COA Attribute Maintenance E-Docs

>

>

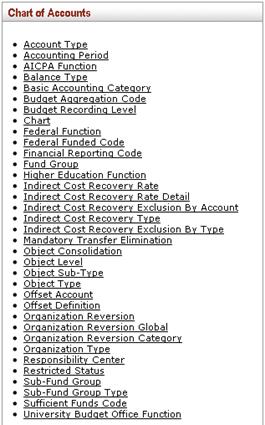

On the Maintenance menu tab, the Chart of Accounts submenu provides access to numerous maintenance documents for your institution's charts.

COA e-docs available from the Maintenance Menu

|

|

Description |

|

Identifies an attribute of account that categorizes accounts for reporting purposes. | |

|

Defines the accounting year, its subdivisions and their attributes to be used throughout the KFS. These periods usually correspond to calendar months but may include special processing periods. | |

|

Identifies an attribute of the higher education function code that may be used for reporting specifically related to American Institute of Certified Public Accountants. | |

|

Defines the different types of balances supported by the application. | |

|

Groups the object type codes into the basic accounting categories for reporting purposes. | |

|

Indicates the level at which the object can be used for budgeting. | |

|

Indicates the level at which an account is budgeted. | |

|

Defines the valid charts that make up the high-level structure of the KFS Chart of Accounts. It also specifies who has management responsibilities for each chart. Accounts and object codes are specific to each chart. Represented by a two character code. | |

|

Defines an attribute of the higher education function code that is used for federal reporting purposes. | |

|

Defines an attribute of object code that indicates the funding source and ownership of capital equipment. | |

|

Defines an optional attribute of sub-account that may be used for reporting. | |

|

The broadest category of funds. Used for reporting and business rules. | |

|

Classifies the purpose and activities of an account such as instruction, research, or public outreach. | |

|

Defines the recovery rate relative to direct costs spent in a particular fiscal year on Contracts and Grants that covers the cost of indirect expenses such as light, heat, central administration, etc. that cannot be directly allocated to any particular sponsored project. Offsetting revenue is recovered by the institution from the sponsoring agency to cover these indirect costs. | |

|

Defines the chart, account, object and percentage related to an indirect cost recovery rate. | |

|

Defines a specific object code for an account that is excluded from creating system-generated indirect cost transactions. | |

|

Defines the type of expenses that are eligible (or ineligible) for indirect cost recovery. ICR types are optional attributes of accounts that automatically generate indirect cost recovery entries. | |

|

Defines the specific chart and object code combinations to be used with an ICR type code that is excluded from system-generated indirect cost transactions. | |

|

Identifies an attribute of object code that can be used to indicate whether the object code is considered a mandatory transfer code, an elimination code, or neither. | |

|

Identifies an attribute of object level that represents a general category of object code for reporting. | |

|

Identifies an attribute of object code that is used to group similar object codes into categories for reporting. | |

|

Identifies an attribute of object code that is used to further refine object type. Used for reporting and sometimes for business rules. | |

|

Identifies an attribute of object code that is used to identify its general use, such as income, asset, expense, or liability. Used for reporting and business rules. | |

|

Allows an account to be specified for offsets of a KFS account, used for offset or elimination transactions. | |

|

Establishes the types of offset entries that the General Ledger will generate for each document type as part of the batch process, an e-doc or the accounting cycle. | |

|

Defines the reversion/carry forward rules by organization for the year-end process. The combination of GL balances and established rules determine whether current budget can be carried forward or reverted back to the reversion account number. | |

|

Creates new organization reversion categories by assigning them a code, a name, and assigning them a place in the display sequence. | |

|

Categorizes organizations for reporting purposes. | |

|

Identifies an attribute of organization used to assign an identifying number and description of an organization that has ultimate fiscal responsibility to those that report to it. | |

|

Identifies an attribute of account that is used to indicate whether the funds within an account are 'unrestricted,' 'restricted,' or 'temporarily restricted'. | |

|

Identifies an attribute of account used to designate the type or purpose of funds that are found in that account. | |

|

Identifies an attribute of sub-fund that can be used to further categorize or group sub-funds. | |

|

Identifies a unique identifier for the code that indicates what level the account is going to be checked for sufficient funds in the transaction processing environment. | |

|

Identifies an attribute of higher education function code that is used to identify a function for budget reporting. |

Account Type

Account Type