Drilldown into KEMID Tax Lot Detail

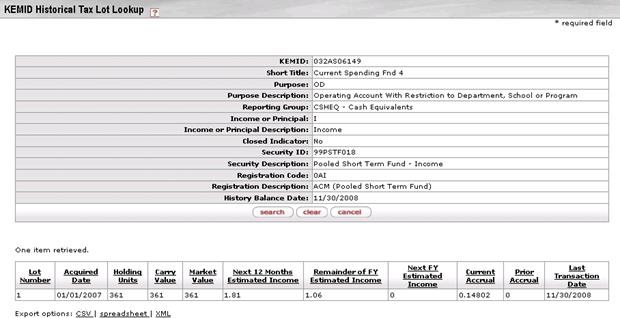

From the results table for the KEMID Historical Reporting Group Lookup screen, you may drill down further to view the detail of a specific security held at a specific location (registration code) and the holding and tax lots as of the selected month end. To do so, click the underlined link for Units. The system displays the KEMID Historical Tax Lots Lookup screen with results.

The search fields are pre-filled with the security ID and balance date for the month-end date/KEMID/reporting group/security/registration code combination whose Units link you chose. Each row of the results table displays information for a tax lot held for that security number and registration code as of the selected month end.

KEMID Historical Tax Lots Lookup results definition

|

Description |

| |

|

Lot Number |

The ID number for this tax lot. |

|

|

Acquired Date |

The date this lot was acquired. |

|

|

Holding Units |

The number of units in this tax lot as of the month-end date. |

|

|

Carry Value |

The carry value of this tax lot as of the month-end date. |

|

|

Market Value |

The market value of this tax lot as of the month-end date. |

|

|

Next 12 Months Estimated Income |

The estimated income for this tax lot in the next twelve months. This calculation represents what an endowment might realize should there be no changes in the number of units held and no change in the payout rate. |

|

|

Remainder of FY Estimated Income |

The estimated income for this tax lot in the rest of the current fiscal year. This calculation represents what an endowment might realize should there be no changes in the number of units held and no change in the payout rate. This estimate is displayed only for current holdings at the tax lot level. The calculation takes into account the frequency of the payments for the security and the next payment date—factors that are tied to the type of security. Consequently, the calculation varies based on the class code type of the security.

Some securities do not have an estimated income because the expected payout is not known (e.g., alternative investments, real estate, receivables, liabilities, etc). If the calculation cannot be made because the rate is zero, the estimated income is zero. |

|

|

Next FY Estimated Income |

The estimated income for this tax lot in the next fiscal year. This calculation represents what an endowment might realize should there be no changes in the number of units held and no change in the payout rate. This estimate is the result of the next fiscal year distribution amount (if a value has been placed in that field for the security record) times the number of holding units. At the end of the fiscal year this value is returned to zero until a user enters another value. |

|

|

Current Accrual |

The accrued value of the lot as of the month-end date. | |

|

Prior Accrual |

The prior accrued value of the lot. | |

|

Foreign Tax Withheld |

The amount withheld for foreign taxes. | |

|

Last Transaction Date |

The date of the last transaction for this lot. | |

For more information on the

calculations for each class code type, see

For more information on the

calculations for each class code type, see  Transaction

Archives

Transaction

Archives