Tax Lots Lines tab automatically.

The tab header indicates the number of tax lines in the e-doc.

All calculations for tax lot lines

are rounded according to the standard KFS endowment rules for rounding. For more

information on these rules, see Standard

Rounding Rules.

All calculations for tax lot lines

are rounded according to the standard KFS endowment rules for rounding. For more

information on these rules, see Standard

Rounding Rules.

Tax Lot Lines tab definition

|

Description | |

|

Line Number |

Display only. Indicates the transaction line with which this tax lot is associated. |

|

Transaction Lot Number |

Display only. Identifies the tax lot affected by the transaction line. If the tax lot indicator for the security is 'No,' the holding lot number is set at 1. If the tax lot indicator for the security is 'Yes,' the holding lot number is set at the next sequential number for the KEMID and security. |

|

Units/Shares |

Display only. Indicates the number of units or shares in the tax lot. Reflects the number of units in the associated transaction line. |

|

Holding Cost |

Display only. Indicates the original cost of the units being increased. Reflects the holding cost in the associated transaction line. |

|

Acquired Date |

Display only. Indicates the date the security was acquired. |

Process Overview

Process Overview