Holding Tax Lot Rebalance

>

>

>

>

>

>  >

>

The Holding Tax Lot Rebalance e-doc allows you to edit the tax lots held by a KEMID. In this e-doc, you may modify the units and/or the carry value of the tax lots but you cannot change the overall total of the holding for the KEMID (units and carry value). You may bring one tax lot to zero units and zero carry value, but you cannot create a new tax lot.

This e-doc is useful when reversing an original transaction and re-entering a new one is not feasible.

The Holding Tax Lot

Rebalance e-doc does not create a record in the transaction archive table even

though it affects the balance tables. Use of this e-doc should, therefore, be

very carefully documented and controlled because such documentation is the only

audit trail for the change.

The Holding Tax Lot

Rebalance e-doc does not create a record in the transaction archive table even

though it affects the balance tables. Use of this e-doc should, therefore, be

very carefully documented and controlled because such documentation is the only

audit trail for the change.

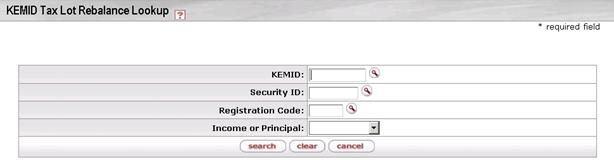

When you select Holding Tax Lot Rebalance from the menu, the system displays the KEMID Tax Lot Rebalance Lookup screen.

Here you may enter information into any combination of search fields in order to retrieve a tax lot you want to work with.

KEMID Tax Lot Rebalance Lookup definition

|

Title |

Description |

|

KEMID |

The KEMID that holds the tax lot you want to rebalance. |

|

Security ID |

The security associated with the tax lot you want to rebalance. |

|

Registration Code |

The registration code associated with the tax lot you want to rebalance. |

|

Income or Principal |

Type of funds (income or principal) associated with the tax lot you want to rebalance. |

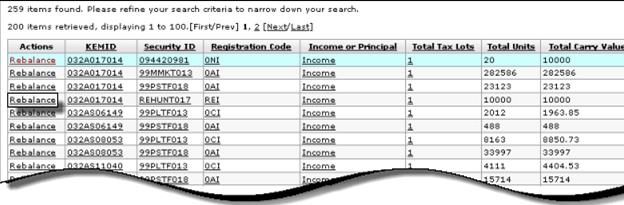

After you enter search criteria and click search, the system displays a list of matching records at the bottom of the screen.

For more information about the

columns in the search results display, see Document Layout.

For more information about the

columns in the search results display, see Document Layout.

To rebalance one of these records, click the  link in the Actions

column.

link in the Actions

column.

Document Layout

Document Layout