Asset Fabrication

![]() >

> ![]() >

>![]() >

>![]() >

>![]()

Movable, fabricated equipment are assets created by a university or an institution. The Asset Fabrication document creates an Asset record that describes each of these constructed asset. 'Construction in progress' assets are identified by a specific asset type code. The Capital Asset Office assigns the in-service date and changes the asset type code from 'construction in progress' to an asset type code with a depreciable life. At that point the asset begins to depreciate (from an accounting perspective).

Fabrications can be distinguished by any one of the following characteristics:

· Original Development - the fabrication construction creates a one-of-a-kind piece of equipment.

· Original Components - the original components bear no resemblance to the finished equipment.

· Original Components - the original components are attached to, or are internal to the finished equipment.

After a fabrication has been approved, the asset number must be referenced on all related PURAP transactions. Requisitions for fabricated equipment should have the Capital Asset System Type set to 'One System' and the Capital Asset System State set to 'Modify Existing' in the Capital Asset tab on requisitions and purchase orders. These settings allow the requisition initiator to enter the fabrication asset number(s) to which the line items should be applied. To complete the information on the Capital Asset tab, each line item must be assigned a Capital Asset Transaction Type of 'fabrication' on the requisitions and purchase orders. The system will use the capital asset transition type to ensure that the line item is assigned a fabrication object code. Then, as related invoices are processed in the Capital Asset Builder (CAB), the payments are applied to the fabrication asset number(s). This capital asset system type can be found on the Capital Asset tab on requisitions and purchase orders.

The Asset Fabrication Maintenance document is also used to create 'control assets.' Control assets are used to post payments that are:

· reclassified as supplies and

· canceled invoices

They can be identified by the asset type codes of 5998 or 5999 (control asset).

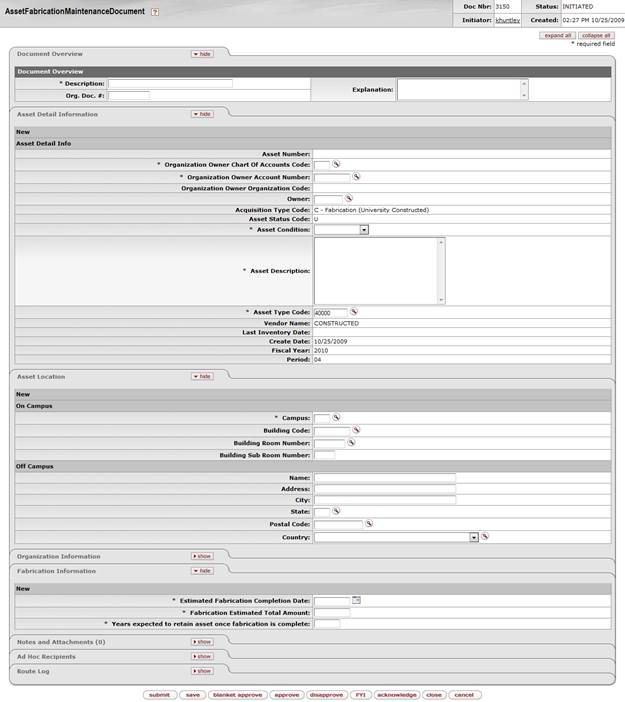

When the user selects Asset Fabrication from the Capital Asset Management submenu group in the Lookup and Maintenance submenu on the Main Menu tab, the system displays the AssetFabricationMaintenance document.

Document Layout

In addition to the standard tabs, the Asset Fabrication Maintenance document contains Asset Detail Information, Asset Location, Organization Information, and Fabrication Information tabs.

![]() For more information about the

standard tabs, see ‘Standard Tabs’ in the KFS

Overview and Introduction to the User Interface.

For more information about the

standard tabs, see ‘Standard Tabs’ in the KFS

Overview and Introduction to the User Interface.

Asset Fabrication Maintenance document tabs

|

Tab Name |

Purpose |

|

Asset Detail Information |

Notes specific attributes of the asset. |

|

Asset Location |

Specifies the location of the asset. |

|

Organization Information |

Provides organization information for the asset. |

|

Fabrication Information |

Contains the fabrication information for the asset. |

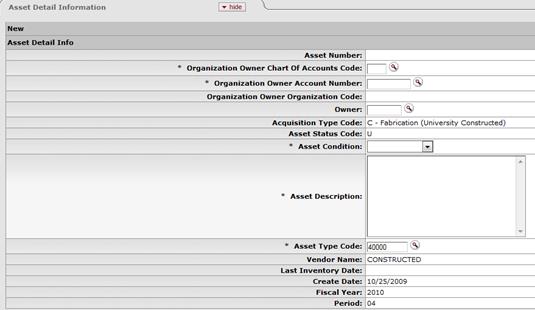

Asset Detail Information Tab

![]() The

system parameter DEFAULT_FABRICATION_ASSET_TYPE is used to define the default

asset type code set on the fabrication document.

The

system parameter DEFAULT_FABRICATION_ASSET_TYPE is used to define the default

asset type code set on the fabrication document.

This tab contains the identification and ownership information for the asset.

Asset Detail Information tab definition

|

Title |

Description |

|

Asset Number |

Display-only. A system-assigned identifier unique to each asset. The asset number will be assigned after the user submits the document. This field cannot be modified. |

|

Organization Owner Chart Of Accounts Code |

Required. Enter the chart code for the owner account that

is responsible for the asset or search for the code from the Chart lookup

|

|

Organization Owner Account Number |

Required. Enter the account number for the owner that is

responsible for the asset or search for the number from the Account lookup |

|

Organization Owner Organization Code |

Display-only. Identifies the organization responsible for the asset and is set by the owner account number. |

|

Owner |

Optional. Used when the title is vested in other

universities or agencies. Enter the name of the owner or search for it from

the Agency

lookup |

|

Acquisition Type Code |

Display-only. Describes how the asset was acquired by the institution (i.e., gift, found, etc.) For fabricated assets, the acquisition type is defaulted to 'C' (university construction) and is view only. |

|

Asset Status Code |

Display-only. A code indicating the current status of the asset (i.e. 'A' for active, 'R' for retired, 'U' for university constructed.) When the asset is completed, the asset status is updated to 'A' (active). |

|

Asset Condition |

Required. Text describing the condition of the asset. Excellent = Newly acquired. Good = Still in good working order. Fair = Equipment is beginning to show age. Poor = Equipment still works but is old and nearly ready for disposal. |

|

Asset Description |

Required. Enter a detailed description of the asset. |

|

Asset Type Code |

Describes how the asset was acquired by the institution (i.e., gift, found, etc.) For fabricated assets, the acquisition type is defaulted to 'C' (university construction) and is view only. |

|

Vendor Name |

Display-only. The company or person who has sold the asset to the institution and to whom the first payment was made. |

|

Last Inventory Date |

Display-only. The date of last inventory performed by the university or the date an asset was last physically verified, moved, relocated, inventoried, or tagged. The last inventory date for the fabricated asset will be set to today's date, and is view only. |

|

Create Date |

Display-only. The date the asset was added to the asset database. Defaults to the current date. |

|

Fiscal Year |

Display-only. The fiscal year in which the asset was created. The fiscal year is based on the create date. Defaults to the current fiscal year. |

|

Period |

Display-only. The period (fiscal month) of which the asset was created. The period is based on the create date. Defaults to the current fiscal period. |

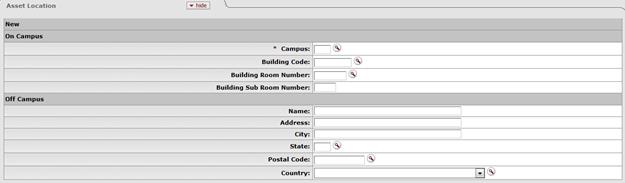

Asset Location Tab

The Asset Location tab allows the user to specify the location of the asset. It contains information on where the asset will be located, whether on-campus or off-campus. To enter a location, you must provide the asset status and asset type code.

· The asset status is used to specify whether the asset is capital or non-capital. The asset type code identifies the asset category.

· The Asset Type Code table has a required building indicator and a movable indicator.

The asset status in conjunction with the asset type code determines what location information is required.

For example, capital movable equipment requires a valid campus, building, and room combination or an off-campus address. Non-capital assets require only a campus code.

Asset Location tab definition

|

Title |

Description |

|

|

Campus |

Required. Enter the code identifying the physical campus

in which the asset is/will be physically located or

search for the code from the Campus

lookup |

|

|

Building Code |

Enter the code designated to the building in which the

asset is/will be physically located or search for the code from the Building lookup |

|

|

Building Room Number |

Enter the building's room number in which the asset

is/will be physically located or search for

the number from the Room

lookup |

|

|

Building Sub Room Number |

Enter the code created for departmental use. Most departments use this field to enter the cubicle sub-room number. |

|

|

(Off Campus) Name |

Enter the name of the person in charge of the asset at the off-campus location. |

|

|

(Off Campus) Address |

Enter the off-campus street address where the asset is/will be located or stored. |

|

|

(Off Campus) City |

Enter the off campus city where the asset is/will be located or stored. |

|

|

(Off Campus) State |

Enter the state or search for it from the State lookup |

|

|

(Off Campus) Postal Code |

Enter the postal code or search for it from the Postal Code lookup |

|

|

(Off Campus) Country |

Select the country from the Country list or

search for it from the Country

lookup |

|

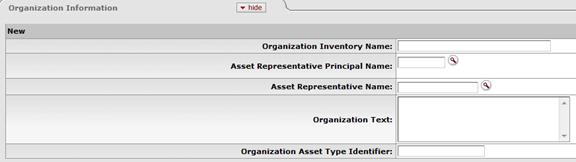

Organization Information Tab

This tab contains the organization information for the asset.

Organization Information tab definition

|

Title |

Description |

|

Organization Inventory Name |

Enter a common name for inventory purposes. This name is used to sort assets within an organization to assist with physical inventories.

|

|

Asset Representative Principal Name |

Enter a user ID for identifying a name with which to group

and sort assets on reports. The information on reports is formatted as last

name, first name. Using the field in this manner ensures the sort order for

reporting purposes. You may also search for the user ID from the Person lookup |

|

Asset Representative Name |

Enter the actual name of the person using the asset

representative user ID. You may also search for the name from the Person lookup |

|

Organization Text |

Enter additional organization-related information for the asset as appropriate. |

|

Organization Asset Type Identifier |

Enter the type used by the organization to classify the equipment. (This is a field used by the organization to classify the type of equipment.) |

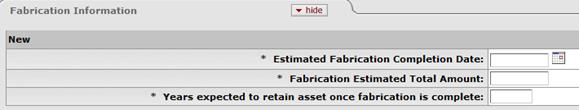

Fabrication Information Tab

This tab contains the fabrication information for the asset.

Fabrication Information tab definitions

|

Title |

Description |

|

Estimated Fabrication Completion Date |

Required. Enter the estimated completion date for the asset or select a date using the calendar icon. |

|

Required. Enter the estimated dollar cost of the fabricated asset. |

|

|

Years expected to retain asset once fabrication is complete |

Required. Enter the number of years the organization is expecting to retain the fabricated asset once it has been completed. When the field is populated with 0, it is an indication that the fabricated asset will be sold upon completion and should not be eligible for depreciation. This serves as a reminder to the Capital Asset Office, that when the construction is complete to treat the asset accordingly. |

Process Overview

Business Rules

· To initiate a fabrication request the user must complete the following:

o Asset Detail Information (a valid organization owner Chart of Accounts code, a valid and active organization owner account number, an asset description, and a valid asset type code)

o Asset Location (if the asset will remain on campus, input a valid campus code, building code and building room code; if the asset will be located off campus the user must input name, address, city, state, postal code, and country; in addition the campus code is required)

· Additionally, the Fabrication document uses the Asset Type Code table to determine whether a building number and room number are required for the asset type category.

o Any asset type code with the 'moving indicator' checked 'yes' requires a building code and room number, or an off campus address. All asset type codes for movable equipment have this indicator checked.

o Any asset type code with the 'required building indicator' checked 'yes' requires a building code. Asset type codes for buildings have this indicator checked.

o Any asset type code with the 'moving indicator' and 'required building indicator' marked 'no' requires a campus code, but no building or room number. Asset type codes for land, land improvements, and leasehold improvements have the 'moving indicator' and 'required building indicator' marked 'no.'

· Fabrication Information is also required as follows:

· An estimated fabrication completion date is required.

· The total estimated cost is required and must be numeric.

· The Years expected to retain asset once fabrication is complete is required and must be numeric.

· For capital assets, the building code is the building in which the asset is located. The asset category identified by the asset type determines whether a building code, room number or off-campus information is required. For this reason, the asset type must be entered before the building and room number.

· For non-capital assets, a building code or room number is not required. For this reason, the asset status must be entered before the building code or room number is entered. If these values are entered, they must be valid values.

· Any asset type code with the moving code indicator checked requires a valid campus, building code, and room number combination, or an off-campus address. All asset type codes for movable equipment have this code checked.

· Any asset type code with the reg bldg indicator checked requires a building code. Asset type codes for buildings have this code checked.

· Any asset type code with both moving code and reg bldg indicators unchecked requires a campus code but no building or room number. Asset type codes for land, land improvements, and leasehold improvements have these codes unchecked.

Routing

· Asset Fabrication Maintenance documents are automatically routed to the appropriate fiscal officer or delegate. The fiscal officer to whom this document is routed is defined by the Organization Owner Chart/Account. If the Owner account is a Grant account, the fabrication is routed to Contracts and Grants Level 1 for approval.

· When routing to 'Management' node, the document routes to these roles: 'KFS-SYS Asset Manager'(requiring approve) and 'KFS-CAM Asset Manager'(requiring FYI). The document shows up in both roles' action lists.

· If 'KFS-SYS Asset Manager' takes Approve action on this document first, it will not show up in the action list for 'KFS-CAM Asset Manager.' However, if 'KFS-CAM Asset Manager' takes FYI action first, it will show up in the action list for approve to 'KFS-SYS Asset Manager.'