Financial ProcessingAdministrative Transaction E-Docs

Non-Check Disbursement

![]() >

> ![]() >

> ![]() >

> ![]() >

> ![]()

![]() In order for users to submit

the Non-Check

Disbursement document,

the ENABLE_BANK_SPECIFICATION_IND

parameter

must be set to Y and the DEFAULT_BANK_BY_DOCUMENT_TYPE parameter must be completed.

Even if your institution is not planning to use the Bank Offset

feature in KFS,

the DEFAULT_BANK_BY_DOCUMENT_TYPE parameter must be completed if your users plan

to use the Non-Check Disbursement document. Bank offsets will not be created if

the Bank Offset feature has not been configured.

In order for users to submit

the Non-Check

Disbursement document,

the ENABLE_BANK_SPECIFICATION_IND

parameter

must be set to Y and the DEFAULT_BANK_BY_DOCUMENT_TYPE parameter must be completed.

Even if your institution is not planning to use the Bank Offset

feature in KFS,

the DEFAULT_BANK_BY_DOCUMENT_TYPE parameter must be completed if your users plan

to use the Non-Check Disbursement document. Bank offsets will not be created if

the Bank Offset feature has not been configured.

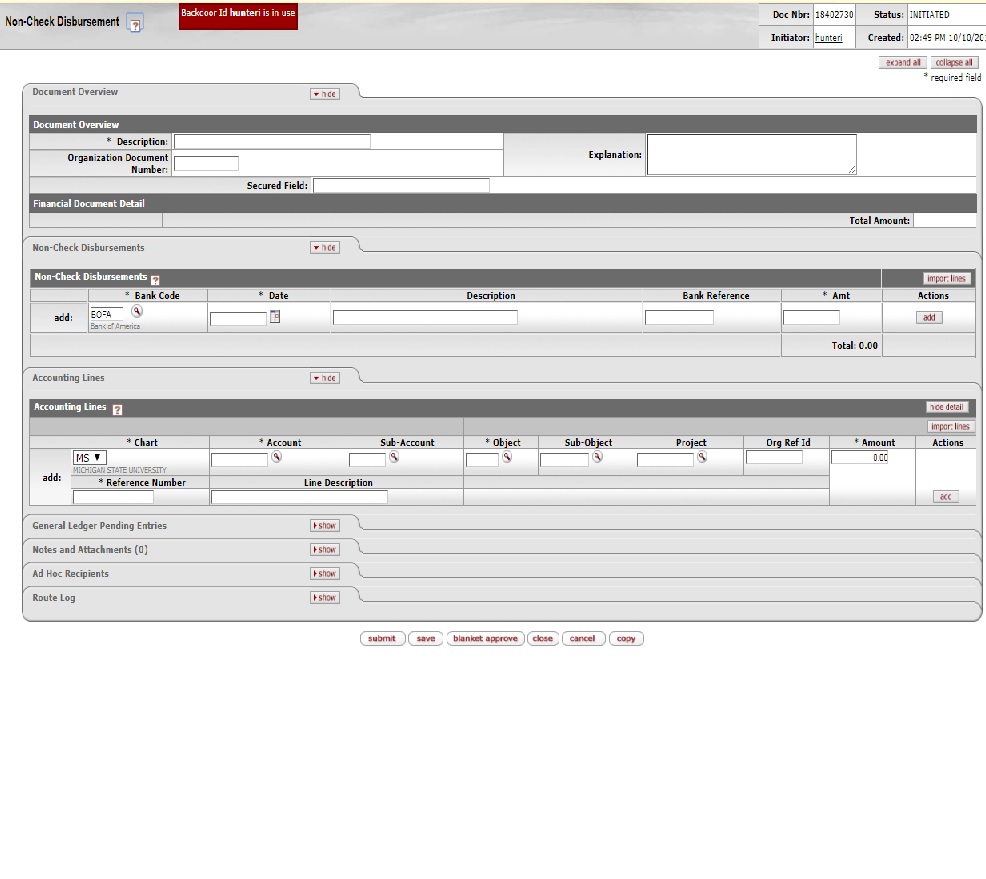

The Non-Check Disbursement (ND) document is used to record charges or debits directly assessed to a bank account created by banking transactions that do not automatically update the accounts in the system. It is used primarily by the Tax and Treasury Accounting areas to record wire transfers, foreign drafts, etc.

Document Layout

The ND document only has the standard financial transaction document tabs and does not have any unique tabs of its own.

![]() For information about the standard tabs such as Document Overview,

Notes and Attachments, Ad

Hoc Recipients, Route

Log, and Accounting Lines tabs, see Standard

Tabs.

For information about the standard tabs such as Document Overview,

Notes and Attachments, Ad

Hoc Recipients, Route

Log, and Accounting Lines tabs, see Standard

Tabs.

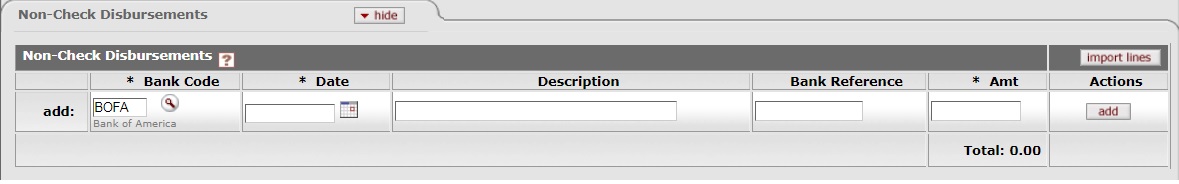

Non-check disbursement tab definition

|

Title |

Description |

|

Bank Code |

Required.

Enter the bank code number to which the funds are deposited or search for a

bank account from the Bank Account lookup |

|

Date |

Required.

Enter the actual date of the deposit or select it from the calendar |

|

Description |

Optional. 40 Character field provides a brief description of the deposit transaction. This is for departmental use only, and does not appear on financial reports. |

|

Bank Reference |

Optional. Intended for bank reconciliation purposes by central office. Field may be blank or, if used, must be exactly 11 digits. |

|

Amt |

Required. Enter the total amount of the non-check disbursement. |

Process Overview

![]() Initiating

a Non-Check Disbursement Document

Initiating

a Non-Check Disbursement Document

Business Rules

· There must be at least one accounting line in the document.

· The ND document is one-sided. The KFS automatically generates the other side of the entry affecting the cash account, as defined by information entered into the document.

· Negative amounts are not allowed. Accounting lines entered on the ND are debited.

· Reference Number (Ref Number) is a required field on this document.

· The object code field has the following default restrictions.

Object Code Sub Type restrictions for Non-Check Disbursement documents

|

Object Code Sub Type |

Description |

Restrictions |

|

BU |

Budget-Only Object Codes |

Unallowable |

|

CA |

Cash |

Unallowable |

|

FR |

Fringe Benefits |

Unallowable |

|

HW |

Hourly Wages |

Unallowable |

|

MT |

Mandatory Transfers |

Unallowable |

|

OP |

Other Provisions |

Unallowable |

|

PL |

Plant - Capital Assets |

Unallowable |

|

SA |

Salary and Wages |

Unallowable |

|

TF |

Transfer Of Funds |

Unallowable |

|

TN |

Transfers - Generic |

Unallowable |

Object Code Type restrictions for Non-Check Disbursement documents

|

Object Code Type |

Description |

Restrictions |

|

IC |

Income Not Cash |

Unallowable |

|

ES |

Expense Not Expenditure |

Unallowable |

Object Consolidation restrictions for Non-Check Disbursement documents

|

Object Consolidation |

Description |

Restrictions |

|

FDBL |

Fund Balance |

Unallowable |

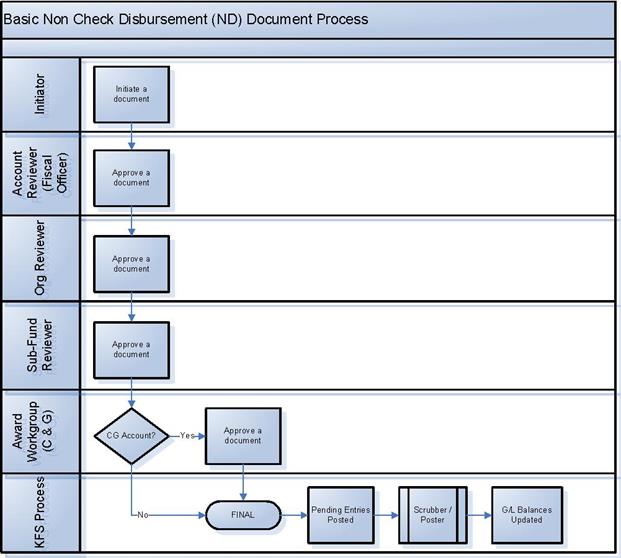

Routing

The ND document routes based on the account numbers used on the document as follows:

· The fiscal officer for each account must approve.

· Organization review routing occurs for the organization that owns each account.

· Sub-fund routing occurs based on the sub-fund of each account.

· The document status becomes 'FINAL' when the required approvals are obtained and the transaction is posted to the G/L during the next G/L batch process.

Initiating a Non-Check Disbursement Document

1. Select Non-Check Disbursement from the Financial Processing submenu group in the Administrative Transactions submenu on the Main Menu tab.

2. Log into the KFS as necessary.

A blank ND document with a new document ID appears.

3. Complete the standard tabs.

![]() For information about the standard tabs such as Document Overview,

Notes and Attachments, Ad

Hoc Recipients, Route

Log, and Accounting Lines tabs, see Standard

Tabs.

For information about the standard tabs such as Document Overview,

Notes and Attachments, Ad

Hoc Recipients, Route

Log, and Accounting Lines tabs, see Standard

Tabs.

4. Click ![]() .

.

5. Review the General Ledger Pending Entries tab.

The pending entries include offset generation lines to cash or fund balance object codes.

6. Review the Route Log tab.

The document is routed to the fiscal officer for each account used in the Accounting Lines tab. The Route Status shows 'ENROUTE'.

![]() For more information about the Route Log, see Route

Log.

For more information about the Route Log, see Route

Log.

7. Appropriate fiscal officers and organization reviewers approve the document.

![]() For more information about how to approve a document, see Workflow

Action Buttons.

For more information about how to approve a document, see Workflow

Action Buttons.

Example

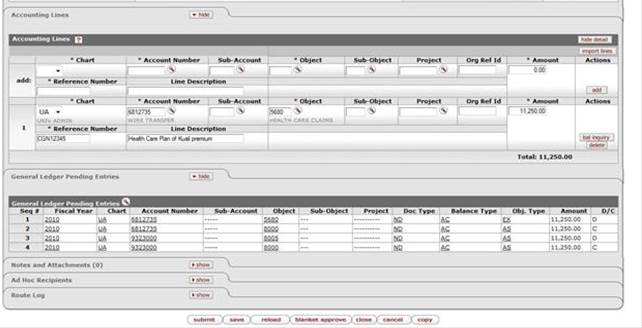

An entry is needed to record funds directly withdrawn from the First National Test Bank of Kuali bank account to pay for a dental plan, charging the expense to account 6812735.

The dental plan expense account is debited and offset entries are automatically generated. The ND document routes to the fiscal officer of account 6812735 for final approval.

The General Ledger Pending Entries tab shows that account 6812735 has been debited for object code 5680 and the system has automatically generated the appropriate cash offset to object code 8000 and clearing object code 8005.