General Error Correction

![]() >

>![]() >

>![]() >

>![]()

The General Error Correction (GEC) document is used to correct inappropriate or erroneous accounting string data for General Ledger entries generated from other financial transactions.

By consistently referring to the details of each transaction being corrected, the GEC preserves and maintains the audit trail. Fiscal officers and support staff, department, responsibility center, and campus administration staff are typical users of the GEC.

More:

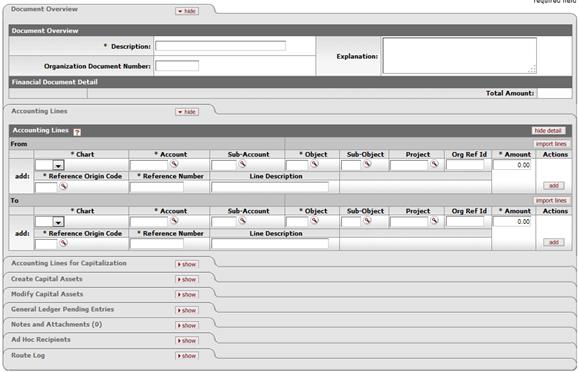

Document Layout

The GEC document only has the standard financial transaction document tabs and does not have any unique tabs of its own.

![]() For information about the standard

tabs such as Document Overview, Notes and Attachments,

Ad

Hoc Recipients, Route

Log, Accounting Lines, Accounting Lines for

Capitalization, Create Capital Assets and Modify Capital Asset

tabs, see Standard

Tabs under Overview > KFS E-Doc Fundamentals.

For information about the standard

tabs such as Document Overview, Notes and Attachments,

Ad

Hoc Recipients, Route

Log, Accounting Lines, Accounting Lines for

Capitalization, Create Capital Assets and Modify Capital Asset

tabs, see Standard

Tabs under Overview > KFS E-Doc Fundamentals.

![]() The Year-End

General Correction (YEGE) document is available only during the fiscal

year-end close.

The Year-End

General Correction (YEGE) document is available only during the fiscal

year-end close.

![]() Do not use the GEC to transfer or correct salary, wages, or benefits. The GEC

does not accept compensation object codes.

Do not use the GEC to transfer or correct salary, wages, or benefits. The GEC

does not accept compensation object codes.

Process Overview

More:

Business Rules

· Debits must equal credits.

· The KFS automatically generates cash offset entries as defined by the information entered into the document.

The following object sub-types are prohibited on this document:

Restricted object sub type in the GEC document

|

Sub-Type |

Description |

Restrictions |

|

BU |

Budget Only Object Codes |

Use Budget Adjustments (BA) document. |

|

CS |

Cash |

Use Journal Voucher (JV) document. |

|

FR |

Fringe Benefits |

Use Benefits Expense Transfer document. |

|

HW |

Hourly Wages |

Use Salary Expense Transfer document. |

|

PL |

Plant Capital Asset |

Use Journal Voucher (JV) document. |

|

MT |

Mandatory Transfers |

Use Transfer of Funds (TF) document. |

|

OP |

Other Provisions |

Use Auxiliary Voucher (AV) document. |

|

SA |

Salaries and Wages |

Use Salary Expense Transfer document. |

|

TF |

Transfer of Funds |

Use Transfer of Funds (TF) document. |

|

TN |

Transfer - Generic |

Use Transfer of Funds (TF) document. |

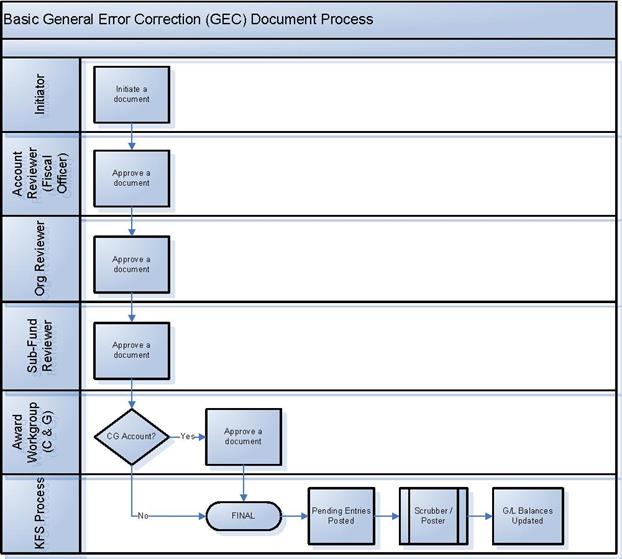

Routing

Fiscal Officers for all accounts must approve the GEC document. Additional approvals may be established within the institution's review hierarchy or set up through Ad Hoc routing. The document status becomes 'FINAL' when the required approvals are obtained and the transaction is posted to the G/L during the next G/L batch process.

Initiating a GEC Document

1. Select General Error Correction from the Financial Processing submenu group in the Transactions submenu on the Main Menu tab.

2. Log into the KFS as necessary.

A blank GEC document with a new document ID appears.

3. Complete the standard tabs.

· The Accounting Lines tab of the GEC document varies slightly from other types of financial transaction documents:

· The Ref Number is a required field on the GEC document. This field identifies the reference number of the document being corrected.

· The Line Desc box is optional and can be used to enter a description specific to that line of the GEC. If left blank, the description from the Document Overview tab passes to the G/L for that line of the transaction.

· The Ref Origin Code is a required field. This code identifies the system that created the transaction being corrected.

![]() For information about the standard tabs such as Document Overview,

Notes and Attachments, Ad

Hoc Recipients, Route

Log, Accounting Lines, Accounting Lines for

Capitalization, Create Capital Assets and Modify Capital Asset

tabs, see Standard

Tabs under Overview > KFS E-Doc Fundamentals.

For information about the standard tabs such as Document Overview,

Notes and Attachments, Ad

Hoc Recipients, Route

Log, Accounting Lines, Accounting Lines for

Capitalization, Create Capital Assets and Modify Capital Asset

tabs, see Standard

Tabs under Overview > KFS E-Doc Fundamentals.

4. Click ![]() .

.

5. Review the General Ledger Pending Entries tab.

This document automatically generates cash offset entries to cash or fund balance object codes.

6. Review the Route Log tab.

The document is routed to the fiscal officer for each account used in the Accounting Lines. The Route Status shows 'ENROUTE'.

![]() For information about the Route Log tab, see Route

Log.

For information about the Route Log tab, see Route

Log.

7. Appropriate fiscal officers and organization reviewers approve the document.

![]() For more information about how to approve a document, see Workflow

Action Buttons.

For more information about how to approve a document, see Workflow

Action Buttons.

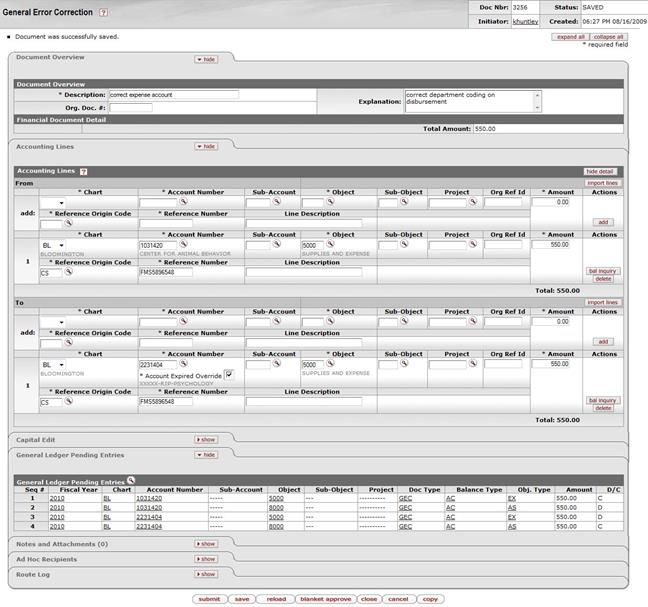

Example

Supplies were charged to an incorrect account. Use the From section to move the expense (credit expense) from the incorrect account and the To section to charge expense to the correct account (debit expense). The correct expense is debited and the incorrect expense is credited. The GEC document allows users to easily make corrections to documents previously submitted and approved.