Core

Modules > Chart of

Accounts (COA) > Standard

COA E-Docs > Object Code > Document Layout

Object Code

![]() >

> ![]() >

>![]() >

>![]() >

> ![]() >

> ![]()

The Object Code document is used to establish new object codes or to copy or edit existing object codes. Object codes represent all income, expense, asset, liability and fund balance classifications that are assigned to transactions and help identify the nature of the transaction. Examples of object codes might include travel expenditures, student fee income, accounts receivable, and invoices payable. Object codes are specific to a chart and a fiscal year and contain several attributes throughout the KFS for financial reporting at the detail and consolidated levels.

The Object Code document comes with a global document option where you can create a group of new object codes or update the existing object codes all at once.

![]() For

more information about the global document see Object

Code Global.

For

more information about the global document see Object

Code Global.

Document Layout

The Object Code document includes the Edit Object Code tab.

Edit Object Code Tab

Edit Object Code tab definition

|

Description |

|

|

Required. Enter the

fiscal year of the object code or search for it from the Fiscal

Year lookup

|

|

|

|

Required. From the Chart list select the chart

to which the object code belongs, or search for it from the lookup |

|

Object Code |

Required. Enter the code to identify the object code which must be unique within the chart and fiscal year to which it belongs. |

|

Object Code Name |

Required. Enter the long descriptive name of the object code which appears on the Accounting Lines tab in financial documents as well as in searches and reports. |

|

Object Code Short Name |

Required. Enter the shortened version of the object code name for use in reporting where space is limited. |

|

Reports to Chart Code |

Display-only. The value automatically defaults to the Reports to Chart of Accounts Code value associated with the Reports to Object Code's Chart Code value once it is entered. |

|

Reports to Object Code |

Required. Enter the

object code that the object code reports to in the next higher chart, or

search for it from the Object Code lookup |

|

Object Type Code |

Required. Enter the

code or search for it from the Object Type lookup |

|

Level Code |

Required. Enter the

code or search for it from the Level lookup |

|

Object Sub-Type Code |

Required. Enter the

code or search for it from the Object Sub-Type lookup |

|

Historical Financial Object Code |

Optional. Enter the

code or search for it from the Historical

Financial Object Code lookup |

|

Legacy Object Code: |

Optional. .

Enter the code or search for it from the Legacy |

|

Active Code |

Optional. Select the check box if the object code is active and can be used on financial documents. Clear the check box if it is inactive. |

|

Budget Aggregation Code |

Required. Enter the

code that indicates at what level the object code can be used for budgeting,

or search for it from the Budget Aggregation Code lookup O = Object code

level |

|

Mandatory Transfers or Elimination Code |

Required. Enter the

code or search for it from the Mandatory Transfers

or Elimination Code lookup M = Mandatory

transfer code |

|

Federally Funded Code |

Required. Select

the indicator to show whether this is an object code for capital equipment

from the Federally

Funded Code list,

or search for it from the lookup N = Non-federally

funded, university owned |

|

Next Year Object Code |

Optional. Enter the object code that represents the object code in the next fiscal year. |

Process Overview

Business Rules

• If the Reports to Chart Code value is not the highest chart level, the reports to object code, fiscal year, and chart code combination must exist in the Object Code Table.

• If the Reports to Chart Code value is at the highest level, then the object code must report to itself as an additional rule.

• If a Next Year Object Code value is entered, then the current fiscal year, chart code, and next year object code combination must exist in the Object Code Table.

![]() Institutional

Reporting: The KFS provides for various fields available for

institutional reporting. You can, for example, define a top level chart that

consolidates activity for reporting purpose. After the top level chart is

defined, the Statement of Net Assets and Statement of Revenues, Expenses and

Changes in Net Assets can be designed, using 'Reports To' chart and object code

and the sub-totals by the object code levels and consolidations on the top

chart. Or, you may design responsibility center reports using the organization roll-up of accounts. For more information

about the capabilities of the organization within the Chart of Accounts, refer to Organization

and Organization

Type.

Institutional

Reporting: The KFS provides for various fields available for

institutional reporting. You can, for example, define a top level chart that

consolidates activity for reporting purpose. After the top level chart is

defined, the Statement of Net Assets and Statement of Revenues, Expenses and

Changes in Net Assets can be designed, using 'Reports To' chart and object code

and the sub-totals by the object code levels and consolidations on the top

chart. Or, you may design responsibility center reports using the organization roll-up of accounts. For more information

about the capabilities of the organization within the Chart of Accounts, refer to Organization

and Organization

Type.

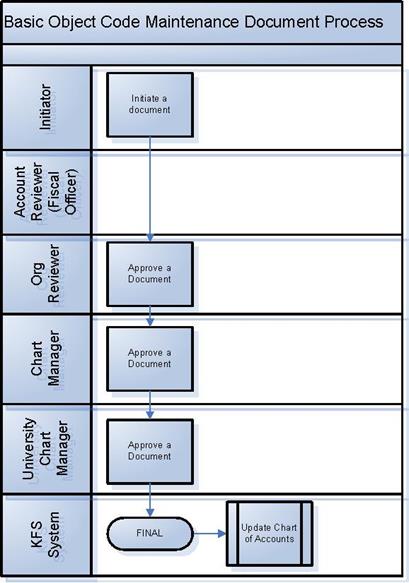

Routing

The Object Code document routes to the Chart Manager for the chart associated with the object code followed by routing to the University Chart Manager.