Intra Account Adjustment[p1]

![]() >

>![]() >

>![]() >

>![]() >

>![]()

The Intra Account Adjustment (IAA) document is used to allow adding sub-account/sub-object code information or to transfers between sub-accounts or between sub-object codes, within the same account, for accurate detailed reporting, without any approval levels beyond that of the fiscal officer for the account.

![]() This

document is not used to record the transfer of capital equipment

between university accounts. Normally this type of transaction is recorded via

a Transfer of Funds (TF) document.

This

document is not used to record the transfer of capital equipment

between university accounts. Normally this type of transaction is recorded via

a Transfer of Funds (TF) document.

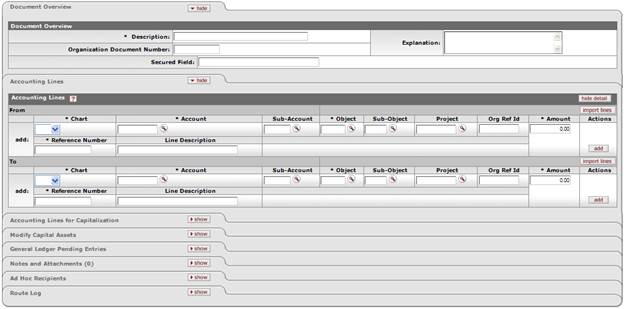

Document Layout

An IAA document has only the standard financial transaction document tabs including the Accounting Line for Capitalization, to Modify Capital Assets.

![]() For more

information about the standard tabs, see ‘Standard

Tabs’ in the KFS Overview and Introduction to the User Interface.

For more

information about the standard tabs, see ‘Standard

Tabs’ in the KFS Overview and Introduction to the User Interface.

Process Overview

Business Rules

· The total amount charged to an individual account on the source line must be equal to the total amount charged to an individual account on the target line.

· The total amount charged to an individual object code on the source line must be equal to the total amount charged to an individual object code on the target line.

· The IAA will not allow adjustments to the chart, account and/or object code on the accounting lines. An error message will be generated.

· The IAA will only allow transactions to Modify Capital Assets.

· OBJECT_TYPES parameter to control the object types allowed on the document. Values to start should be IN and EX under the “A” constraint code.

· OBJECT_SUB_TYPES parameter to control the object sub-types allowed on the document. All object sub-types associated with salary and fringe benefits should be under the “D” constraint code.

· Sub-Accounts that contain entries in the cost sharing and indirect cost rate sections are not allowed on the Intra Account Adjustment (IAA) document.

Restrictions invoked by Parameter set up:

|

Object Types |

Description |

Restrictions |

|

IN |

Income -Cash |

Allowable |

|

EX |

Expense Expenditure |

Allowable |

|

Object Sub-Types |

Description |

Restrictions |

|

FR |

Fringe Benefits |

Denied |

|

HW |

Hourly Wages |

Denied |

|

SA |

Salaries |

Denied |

Routing

The IAA document routes based on the account numbers used on the document as follows:

· Only fiscal officer approval can be required on the document. See note below.

The document status becomes 'FINAL' when the FO approvals are obtained and the transaction is posted to the G/L during the next G/L batch process.

Initiating an Intra Account Adjustment Document

1. Select Intra Account Adjustment from the Financial Processing submenu group.

2. Log into the KFS as necessary.

A blank IAA document with a new document ID appears.

3. Complete the standard tabs.

![]() For

information about the standard tabs such as Document Overview,

Notes and Attachments, Ad Hoc Recipients, Route

Log, Accounting Lines and Accounting

Lines for Capitalization tabs, see “Standard

Tabs” in the KFS Overview and Introduction to the User Interface.

For

information about the standard tabs such as Document Overview,

Notes and Attachments, Ad Hoc Recipients, Route

Log, Accounting Lines and Accounting

Lines for Capitalization tabs, see “Standard

Tabs” in the KFS Overview and Introduction to the User Interface.

4. If entering an Intra

Account Adjustment transaction for a capital asset enter the appropriate

existing asset number in the Asset Number field on the Capital Assets

for Accounting Lines section of the Modify Capital Asset

tab. When completed click the ![]() button.

button.

5. Click ![]() .

.

6. Review the General Ledger Pending Entries tab.

7. Review the Route Log tab.

The document is routed to the fiscal officer for each account used in the Accounting Lines tab. The Route Status shows 'ENROUTE'.

![]() For information

about the Route Log tab, see “Route Log” in the KFS Overview and

Introduction to the User Interface.

For information

about the Route Log tab, see “Route Log” in the KFS Overview and

Introduction to the User Interface.

8. Appropriate fiscal officers approve the document.

![]() For more

information about how to approve a document, see “Workflow

Action Buttons” in the KFS Overview and Introduction to the

User Interface.

For more

information about how to approve a document, see “Workflow

Action Buttons” in the KFS Overview and Introduction to the

User Interface.

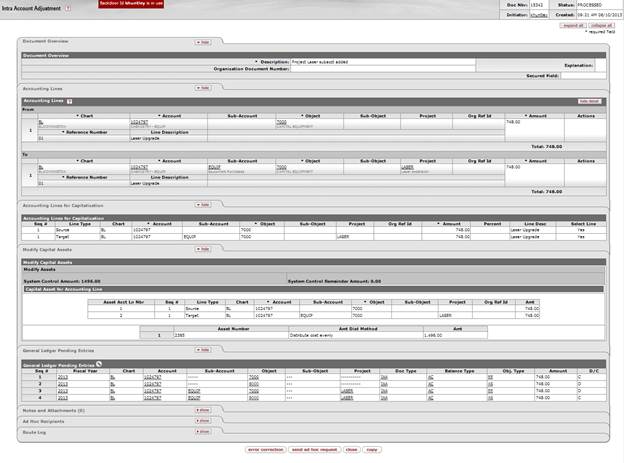

Example

The Chemistry department FO has a transaction to add additional attributes for, a sub-account and a project code.

The expense on the transaction for the project was of $748.00. It is recorded to Chemistry account 1024797 under Object code 7000. Add the sub-account and project code for more detailed reporting capabilities for the transaction.

The IAA document provides a simple mechanism for departments to add details to a transaction without requiring approval past the Fiscal Officers review.