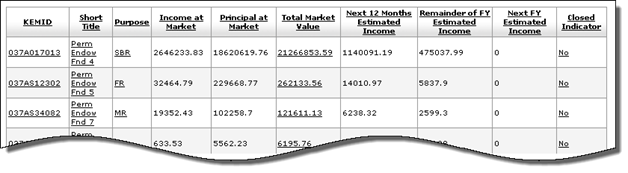

Search Results

Current KEMID Balances Lookup results definition

|

Description | |

|

KEMID |

Identifies a specific set of funds held by your institution as an endowment or a specific set of funds functioning as an endowment. To view more detail about a KEMID, click the underlined link. |

|

Short Title |

The descriptive name of this KEMID. To view more detail about a KEMID, click the underlined short title. |

|

Purpose |

The purpose for which this KEMID has been established. To view more detail about a purpose, click the underlined link. |

|

Income at Market |

The market value of the KEMID's current income holdings. This value is the total of: current income cash for the KEMID. plus the total market value of all current tax lot balance records held as income by the KEMID |

|

Principal at Market |

The market value of the KEMID's current principal holdings. This value is the total of: current principal cash for the KEMID plus the total market value of all current tax lot balance records held as principal by the KEMID. |

|

Total Market Value |

The market value of the KEMID's current total (income at market plus principal at market) balance. To view more detail about the KEMID's total market value, click the underlined link. |

|

Next 12 Months Estimated Income |

The estimated income for this KEMID in the next twelve months. This calculation represents what an endowment might realize should there be no changes in the number of units held and no change in the payout rate. This estimate is the result of the number of units in the holding lot times the rate for the security. |

|

Remainder of FY Estimated Income |

The estimated income for this KEMID for the rest of the current fiscal year. This calculation represents what an endowment might realize should there be no changes in the number of units held and no change in the payout rate. This estimate is displayed only for current holdings at the tax lot level. The calculation takes into account the frequency of the payments for the security and the next payment date—factors that are tied to the type of security. Consequently, the calculation varies based on the class code type of the security.

Some securities do not have an estimated income because the expected payout is not known (e.g., alternative investments, real estate, receivables, liabilities, etc). If the calculation cannot be made because the rate is zero, the estimated income is zero. |

|

Next FY Estimated Income |

The estimated income for this KEMID in the next fiscal year. This calculation represents what an endowment might realize should there be no changes in the number of units held and no change in the payout rate. This estimate is the result of the next fiscal year distribution amount times the number of holding units.

|

|

Closed Indicator |

Status indicator: No = KEMID is open. Yes = KEMID is closed. A KEMID may be closed only if the cash balances are zero, all holdings are zero, and the accrual amounts in the holding records are zero for all securities held by the KEMID. |

For more information on the calculations for each class code type, see

For more information on the calculations for each class code type, see  This value is

typically visible only for a short period of time (the length of which is

determined by your institution as the new fiscal year

approaches).

This value is

typically visible only for a short period of time (the length of which is

determined by your institution as the new fiscal year

approaches). Drilldown into KEMID Detail

Drilldown into KEMID Detail