Financial ProcessingAdministrative Transaction E-Docs

Service Billing

![]() >

>

![]() >

>

![]() >

>

![]() >

>

![]()

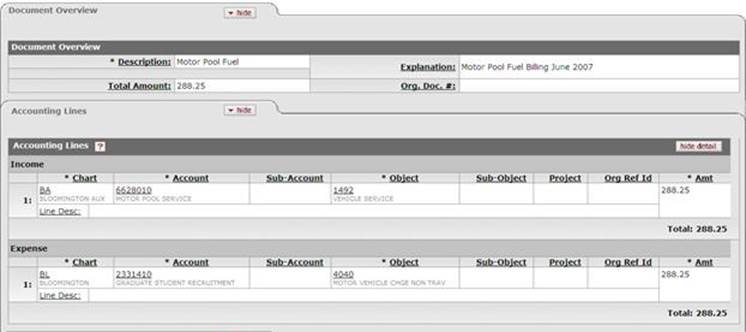

The Service Billing (SB) document is a restricted use document. Like the Internal Billing (IB) document, it is used for the billing of goods and services provided by a university department to another internal department, reflecting income to the provider and expense to the customer. These transactions are generated by the servicing department.

The difference between the SB document and the IB document is that the SB does not route for fiscal officer approval. A formal pre-agreement exists between the service provider and the department being billed; based on a service provider's ability to provide documentation for all transactions. This pre-agreement serves as an ongoing approval for these transactions and restricted access for SB document initiation ensures that only authorized organizations can create a billing without approval routing.

The SB document is used by the members of KFS-FP Service Billing Processor role. These users belong to university departments that have pre-agreements for the billing of goods or services provided to other departments.

![]() The KFS-FP Service Billing Processor Role: Each member of this

role is associated with one or more account

numbers. These account numbers can then be used on the Income side of the

document by that role member,

The KFS-FP Service Billing Processor Role: Each member of this

role is associated with one or more account

numbers. These account numbers can then be used on the Income side of the

document by that role member,

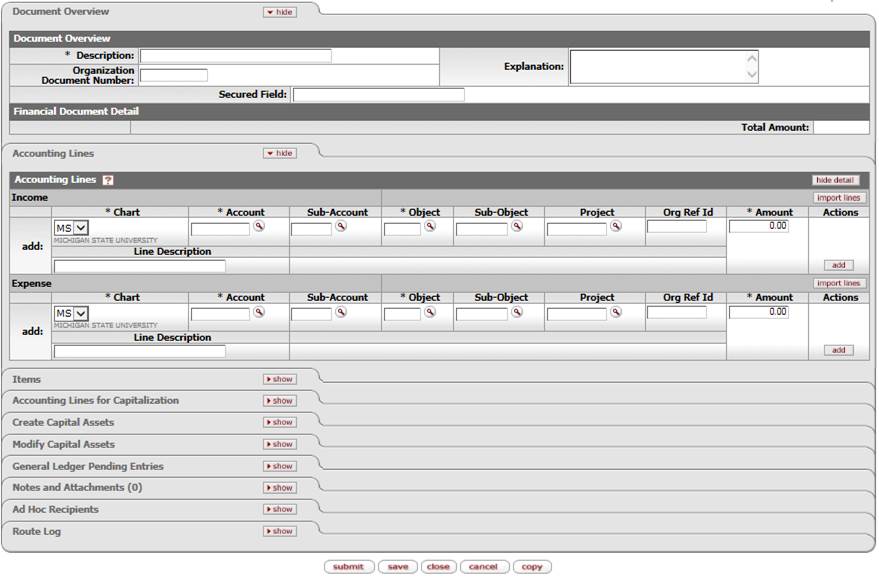

Document Layout

An SB document has its own unique Items in addition to the standard financial transaction tabs.

![]() For information about the standard

tabs such as Document Overview, Notes and Attachments,

Ad

Hoc Recipients, Route

Log, Accounting Lines, Accounting Lines

for Capitalization, Create Capital Assets and Modify Capital Asset

tabs, see Standard

Tabs under Overview > KFS E-Doc Fundamentals.

For information about the standard

tabs such as Document Overview, Notes and Attachments,

Ad

Hoc Recipients, Route

Log, Accounting Lines, Accounting Lines

for Capitalization, Create Capital Assets and Modify Capital Asset

tabs, see Standard

Tabs under Overview > KFS E-Doc Fundamentals.

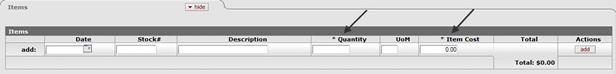

Items Tab

The Items tab is optional; however, if you choose to use this tab, Quantity and Item Cost are required fields. This tab does not have any impact on the Accounting Lines tab, nor does it need to balance to the accounting lines. Therefore, filling out the Items tab does not automatically update the total of the accounting lines.

Items tab definition

|

Description |

|

|

Date |

Optional. Enter the date of service or select it from the

calendar |

|

Stock # |

Optional. Enter the stock number for the goods or services provided. |

|

Description |

Optional. Enter the description of goods or services. |

|

Quantity |

Required. Enter the quantity of goods or services provided. |

|

UOM |

Optional. Enter the unit of measure. |

|

Item Cost |

Required. Enter the cost per item for goods or services. |

|

Total |

Display-only. The extended cost is calculated when you click add to add the line. |

Business Rules

· The document initiator must be authorized (via the KFS-FP Service Billing Processor role) to initiate a SB, and also to affect the specific income accounts.

· Negative accounting line amounts are allowed.

· There must be at least one accounting line in the Income section and one accounting line in the Expense section.

· The income line accepts only a limited set of accounts (listed in the Service Billing Control table).

· The total in the Income section must equal the total in the Expense section in the Accounting Lines tab.

· The KFS automatically generates cash and fund balance object code offset entries as defined by the information entered into the document.

The Sub-Fund Group restrictions are as follows.

Sub Fund Group restrictions for Service Billing documents

|

Sub Fund Group |

Description |

Restrictions |

|

GC |

GEN CMP - Cash Management Program |

Unallowable |

|

GD |

GEN Dean Contingency |

Unallowable |

|

GP |

GEN Summer School |

Unallowable |

The Object Level restrictions are:

Object Level restrictions for Service Billing documents

|

Object Level |

Description |

Restrictions |

|

C&G |

|

Unallowable |

Invalid_Subfund_Group_By_Object_Type

|

Object Type IN |

Description |

Restrictions |

|

GP |

GEN Summer School |

Unallowable |

|

GA |

GEN Operations |

Unallowable |

|

GC |

GEN CMP - Cash Management Program |

Unallowable |

|

GD |

GEN Dean Contingency |

Unallowable |

|

GL |

GEN TLE - Teaching Learning Environment |

Unallowable |

|

GR |

GEN Research |

Unallowable |

|

GS |

GEN Specials |

Unallowable |

|

GT |

GEN Outreach |

Unallowable |

|

GU |

GEN University |

Unallowable |

|

RA |

ERF MAES |

Unallowable |

|

RE |

ERF MSUE |

Unallowable |

|

Object Type EX |

Description |

Restrictions |

|

DU |

DES Undistributed Gains and Losses |

Unallowable |

|

NB |

END Unrestricted Funds Functioning End |

Unallowable |

|

NC |

END Charitable Remainder Trust |

Unallowable |

|

NE |

END Unrestricted Term End Principal |

Unallowable |

|

NG |

END Unrestricted True End Principal |

Unallowable |

|

NM |

END Restricted Term Endowments Principal |

Unallowable |

|

NR |

END Restricted Funds Functioning End |

Unallowable |

|

NU |

END Undistributed Gains and Losses |

Unallowable |

|

NX |

END Restricted True Endowments Principal |

Unallowable |

|

RU |

ERF Undistributed Gains and Losses |

Unallowable |

The object code restrictions are as follows.

Object Type Code restrictions for Service Billing documents

|

Object Type Codes |

Description |

Restrictions |

|

AS |

|

Unallowable |

|

CH |

Cash Not Income |

Unallowable |

|

EE |

Expenditure Not Expense |

Allowed |

|

ES |

Expense Not Expenditure |

Unallowable |

|

EX |

Expense Expenditure |

Allowed |

|

IC |

Income Not Cash |

Unallowable |

|

IN |

Income – Cash |

Allowed |

|

LI |

|

Unallowable |

· The Object Code field has the following restrictions:

· Contracts and Grants Sponsored Programs object level codes are not allowed.

· On an income line, capital object codes may not be used.

· Object code sub-type restrictions are as follows.

Object Code Sub Type restrictions for Service Billing documents

|

Object Code Sub-Type |

Description |

Restrictions |

|

BU |

Budget-Only Object Codes |

Unallowable |

|

CP |

Construction Process |

Unallowable |

|

FR |

Fringe Benefit |

Unallowable |

|

GI |

Gifts |

Unallowable |

|

HW |

Hourly Wages |

Unallowable |

|

IV |

Investment |

Unallowable |

|

MT |

Mandatory Transfers |

Unallowable |

|

PL |

Plant-Capital Assets |

Unallowable |

|

RE |

Reserves |

Unallowable |

|

SA |

Salary and Wages |

Unallowable |

|

ST |

State Appropriations |

Unallowable |

|

|

|

Unallowable |

|

TN |

Transfers - Generic |

Unallowable |

|

WO |

Write-off Expenses |

Unallowable |

Routing

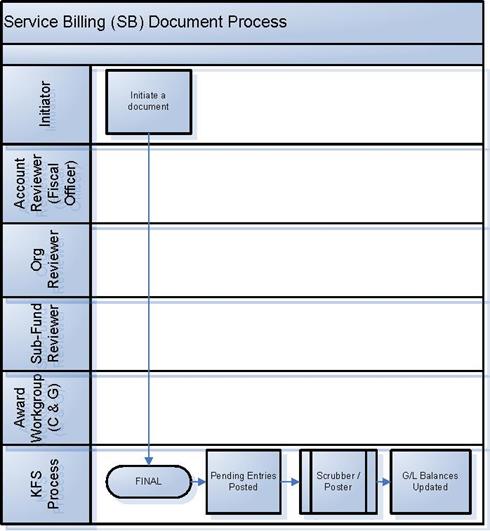

After the SB is submitted, it is automatically approved and does not route. The document status is 'FINAL,' and the transaction is posted to the G/L during the next G/L batch process.

Initiating a Service Billing Document

1. Select Service Billing from the Financial Processing submenu group in the Administrative Transactions submenu on the Main Menu tab.

2. Log into the KFS as necessary.

A blank SB document with a new document ID appears.

3. Complete the standard tabs.

Complete both the Income section and Expense section in the Accounting Lines tab.

![]() For information about the standard

tabs such as Document Overview, Notes and Attachments,

Ad

Hoc Recipients, Route

Log, Accounting Lines, Accounting Lines

for Capitalization, Create Capital Assets and Modify Capital Asset

tabs, see Standard

Tabs under Overview > KFS E-Doc Fundamentals.

For information about the standard

tabs such as Document Overview, Notes and Attachments,

Ad

Hoc Recipients, Route

Log, Accounting Lines, Accounting Lines

for Capitalization, Create Capital Assets and Modify Capital Asset

tabs, see Standard

Tabs under Overview > KFS E-Doc Fundamentals.

4. If entering a Service Billing

transaction for a capital

asset

Either enter the appropriate existing asset

number in the Modify Capital Asset tab or enter

a new asset number in the Create Capital Assets tab.

5. Click ![]() .

.

6. Review the General Ledger Pending Entries tab.

Accounts in the Income section are credited when the amount is positive, and debited when the amount is negative. Accounts in the Expense section are debited when the amount is positive, and credited when the amount is negative. This document automatically generates cash offset entries to cash or fund balance object codes.

7. Review the Route Log tab.

No approval is required.

![]() For more information about the Route Log, see Route

Log.

For more information about the Route Log, see Route

Log.

Example

The Motor Pool needs to bill several departments for fuel expenses totaling $288.25. The Motor Pool income account is 6628010 with this income recorded to Vehicle Service object code 1492. The expenses of $172.48 and $115.77 are charged, respectively, to the Motor Vehicle Charge - Non Travel object code 4040 on Graduate Student Recruitment account 2331410. The SB document provides a simple mechanism for departments to charge each other for services rendered, without the need for the document to route for approval.