Financial Processing > Year End E-Docs

Year-End Depreciation

![]() >

> ![]() >

> ![]() >

> ![]() >

> ![]() >

> ![]()

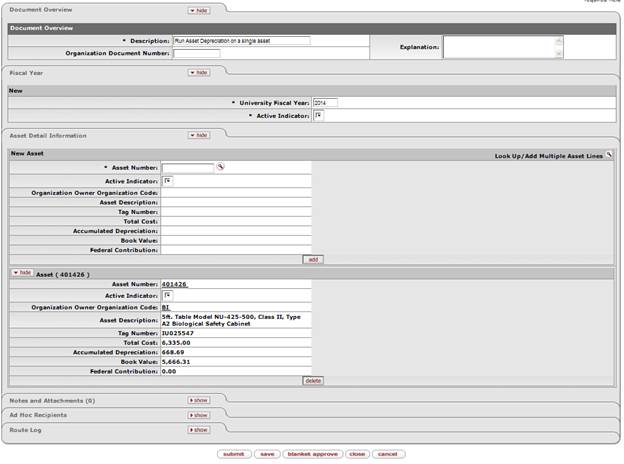

A Year End Depreciation document is used to list an asset or build a list of assets that were not depreciated in the batch year end depreciation run to allow running depreciation separately for these assets.

The AssetYearEndDepreciationBatchJob will adjust the in service and depreciation start dates for these assets as required, to depreciate for the previous FY and run depreciation for the list. Depreciation is posted to Previous FY, period 13. (Normal depreciation is posted to period 12.)

![]() For more

information about the standard tabs, see “Standard

Tabs” in the KFS Overview and Introduction to the User Interface.

For more

information about the standard tabs, see “Standard

Tabs” in the KFS Overview and Introduction to the User Interface.

Document Layout

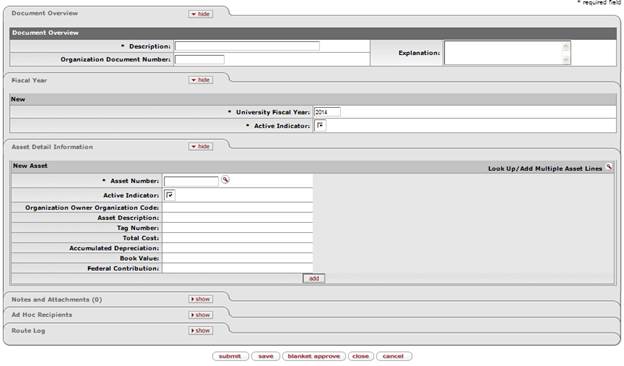

A Year End Depreciation (YDPA) document has two unique tab used to define the Fiscal Year and Asset(s) being depreciated in addition to the standard transaction tabs.

![]() For

more information about the standard tabs, see “Standard

Tabs” in the KFS Overview and Introduction to the User Interface.

For

more information about the standard tabs, see “Standard

Tabs” in the KFS Overview and Introduction to the User Interface.

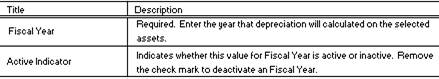

Fiscal Year Tab

The Fiscal Year tab has required fields to determine the Fiscal Year used.

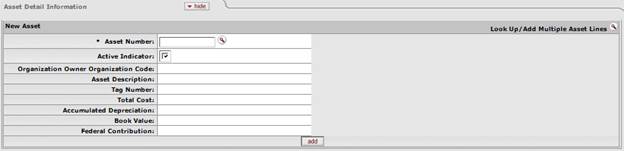

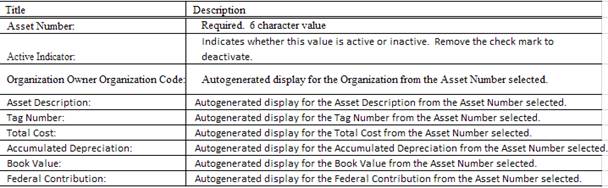

Asset Detail Information Tab

The Asset Detail Information tab has a required field to determine what asset(s) will be selected.

The system-assigned identifierunique to the asset.

Process Overview

Business Rules

· Assets were added after the depreciation run that should have been included in the previous FY.

· Dates are adjusted and depreciation calculated.

· Depreciation is posted to Previous FY, period 13.

Routing

The Year End Depreciation (YDPA) document routes to the Sys-Manager for approval.

The document status becomes 'FINAL' when the required approvals are obtained. When the batch process is run, the action depreciating the value of the asset will be calculated and adjust the asset records Accumulated Depreciation and Book Value fields.

Initiating an Year End Depreciation Document

1. Select the Year End Depreciation document from the Capital Asset Management subgroup under Year End Transactions.

2. A blank YDPA document will display.

3. Complete the standard tabs.

![]() For

information about the standard tabs such as Document Overview,

Notes and Attachments, Ad Hoc Recipients, Route

Log, see “Standard Tabs” in the KFS

Overview and Introduction to the User Interface.

For

information about the standard tabs such as Document Overview,

Notes and Attachments, Ad Hoc Recipients, Route

Log, see “Standard Tabs” in the KFS

Overview and Introduction to the User Interface.

4. Enter the required information identifying the asset(s) to be selected.

5.

Click ![]() for the selected assets.

for the selected assets.

6.

Click ![]() .

.

7. Review the Route Log tab for needed approvals. The Route Status shows 'ENROUTE'. A Sys-Manager will approve the document.

![]() For

information about the Route Log tab, see “Route Log” in the KFS Overview

and Introduction to the User Interface.

For

information about the Route Log tab, see “Route Log” in the KFS Overview

and Introduction to the User Interface.

Example

The Financial Analysis – Plant Fund Accountant has run the yearly depreciation on the full set of assets for last Fiscal Year in July. Several Asset records were locked for due to Asset Transfer documents Enroute. The YDPA document provides a simple mechanism to process and calculate depreciation against these assets after they are unlocked by completing the Enroute documents.