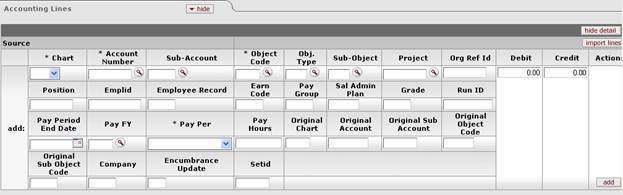

Accounting Lines Tab

The Accounting Lines tab includes all of the fields stored in the Labor Ledger table.

Warning:

The system performs few edits on the data on this tab, so the user must exercise the utmost caution in completing

the fields.

Warning:

The system performs few edits on the data on this tab, so the user must exercise the utmost caution in completing

the fields.

The field names

flagged with an asterisk below reflect the delivered naming convention (from a

third-party vendor HR system). These fields may be renamed and

redefined by an institution.

The field names

flagged with an asterisk below reflect the delivered naming convention (from a

third-party vendor HR system). These fields may be renamed and

redefined by an institution.

Labor Journal Voucher Accounting Lines tab definition

|

Title |

Description |

|

Chart |

Required. Select the chart code for the accounting line from the Chart list.

|

|

Account Number |

Required. Enter the account number for the accounting

line or search for it from the Account lookup

|

|

Sub-Account |

Optional. Enter the sub-account number for the

accounting line or search for it from the Sub-Account

lookup |

|

Object Code |

Required. Enter the object code for the accounting

line or search for it from the Object Code

lookup |

|

Obj. Type |

Required. Enter the object type for the accounting line or

search for it from the Object Type

lookup |

|

Sub-Object |

Optional. Enter the sub-object code for the accounting line

or search for it from the Sub-Object Code

lookup |

|

Project |

Optional. Enter the project code for the accounting line or

search for it from the Project Code

lookup |

|

Org Ref Id |

Optional. Enter the appropriate data for the transaction. |

|

Position |

Required. Enter the number or ID that defines a set of department- or unit-specific duties as defined in the institutional HR/Payroll system. |

|

Emplid* |

Optional. Enter the employee ID defined in the institutional HR/payroll system. |

|

Employee Record* |

Optional. Enter the employee record number associated with the employee ID number in the institutional HR/payroll system. This value is a sequential counter that differentiates between an employee's jobs. |

|

Earn Code* |

Optional. Enter the identifier for the appropriate type of earnings (e.g., regular, vacation, overtime). |

|

Pay Group* |

Optional. Enter the pay group code to identify the sets of employees for payroll processing. For example, separate pay groups are created to differentiate exempt from non-exempt employees. |

|

Sal Admin Plan* |

Optional. Enter the appropriate code to assign a default compensation package to workers at the location, job code, or worker level. For example, the values might indicate 10-month academic, 12-month academic, regular 12-month salary, etc. |

|

Grade* |

Optional. Specify the appropriate compensation plan increment for this level of responsibility or organizational impact. |

|

Run ID* |

Optional. Reference number assigned to each pay period's payroll process for one or more pay groups. |

|

Pay Period End Date |

Optional. Enter the pay period end date or select it

from the

calendar |

|

Pay Fiscal Year |

Required. Enter the pay fiscal year. |

|

Pay Period |

Required. Select the pay period from the Pay Period list. |

|

Pay Hours |

Optional. Enter the number of labor hours included in the pay period earnings dollar value. |

|

Original Chart |

Optional. Enter the original chart code assigned to the transaction if this is an error correction. |

|

Original Account |

Optional. Enter the original account assigned to the transaction if this is an error correction. |

|

Original Sub-Account |

Optional. Enter the original sub-account assigned to the transaction if this is an error correction. |

|

Original Object Code |

Optional. Enter the original object code assigned to the transaction if this is an error correction. |

|

Original Sub Object Code |

Optional. Enter the original sub-object code assigned to the transaction if this is an error correction. |

|

Company |

Optional. Enter a code that identifies a sub-division of the organization used to segregate physical or logical operations for accounting and processing purposes. |

|

Encumbrance Update |

Optional. A one-character indicator that should be included for entries with an encumbrance balance type. A code of 'R' indicates that the encumbrance should update the Open Encumbrance table using the Reference Document Number field. A code of 'D' indicates that the encumbrance should update the Open Encumbrance table using the document number of the Labor Journal Voucher document. |

|

Setid* |

Optional. Enter the code to group an appropriate set of payroll rules together. |

|

Debit/Credit |

Required. Enter the appropriate debit or credit dollar amount. |

When the

When the  .

. .

. Process Overview

Process Overview