Search Results

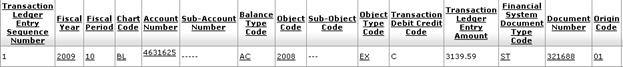

The results are displayed as shown below in four parts.

Labor Ledger Pending Entry Lookup Results definition

|

Column Title |

Description |

|

Transaction Ledger Entry Sequence Number |

The sequence number for the transaction assigned by the system |

|

Fiscal Year |

The fiscal year associated with this entry in the Labor Ledger |

|

The fiscal period associated with this entry in the Labor Ledger | |

|

|

The Chart of Accounts code for the account from which the employee is compensated |

|

Account Number |

The account from which the employee is compensated |

|

Sub-Account Number |

The sub-account for the account from which the employee is compensated |

|

Balance Type Code |

A code which distinguishes one type of balance from another. Options are: AC: Actual |

|

Object Code |

The object code for the account from which the employee is compensated |

|

Sub-Object Code |

The sub-object code for the account from which the employee is compensated |

|

Object Type Code |

The object type code for the object code from which the employee is compensated |

|

Transaction Debit Credit Code |

The debit or credit indicator for the transaction amount |

|

Transaction Ledger Entry Amount |

The transaction amount |

|

Financial System Document Type Code |

|

|

Document Number |

The e-doc document number generated by the system |

|

Origin Code |

The code which identifies the source of transaction |

|

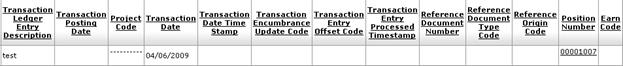

Transaction Ledger Entry Description |

The description for the transaction |

|

Transaction Posting Date |

The date that transaction was posted |

|

Project Code |

The project code for the account from which the employee is compensated |

|

Transaction Date |

The date the transaction was created |

|

Transaction Date Time Stamp |

The time the transaction was created |

|

Transaction Encumbrance Update Code |

A code to indicate whether the encumbrance is to be updated based on this transaction |

|

Transaction Entry Offset Code |

A code to identify the type of offset transaction to be generated in the G/L |

|

Transaction Entry Processed Timestamp |

The date and time that the transaction was processed |

|

Reference Document Number |

The document number of the source system |

|

Reference Document Type Code |

The document type code used in the source system |

|

Reference Origin Code |

The origination code used in the source system |

|

Position Number |

The position number or ID defined in the institutional HR/Payroll system |

|

Earn Code |

The identifier for the type of earnings (for example, regular, vacation, overtime) |

|

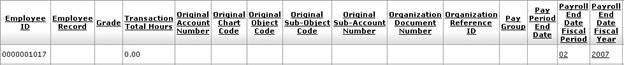

Employee ID |

The employee ID defined in the institutional HR/payroll system |

|

Employee Record |

The employee record number associated with the employee ID number in the institutional HR/payroll system. This value is a sequential counter to differentiate between employee's jobs. |

|

Grade |

The compensation plan increments for different responsibilities or impact levels of organization jobs |

|

Transaction Total Hours |

The number of labor hours included in the pay period earnings dollar value |

|

Original Account Number |

If this is an error correction, the original account assigned to the transaction |

|

Original Chart Code |

If this is an error correction, the Chart of Accounts code assigned to the transaction |

|

Original Object Code |

If this is an error correction, the original object code assigned to the transaction |

|

Original Sub-Object Code |

If this is an error correction, the Sub-Object Code assigned to the transaction |

|

Original Sub-Account Number |

If this is an error correction, the Sub-Account Code assigned to the transaction |

|

Organization Document Number |

The document number referenced by the organization which generated the transaction |

|

Organization Reference ID |

The reference ID referenced by the organization which generated the transaction |

|

Pay Group |

The pay group code to identify the sets of employees for payroll processing. For example, separate pay groups are created to differentiate exempt from non-exempt employees. |

|

Pay Period End Date |

The last day of the pay period in which the employee was compensated |

|

Payroll End Date Fiscal Period |

The fiscal period code which corresponds to the pay period |

|

Payroll End Date Fiscal Year |

The fiscal year for the payroll end date |

|

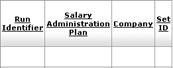

Run Identifier |

The reference number assigned to each pay period's payroll process for one or more pay groups |

|

Salary Administration Plan |

The code to assign default compensation packages to workers at the location, job code, or worker level. For example, the values might indicate 10-month academic, 12-month academic, regular 12-month salary, etc. |

|

Company |

A code to identify a sub-division of the organization to segregate physical or logical operations for payroll purposes |

|

Set ID |

The code to group a set of payroll rules together |

Position Inquiry

Position Inquiry