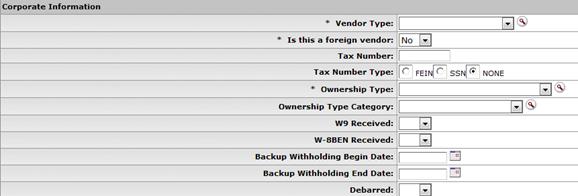

Corporate Information

The Corporate Information section includes the vendor tax information, such as tax number, ownership type, which tax forms are on file and any special withholdings or debarred information.

Corporate Information section definition

|

Title |

Description |

|

Vendor Type |

Required. Select the appropriate vendor type from the

Vendor

Type list or select if from the Vendor Type

lookup |

|

Is this a Foreign Vendor? |

Required. Select 'Yes' from the list if the vendor should be identified as foreign. Select 'No' if the vendor is not identified as foreign. |

|

Tax Number |

Required for non-foreign vendors. Enter the vendor's tax ID number or SSN. |

|

Tax Number Type |

Required. Select the Tax Number Type option that describes the tax number entered in the Tax Number field. If no Tax Number was entered, select 'None. |

|

Ownership Type |

Required. Select the appropriate type from the

Ownership

Type list, or search for it from the Owner Type

lookup |

|

Ownership Category |

Optional. Select the appropriate category from the

Ownership

Category list, or search for it from the Owner

Category lookup |

|

W9 Received |

Optional. Select 'Yes' or 'No' from the list to indicate if a W9 has been received for this vendor. Certain types of vendors may be required to have a W9 on file before they may be approved for use. |

|

W-8BEN Received? |

Optional. Select 'Yes' or 'No' from the list to indicate if a W-8BEN has been received for this vendor. Certain types of foreign vendors may be required to have a W-8BEN on file before they may be approved for use. |

|

Backup Withholding Begin Date |

Optional. Enter the effective date for backup or

select it from the calendar |

|

Backup Withholding End Date |

Optional. Enter the date to discontinue backup

withholding or select it from the calendar |

|

Debarred |

Optional. Select 'Yes' or 'No' from the list to indicate whether or not this vendor has been debarred. This designation indicates that an institution has been barred from doing business with this vendor by the state or federal government. |

. Examples include 'Disbursement

Voucher' and 'Purchase Order. A vendor's type determines on which

. Examples include 'Disbursement

Voucher' and 'Purchase Order. A vendor's type determines on which  , if the vendor is subject to backup

withholdings.

, if the vendor is subject to backup

withholdings. Conflict of Interest

Conflict of Interest