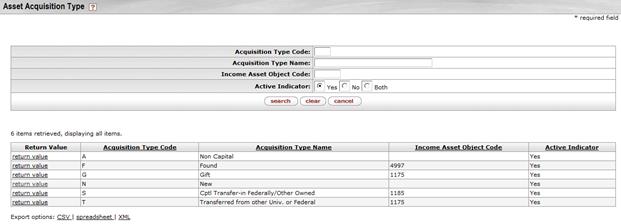

Asset Acquisition Type Lookup

The valid asset acquisition types are as follows.

Asset Acquisition Type definitions

|

Type Name |

Description |

|

Non Capital |

Non-capital assets are assets valued at less than $5,000. |

|

Found |

Found capital assets are assets that were retired in error or incorrectly classified in a prior fiscal year. Found assets create ledger entries.

|

|

Gift |

A gift of a capital asset occur either through a donation to the Foundation or through a direct donation to an organization. Gift assets create ledger entries.

|

|

New |

This acquisition type is used to create non-movable additions that are not created in CAB. An acquisition type of New adds assets to the database without creating a General Ledger entry.

|

|

Cptl Transfer-in Federally/Other Owned |

This acquisition type is used to create assets where the title is not to be vested in the university or receiving institution. This acquisition type generates ledger entries.

|

|

Transferred from other Univ. or Federal |

Transfer-in capital assets are assets received from an external organization (usually another university) or government surplus. This acquisition type generates ledger entries. |

To display and work with a global document, follow these steps:

1. Search for the appropriate asset acquisition type.

2. Click

the  link for this type.

link for this type.

3. The system displays the Asset Global document.

4. Enter information as needed.

5. If desired, use the delete button at the bottom of a section to delete sections that are not needed for adding assets.

The system assigns the

origin code,

The system assigns the

origin code,  Document Layout

Document Layout